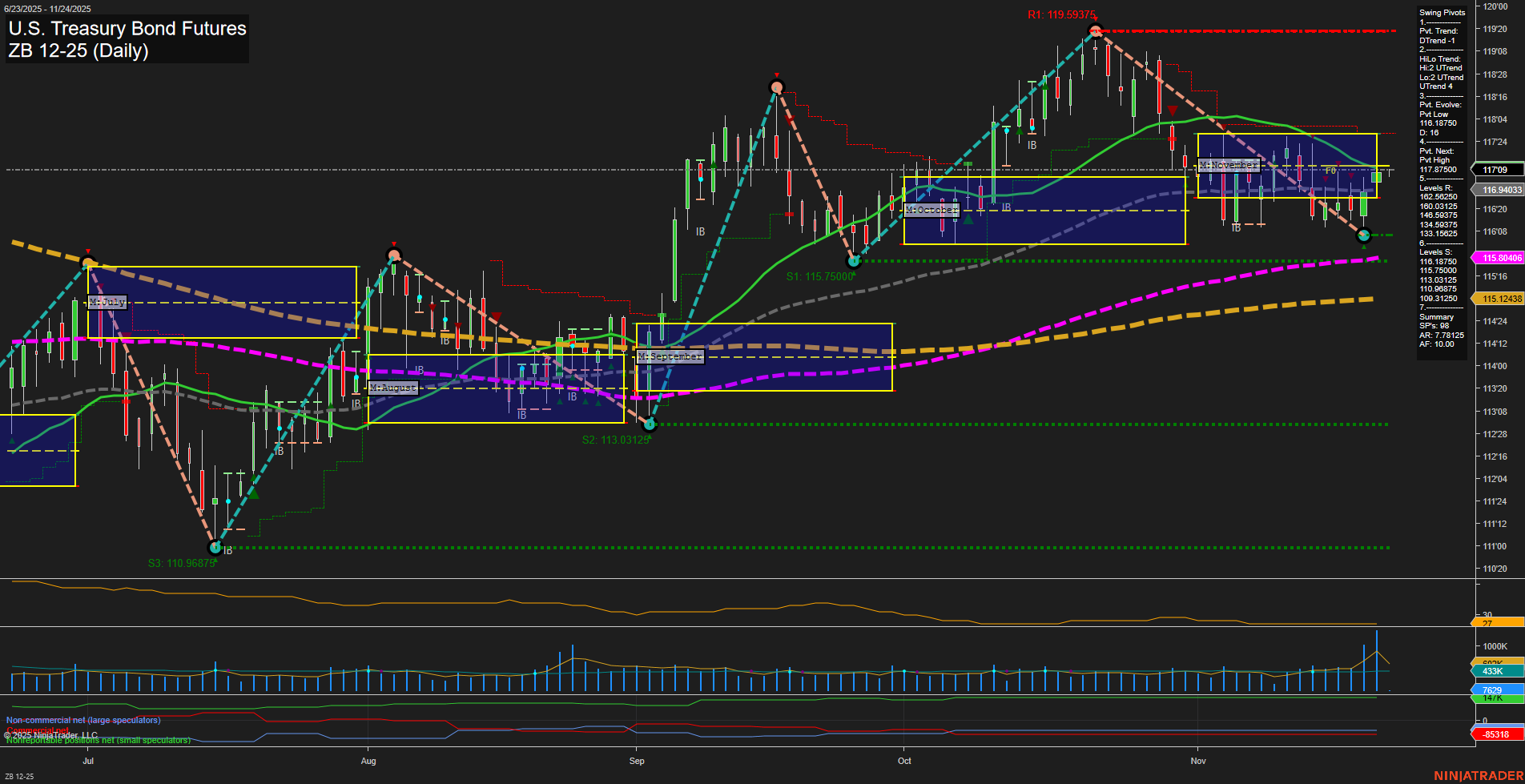

The ZB U.S. Treasury Bond Futures daily chart currently reflects a market in a corrective phase, with both short-term and intermediate-term trends pointing downward as indicated by the swing pivot DTrend and declining short-term moving averages. Price action has recently tested support at 116'1870, with the next significant resistance at 117'8750 and major resistance overhead at 119'5937. The 20-day and 10-day moving averages are both trending down, reinforcing the short-term bearish bias, while the 55, 100, and 200-day moving averages remain in uptrends, suggesting that the longer-term structure is still neutral and not yet in a confirmed downtrend. Volatility has increased, as shown by the elevated ATR and volume metrics, which may indicate heightened market activity or a potential inflection point. The market is consolidating near key support levels, and the neutral stance of the session fib grids (weekly, monthly, yearly) suggests a lack of strong directional conviction from higher timeframes. Overall, the chart signals a short- to intermediate-term bearish environment within a broader neutral long-term context, with traders watching for either a breakdown of support or a reversal signal at these levels.