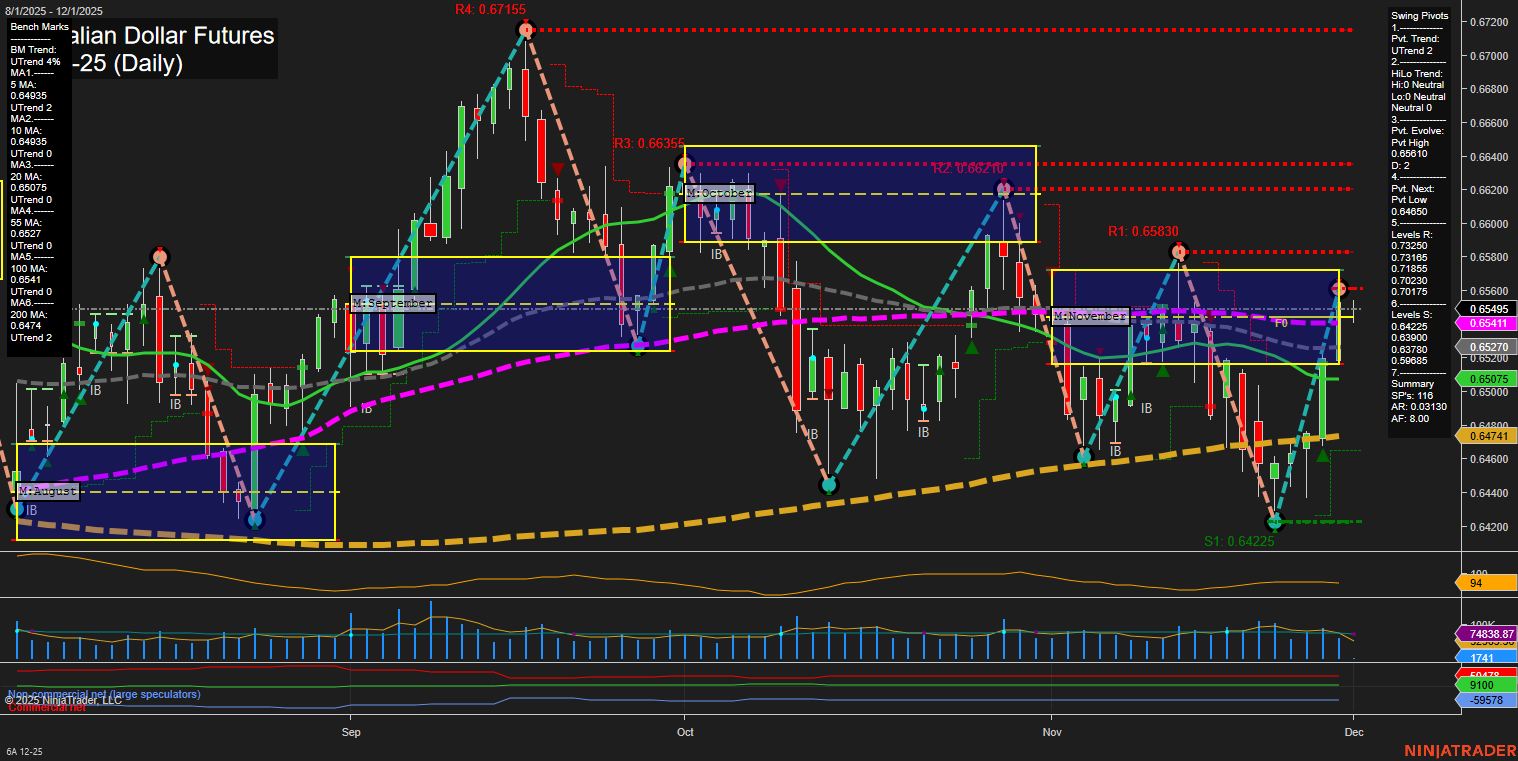

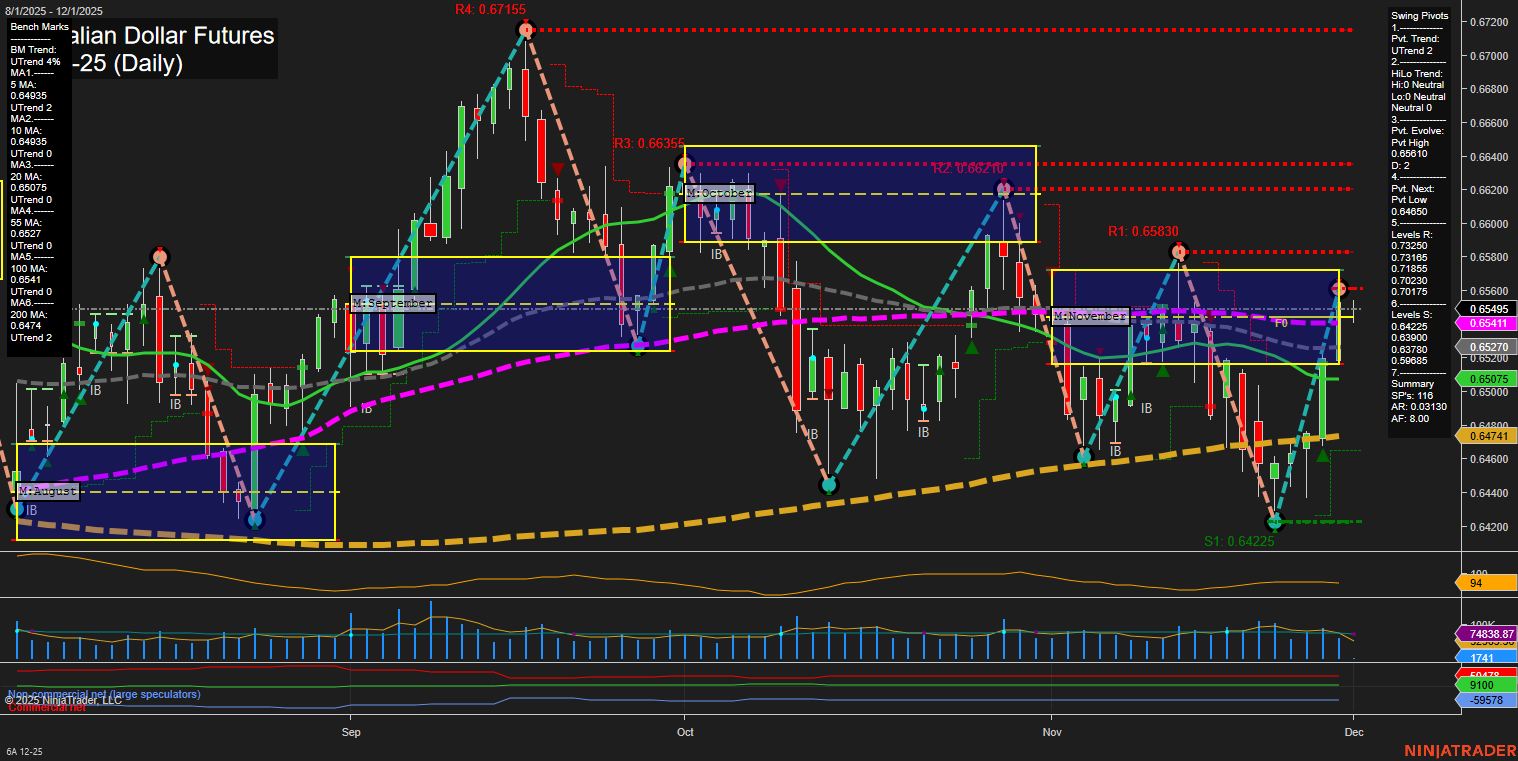

6A Australian Dollar Futures Daily Chart Analysis: 2025-Nov-30 18:00 CT

Price Action

- Last: 0.65495,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 0.65810,

- 4. Pvt. Next: Pvt Low 0.64650,

- 5. Levels R: 0.65830, 0.65270, 0.65115, 0.64850, 0.64635, 0.64225,

- 6. Levels S: 0.65075, 0.64741.

Daily Benchmarks

- (Short-Term) 5 Day: 0.64935 Up Trend,

- (Short-Term) 10 Day: 0.64935 Up Trend,

- (Intermediate-Term) 20 Day: 0.6527 Up Trend,

- (Intermediate-Term) 55 Day: 0.6541 Down Trend,

- (Long-Term) 100 Day: 0.6541 Up Trend,

- (Long-Term) 200 Day: 0.6474 Up Trend.

Additional Metrics

Recent Trade Signals

- 28 Nov 2025: Long 6A 12-25 @ 0.65515 Signals.USAR.TR720

- 25 Nov 2025: Long 6A 12-25 @ 0.6473 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Neutral.

Key Insights Summary

The 6A Australian Dollar Futures daily chart shows a recent shift to a short-term uptrend, supported by a series of higher lows and a swing pivot evolution to a new high. Price is currently trading just below a key resistance cluster (0.65830), with the last two trade signals both on the long side, indicating bullish momentum in the short-term. The moving averages confirm this, with the 5, 10, 20, 100, and 200-day benchmarks all trending up, though the 55-day remains in a downtrend, reflecting some intermediate-term hesitation. The intermediate and long-term session fib grids remain neutral, suggesting the broader trend is still consolidative. Volatility is moderate, and volume is robust, hinting at active participation but not extreme conditions. Overall, the market is in a recovery phase from recent lows, with short-term bullishness but no clear breakout above major resistance yet, keeping the intermediate and long-term outlooks neutral. The environment is characterized by choppy, range-bound action with a slight bullish tilt in the near term.

Chart Analysis ATS AI Generated: 2025-11-30 18:00 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.