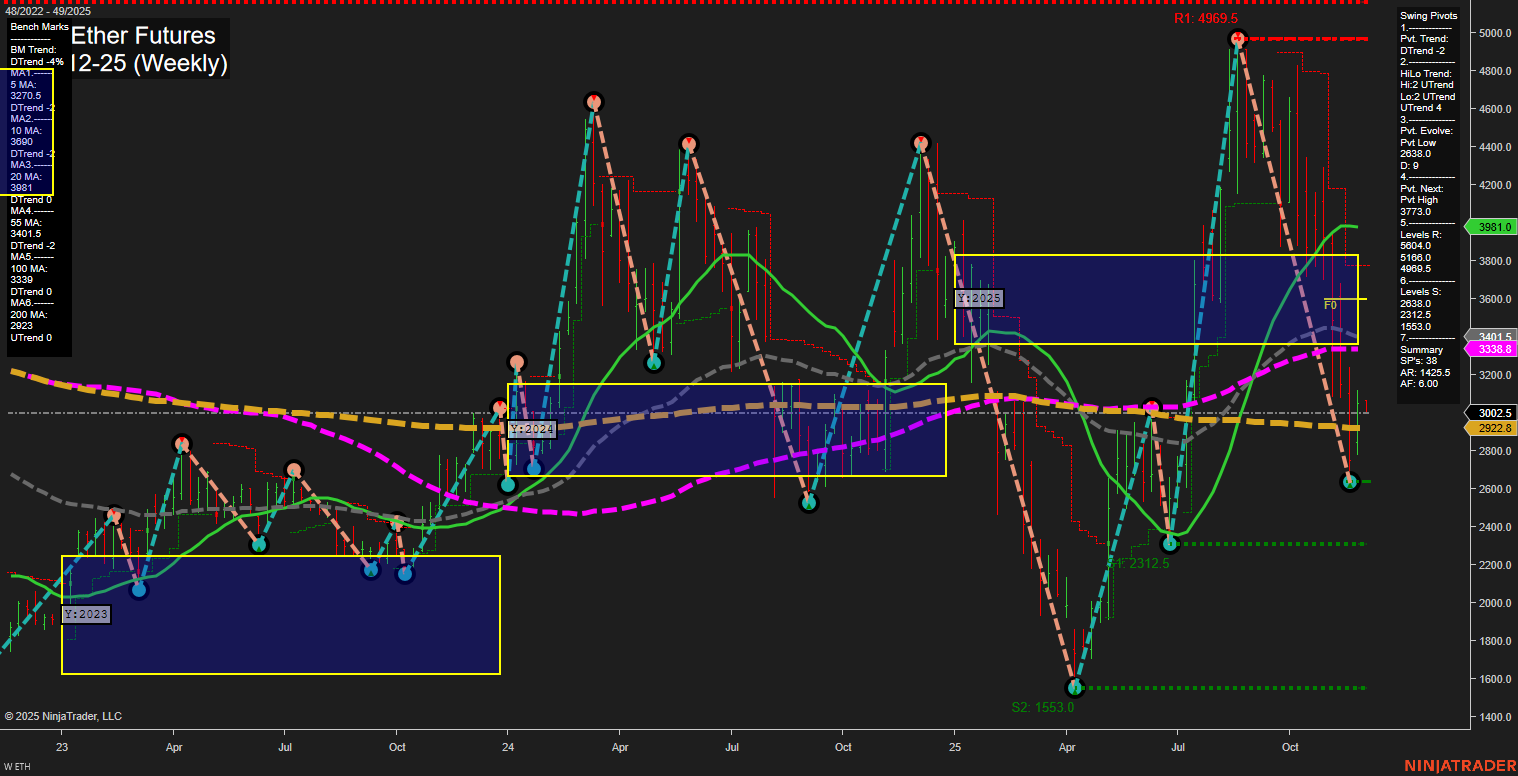

The current weekly chart for ETH CME Ether Futures shows a market in transition. Price action is volatile with large bars and fast momentum, reflecting heightened activity and possible reaction to recent news or macro events. Short-term (WSFG) trend is up, with price above the NTZ center, but the swing pivot trend is down, indicating a possible short-term pullback or correction within a broader move. Intermediate-term (MSFG) and long-term (YSFG) trends are both down, with price below their respective NTZ centers, and all major moving averages except the 200-week are trending down, reinforcing a bearish bias for the medium and long-term outlooks. The most recent swing pivot is a low at 2838.0, with the next key resistance at 3773.0 and major resistance levels much higher, suggesting significant overhead supply. Support is clustered at 2838.0, 2312.5, and 1553.0, highlighting potential downside targets if selling resumes. The recent long signal at 2942.5 aligns with a short-term bounce, but the overall structure suggests rallies may face resistance unless there is a sustained shift in trend. The market is currently in a corrective phase after a sharp move, with the potential for further consolidation or retest of lower supports if the broader bearish momentum persists.