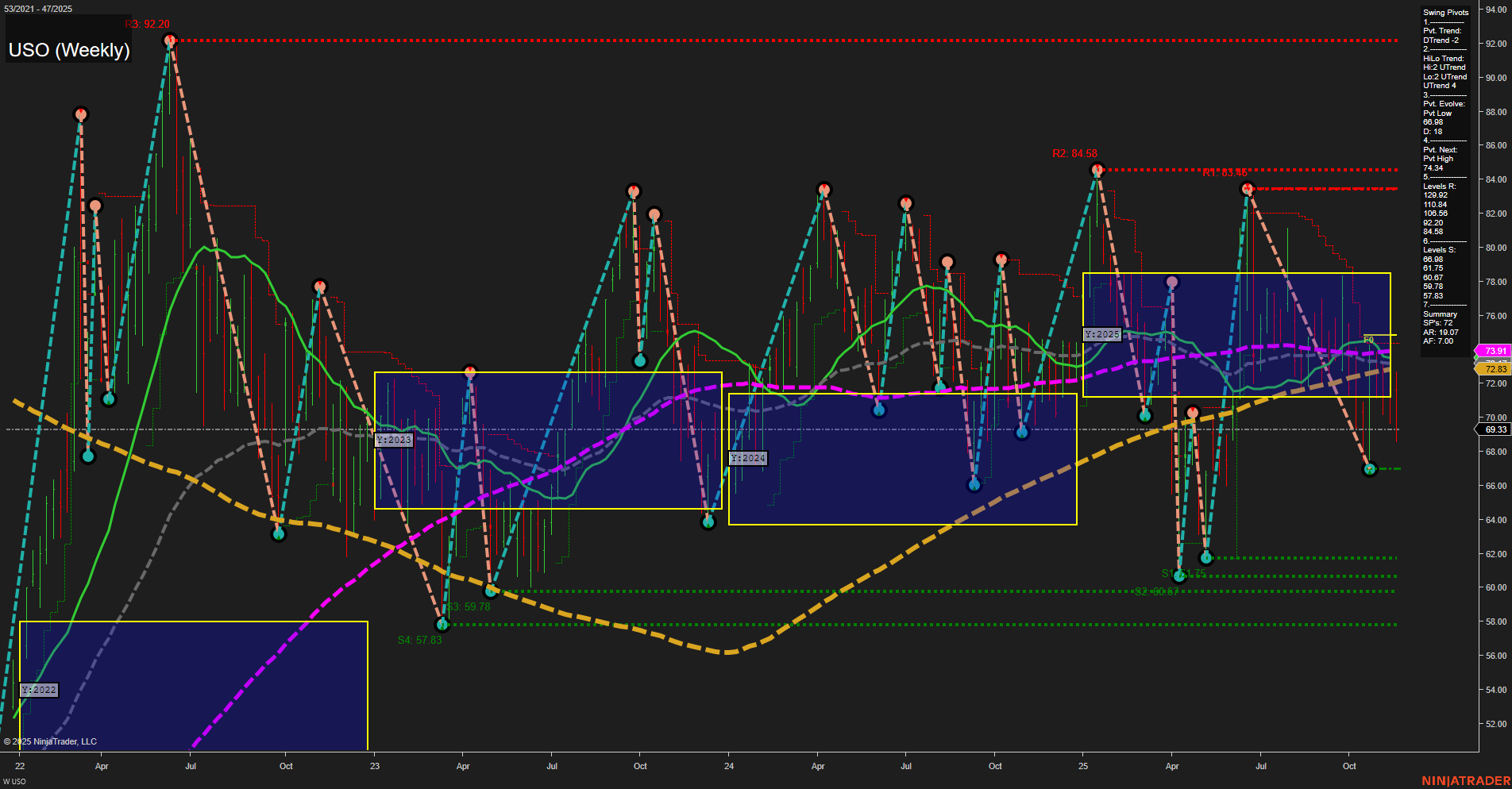

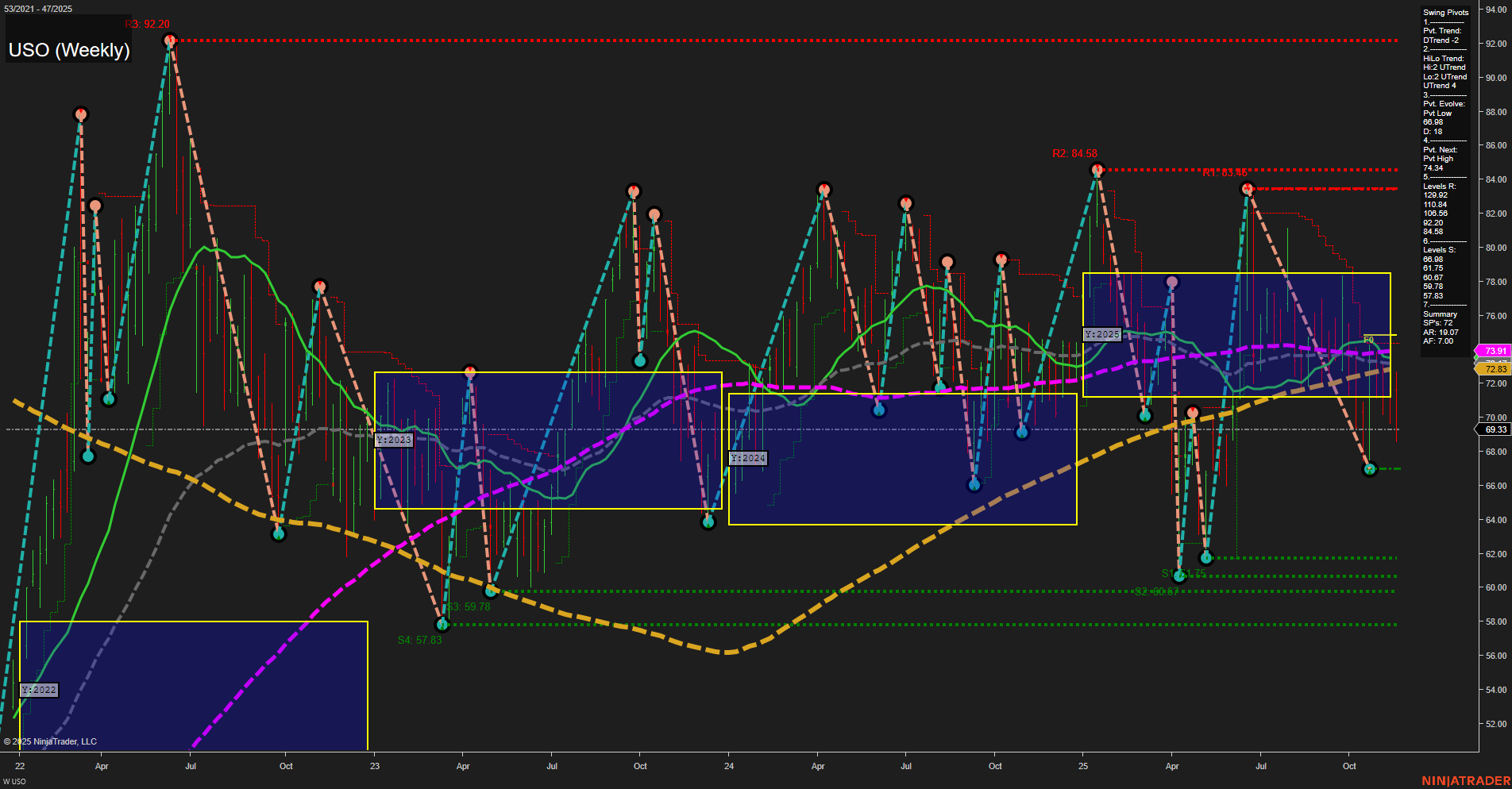

USO United States Oil Fund LP Weekly Chart Analysis: 2025-Nov-23 18:20 CT

Price Action

- Last: 69.33,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 69.33,

- 4. Pvt. Next: Pvt high 73.44,

- 5. Levels R: 92.20, 84.58, 83.85, 73.44,

- 6. Levels S: 69.33, 66.75, 60.75, 59.78, 57.83.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 73.91 Down Trend,

- (Intermediate-Term) 10 Week: 72.83 Down Trend,

- (Long-Term) 20 Week: 72.00 Down Trend,

- (Long-Term) 55 Week: 69.33 Down Trend,

- (Long-Term) 100 Week: 73.91 Down Trend,

- (Long-Term) 200 Week: 72.83 Down Trend.

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

USO is currently experiencing strong downward momentum, as evidenced by large weekly bars and a fast-moving price decline. The short-term swing pivot trend is down, with the most recent pivot low aligning with the current price, suggesting a test of support. Intermediate-term HiLo trend remains up, indicating some underlying resilience, but this is countered by the prevailing downtrend in all major moving averages, which are now acting as resistance. The price is trading below all key benchmarks (5, 10, 20, 55, 100, and 200 week MAs), reinforcing a bearish long-term structure. Multiple resistance levels are stacked above, with significant support levels below, hinting at a potential for further volatility or range-bound action if support holds. The neutral bias in the session fib grids across all timeframes suggests a lack of clear directional conviction, possibly reflecting broader market uncertainty or consolidation after a sharp move. Overall, the technical landscape is dominated by bearish signals in the short and long term, with only the intermediate-term HiLo trend offering a counterpoint.

Chart Analysis ATS AI Generated: 2025-11-23 18:20 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.