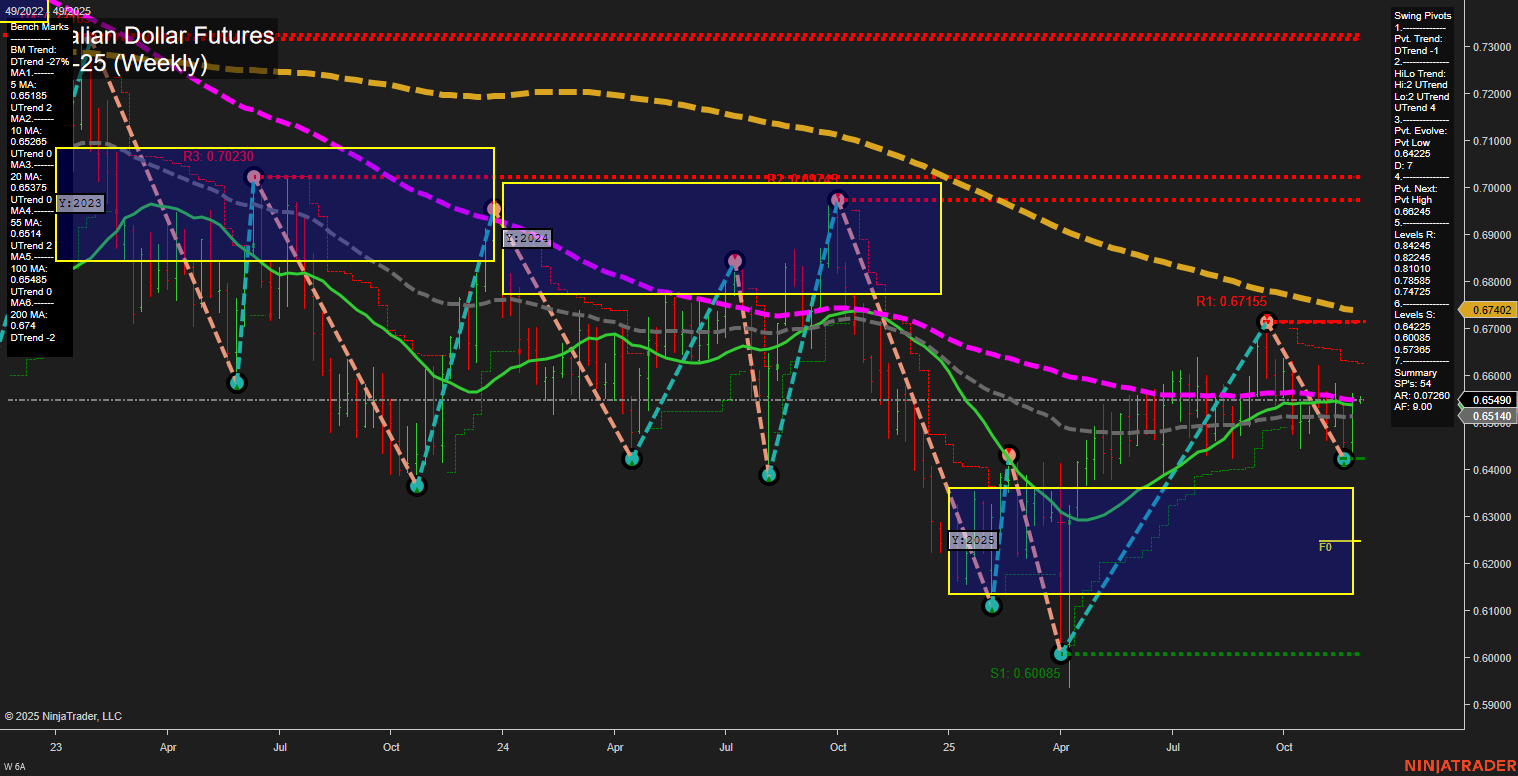

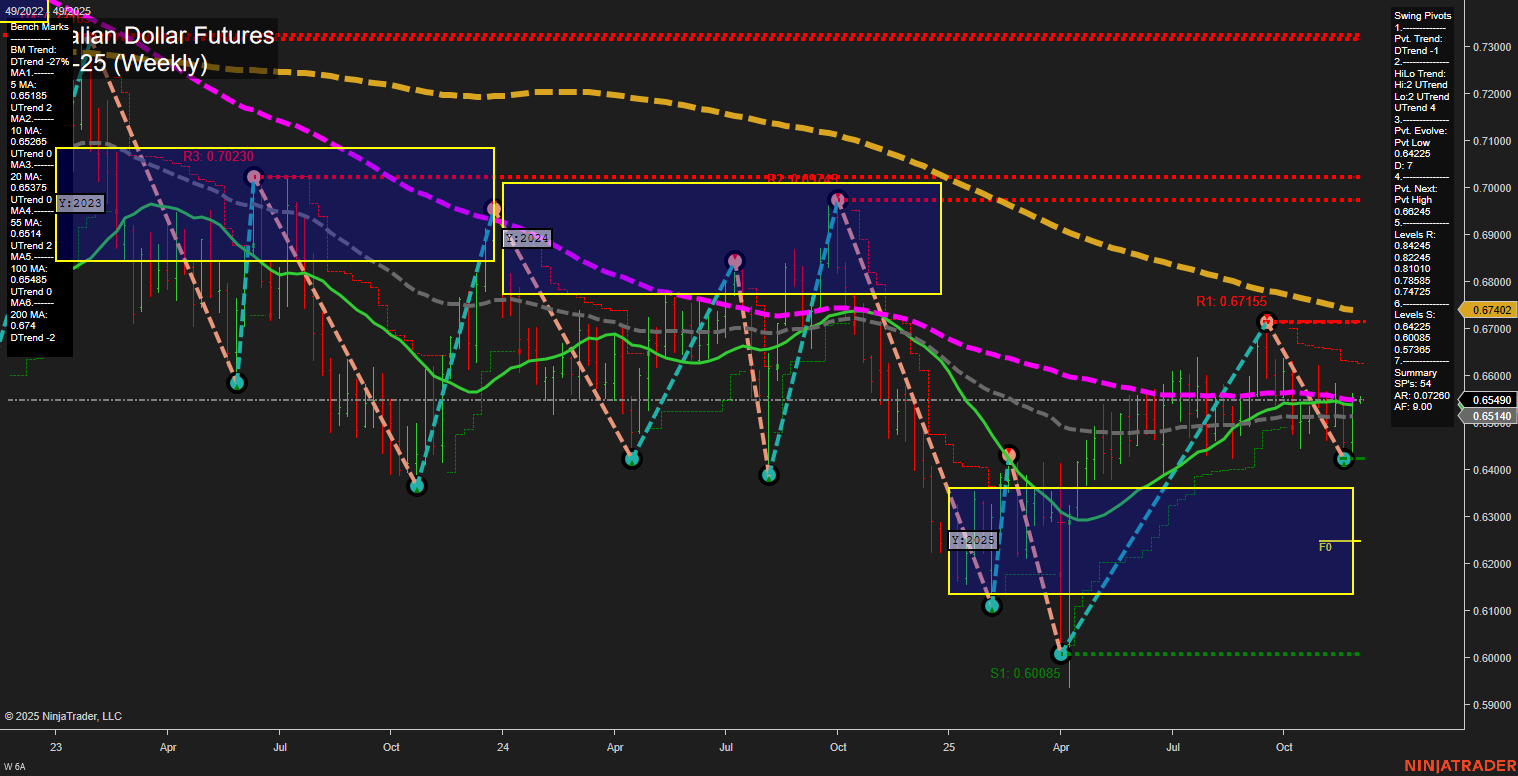

6A Australian Dollar Futures Weekly Chart Analysis: 2025-Nov-30 18:00 CT

Price Action

- Last: 0.65490,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt Low 0.64225,

- 4. Pvt. Next: Pvt High 0.67425,

- 5. Levels R: 0.82445, 0.82215, 0.81810, 0.78585, 0.74725, 0.67425, 0.67155,

- 6. Levels S: 0.64225, 0.60085.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.65185 Down Trend,

- (Intermediate-Term) 10 Week: 0.65414 Up Trend,

- (Long-Term) 20 Week: 0.65825 Up Trend,

- (Long-Term) 55 Week: 0.65140 Up Trend,

- (Long-Term) 100 Week: 0.65485 Up Trend,

- (Long-Term) 200 Week: 0.67400 Down Trend.

Recent Trade Signals

- 28 Nov 2025: Long 6A 12-25 @ 0.65515 Signals.USAR.TR720

- 25 Nov 2025: Long 6A 12-25 @ 0.6473 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The 6A Australian Dollar Futures weekly chart shows a market in transition, with price currently at 0.65490 and trading within a medium-range bar structure. Momentum is average, indicating neither strong buying nor selling pressure. The short-term (WSFG) and long-term (YSFG) session fib grid trends are neutral, reflecting a lack of clear directional bias, while the intermediate-term (MSFG) also remains neutral. Swing pivot analysis reveals a short-term downtrend but an intermediate-term uptrend, with the most recent pivot low at 0.64225 and the next potential pivot high at 0.67425. Resistance levels are clustered well above current price, while support is found at 0.64225 and 0.60085. Weekly benchmarks show mixed signals: the 5-week MA is in a downtrend, but the 10, 20, 55, and 100-week MAs are trending up, suggesting underlying strength in the intermediate to long-term, though the 200-week MA remains in a downtrend. Recent trade signals have triggered long entries, aligning with the intermediate-term bullish bias. Overall, the market is consolidating after a recovery from recent lows, with potential for further upside if resistance at 0.67425 is tested and broken, but the presence of mixed moving average trends and neutral fib grid readings suggest a cautious, range-bound environment in the near term.

Chart Analysis ATS AI Generated: 2025-11-30 18:00 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.