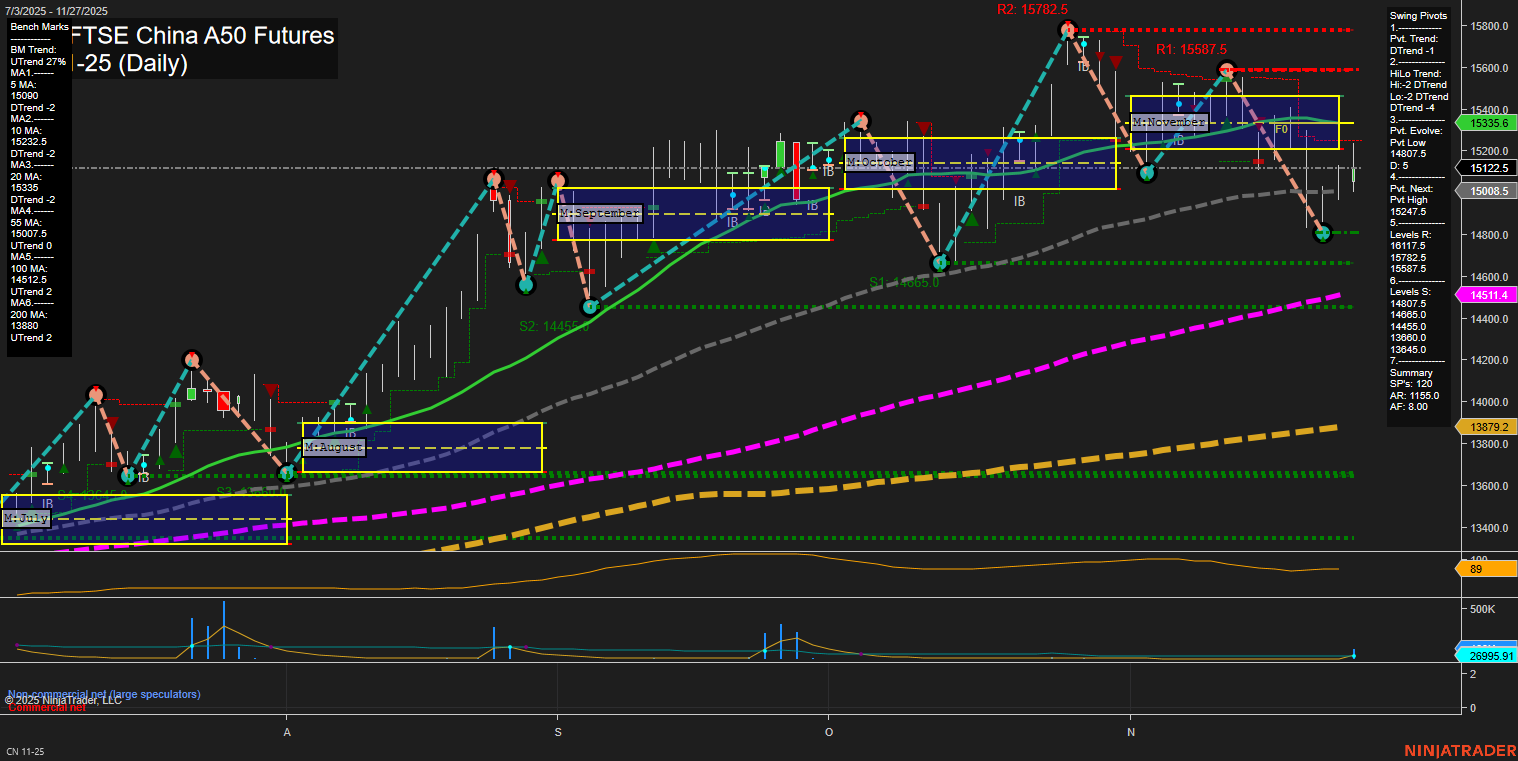

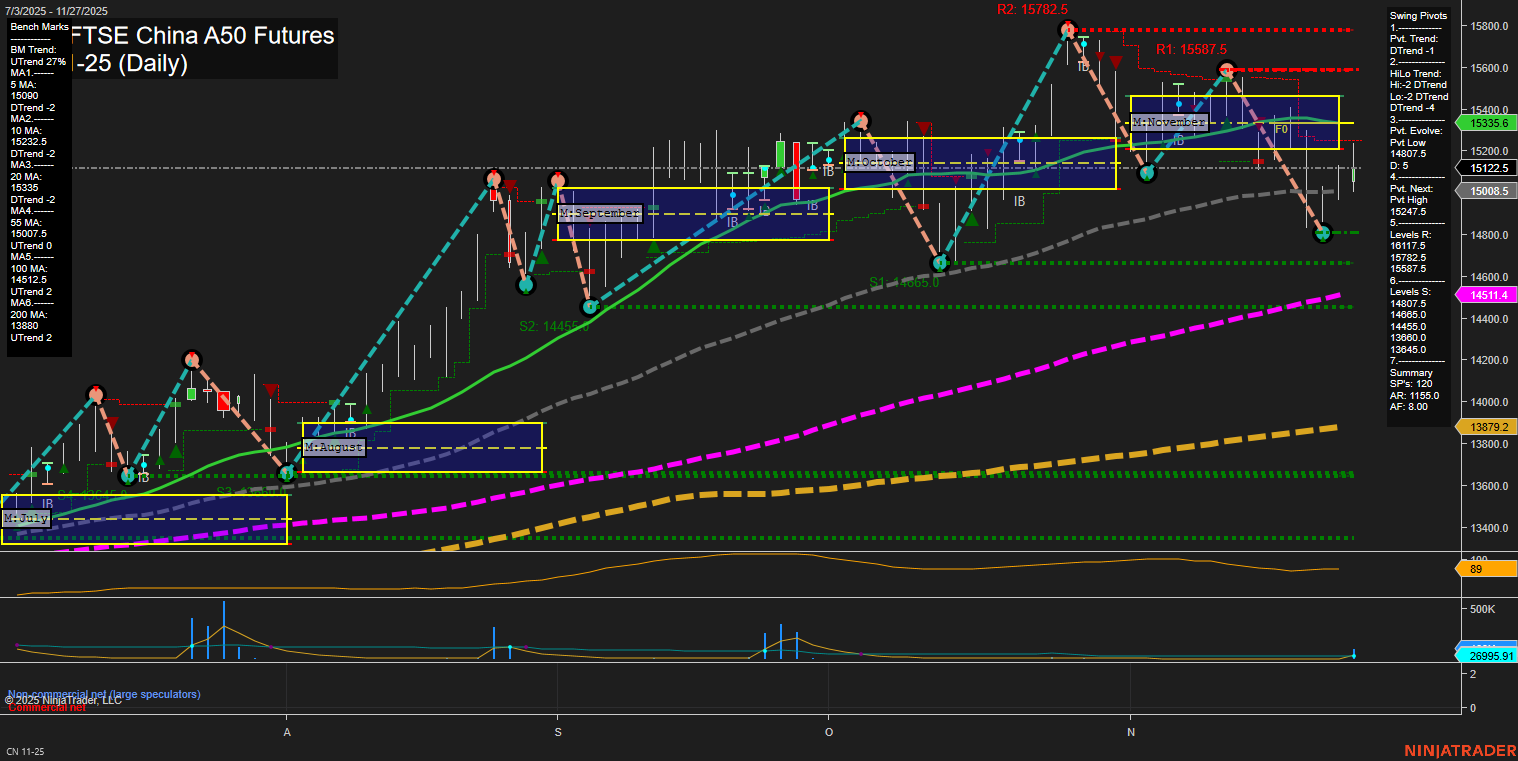

CN SGX FTSE China A50 Futures Daily Chart Analysis: 2025-Nov-30 18:04 CT

Price Action

- Last: 15122.5,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt Low 14807.5,

- 4. Pvt. Next: Pvt High 15247.5,

- 5. Levels R: 15782.5, 15587.5, 15247.5,

- 6. Levels S: 14807.5, 14805, 14455, 14405, 13880, 13845.

Daily Benchmarks

- (Short-Term) 5 Day: 15090 Down Trend,

- (Short-Term) 10 Day: 15232.5 Down Trend,

- (Intermediate-Term) 20 Day: 15335 Down Trend,

- (Intermediate-Term) 55 Day: 15007.5 Up Trend,

- (Long-Term) 100 Day: 14512.5 Up Trend,

- (Long-Term) 200 Day: 13880 Up Trend.

Additional Metrics

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The CN SGX FTSE China A50 Futures daily chart shows a market in a corrective phase after a strong rally earlier in the year. Price action has shifted to a slow momentum decline, with the last price at 15122.5 and medium-sized bars reflecting a controlled pullback rather than panic selling. Both short-term and intermediate-term swing pivot trends are down, with the most recent pivot low at 14807.5 and resistance levels overhead at 15247.5, 15587.5, and 15782.5. Support is layered below, with key levels at 14807.5 and 14455. The 5, 10, and 20-day moving averages are all trending down, confirming short-term and intermediate-term bearishness, while the 55, 100, and 200-day moving averages remain in uptrends, indicating the longer-term structure is still bullish. Volatility (ATR) is moderate, and volume is steady. The market is consolidating within the monthly and weekly session fib grids, with no clear directional bias from those frameworks. Overall, the chart suggests a market in a corrective retracement within a larger uptrend, with the potential for further downside in the short to intermediate term before a possible resumption of the longer-term bullish trend if key support levels hold.

Chart Analysis ATS AI Generated: 2025-11-30 18:04 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.