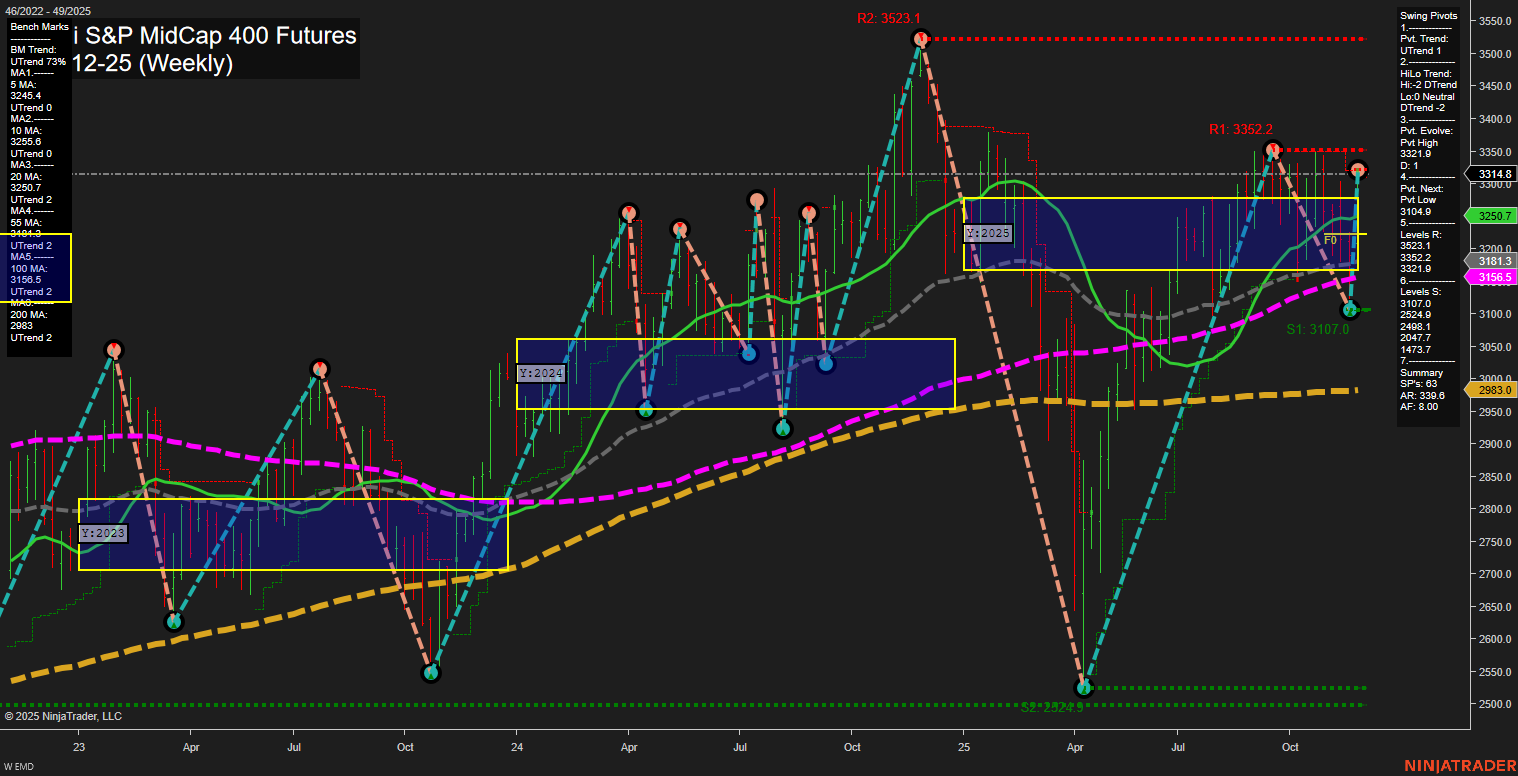

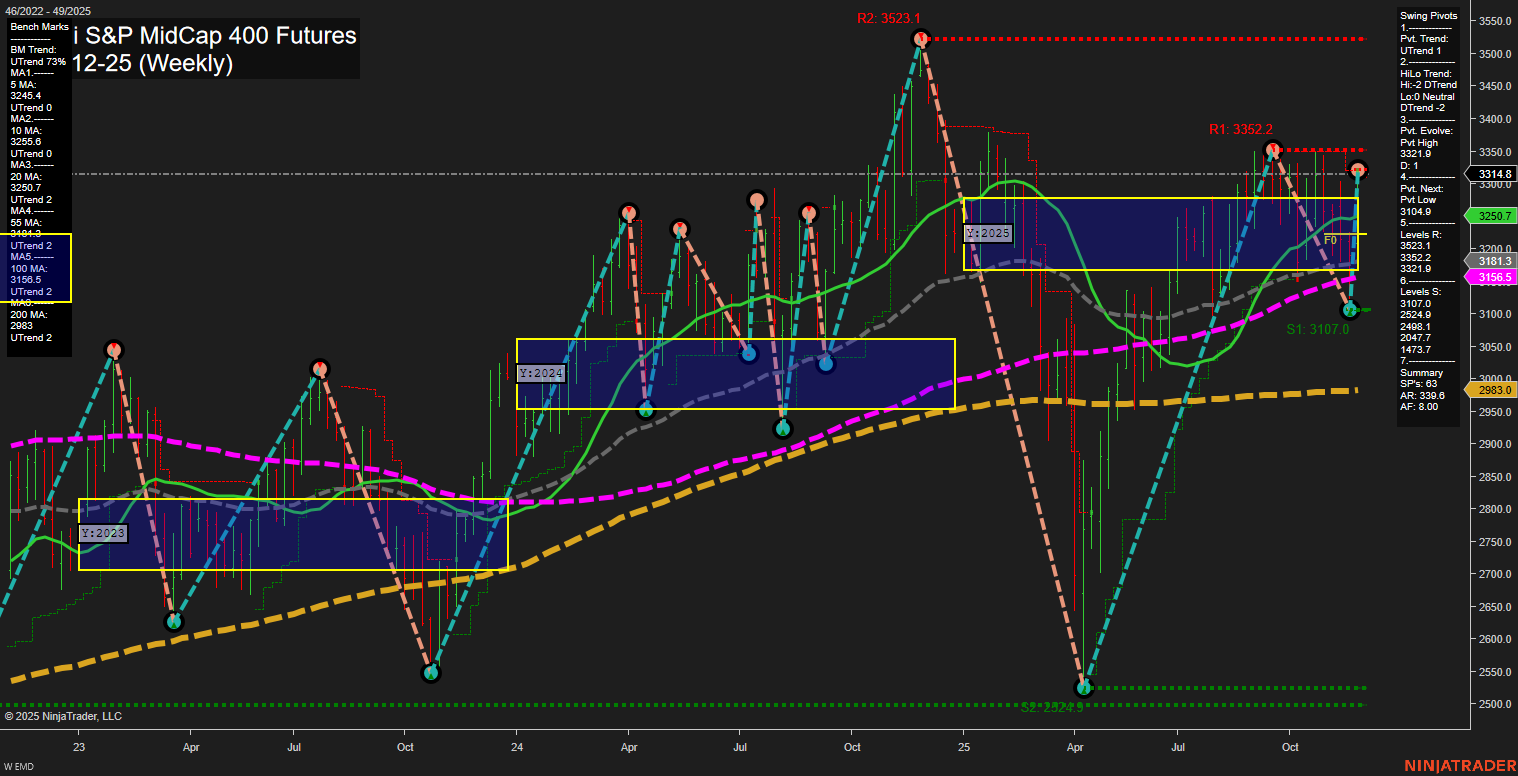

EMD E-mini S&P MidCap 400 Futures Weekly Chart Analysis: 2025-Nov-30 18:05 CT

Price Action

- Last: 3314.8,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 112%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 26%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 14%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 3321.9,

- 4. Pvt. Next: Pvt low 3107.0,

- 5. Levels R: 3352.2, 3321.9,

- 6. Levels S: 3107.0, 2624.9, 2048.1, 1473.7.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 3241.5 Up Trend,

- (Intermediate-Term) 10 Week: 3255.6 Up Trend,

- (Long-Term) 20 Week: 3250.7 Up Trend,

- (Long-Term) 55 Week: 3165.5 Up Trend,

- (Long-Term) 100 Week: 3155.5 Up Trend,

- (Long-Term) 200 Week: 2983 Up Trend.

Recent Trade Signals

- 26 Nov 2025: Long EMD 12-25 @ 3291.3 Signals.USAR-MSFG

- 25 Nov 2025: Long EMD 12-25 @ 3271 Signals.USAR.TR720

- 25 Nov 2025: Long EMD 12-25 @ 3221.2 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The EMD futures weekly chart shows a strong bullish structure in both the short- and long-term, with price action holding above all major moving averages and the yearly, monthly, and weekly session fib grids all trending upward. The most recent swing pivot is a high at 3321.9, with the next key support at 3107.0, indicating a healthy distance between current price and major support. Resistance is close overhead at 3352.2, suggesting the market is testing upper boundaries after a strong rally. Intermediate-term swing structure is more mixed, with a downtrend in the HiLo trend, hinting at some consolidation or corrective action within the broader uptrend. Recent trade signals are all long, confirming the prevailing bullish bias. The market is in a phase of trend continuation, with higher lows and higher highs, but faces a test at resistance. Volatility is moderate, and the technical backdrop supports a constructive outlook unless there is a decisive break below the 20- or 55-week moving averages.

Chart Analysis ATS AI Generated: 2025-11-30 18:05 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.