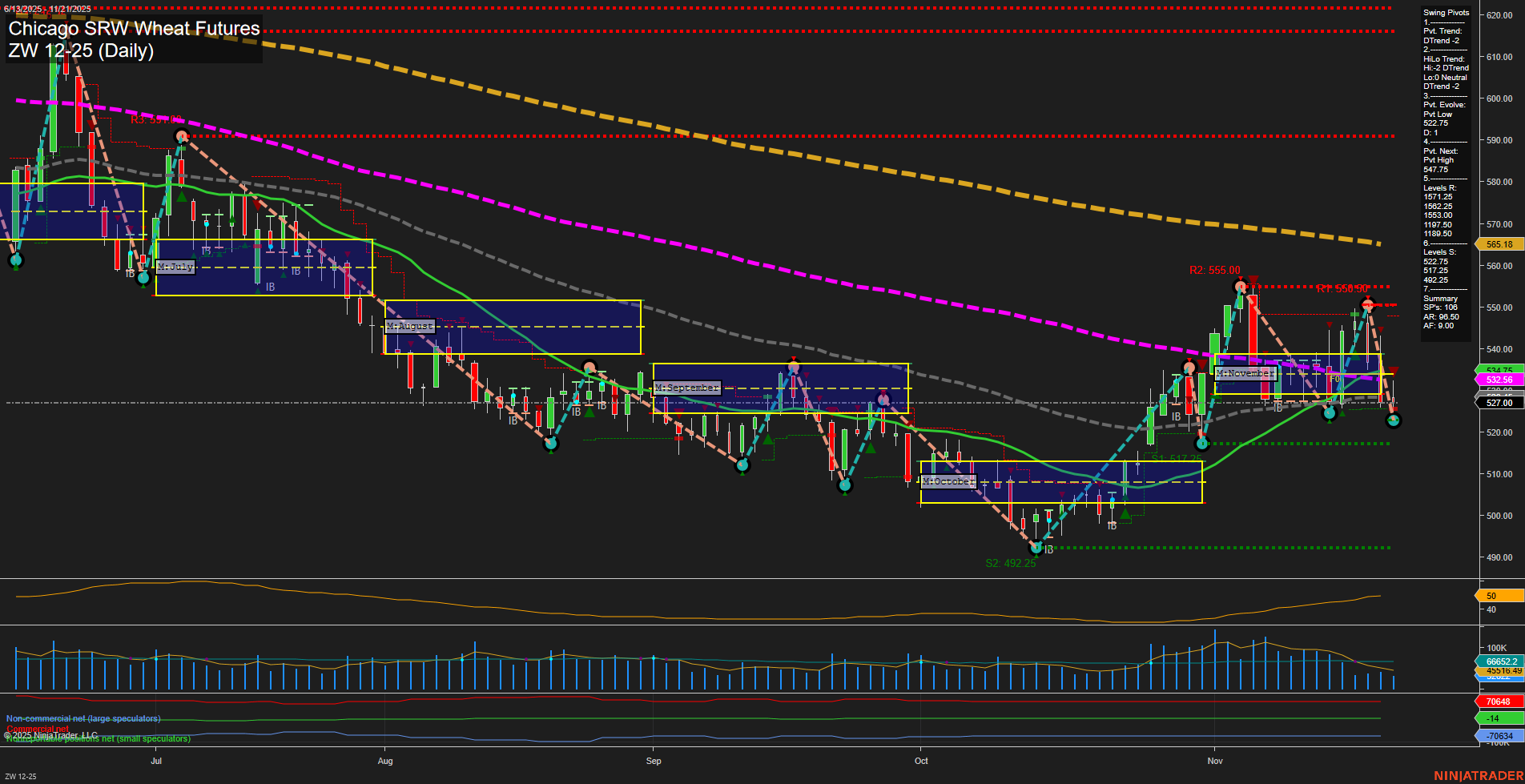

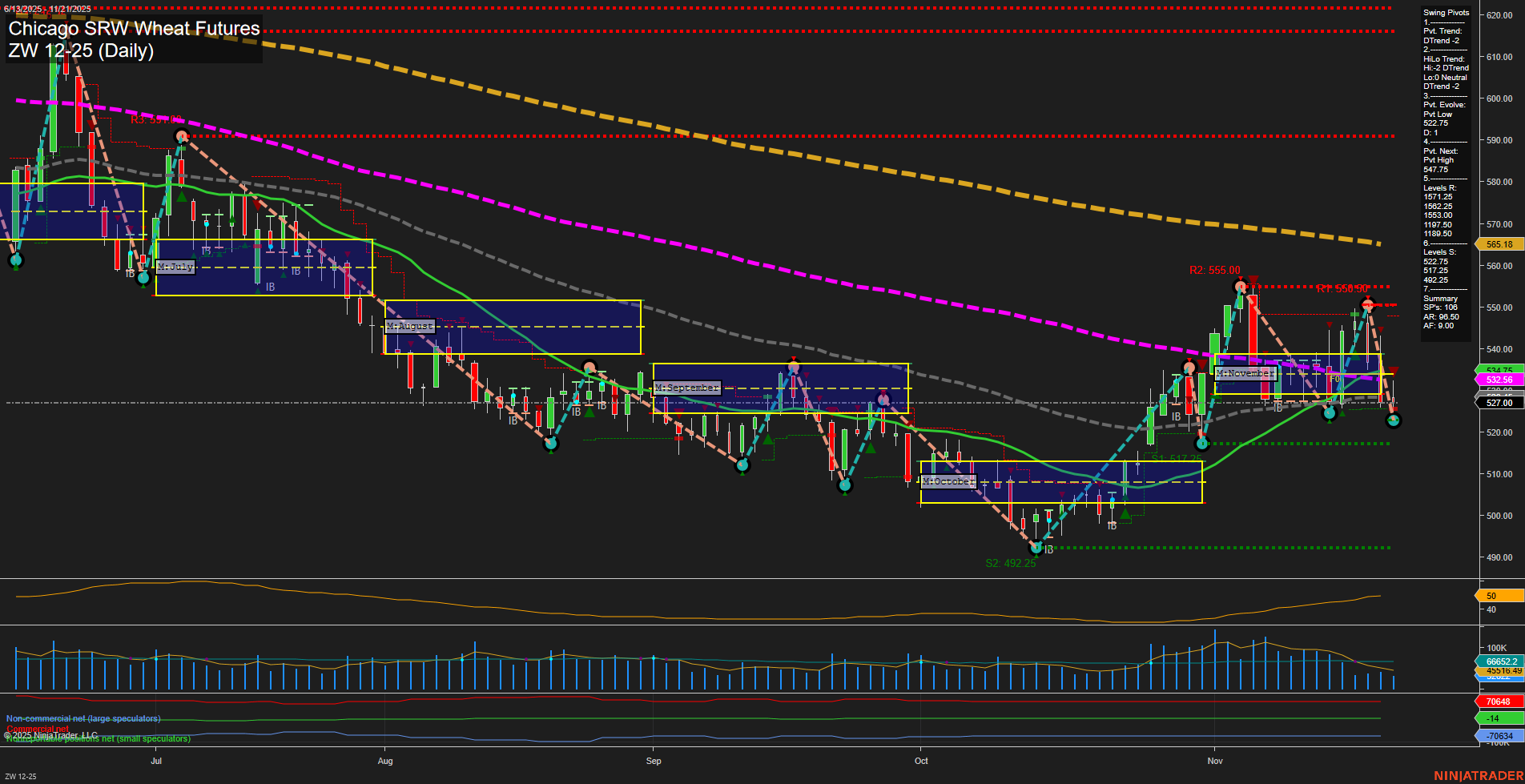

ZW Chicago SRW Wheat Futures Daily Chart Analysis: 2025-Nov-23 18:24 CT

Price Action

- Last: 527.00,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 8%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 72%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: -36%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt Low 527.25,

- 4. Pvt. Next: Pvt High 547.75,

- 5. Levels R: 560.50, 555.00, 547.75,

- 6. Levels S: 517.25, 492.25.

Daily Benchmarks

- (Short-Term) 5 Day: 532.56 Down Trend,

- (Short-Term) 10 Day: 532.56 Down Trend,

- (Intermediate-Term) 20 Day: 532.56 Up Trend,

- (Intermediate-Term) 55 Day: 519.49 Up Trend,

- (Long-Term) 100 Day: 545.19 Down Trend,

- (Long-Term) 200 Day: 565.18 Down Trend.

Additional Metrics

Recent Trade Signals

- 21 Nov 2025: Short ZW 03-26 @ 537.25 Signals.USAR-WSFG

- 17 Nov 2025: Long ZW 12-25 @ 545.25 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The ZW Chicago SRW Wheat Futures daily chart shows a recent shift in short-term momentum to the downside, with the last price at 527.00 and slow momentum following a failed attempt to break above resistance near 555.00–560.50. Both the short-term and intermediate-term swing pivot trends have turned down, with the most recent pivot low established at 527.25 and the next key resistance at 547.75. Price is currently below the short-term moving averages (5 and 10 day), both trending down, while the 20 and 55 day averages remain supportive but are being tested. The long-term trend remains bearish, with price well below the 100 and 200 day moving averages. The ATR indicates moderate volatility, and volume is steady but not elevated. Recent trade signals reflect this mixed environment, with a short signal triggered after a failed rally. Overall, the market is in a corrective phase after a sharp rally, with the potential for further downside if support at 517.25 fails, but intermediate-term structure is still holding above key levels. The environment is characterized by choppy price action and a possible transition phase, with no clear long-term reversal yet in place.

Chart Analysis ATS AI Generated: 2025-11-23 18:24 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.