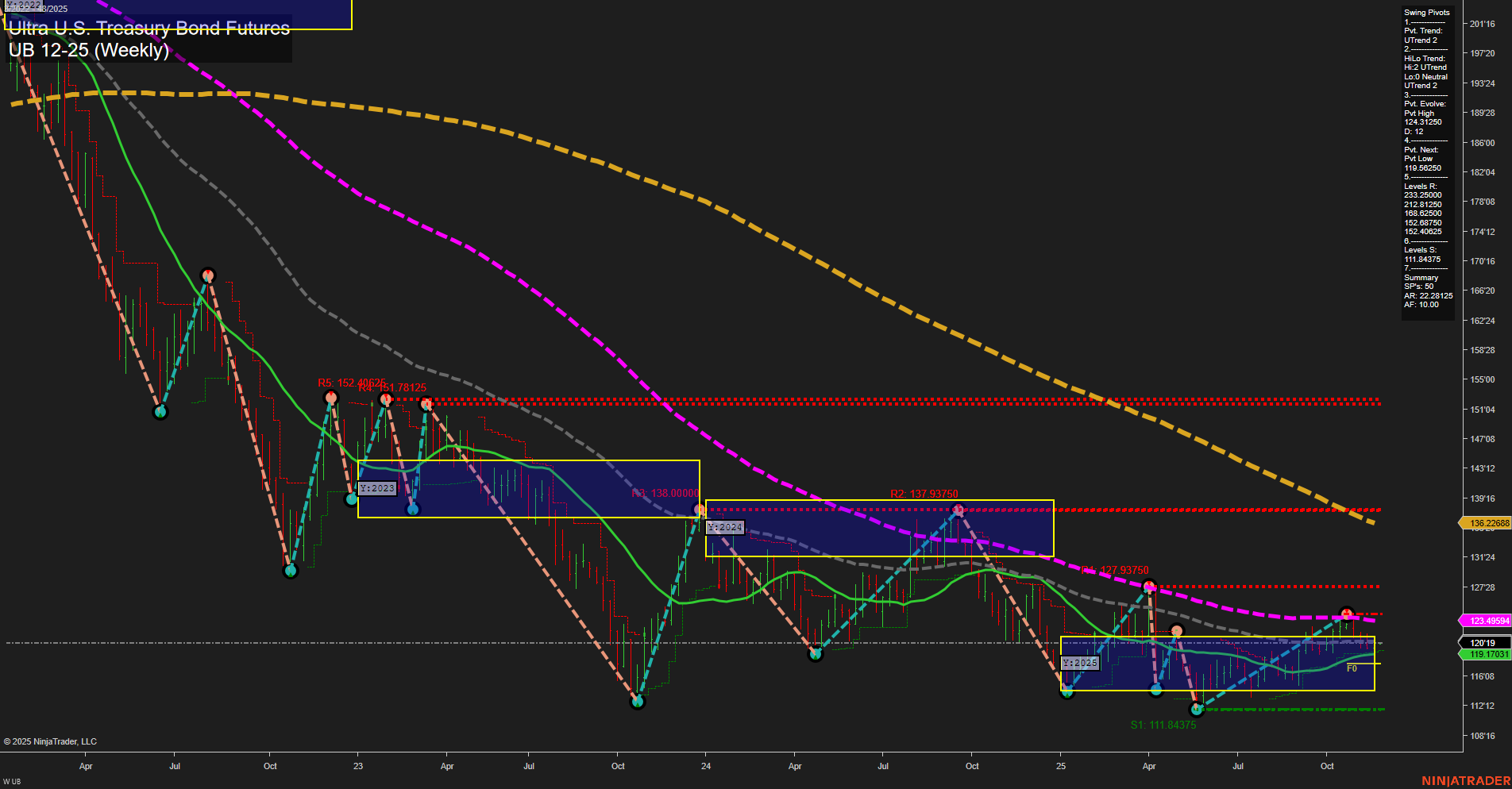

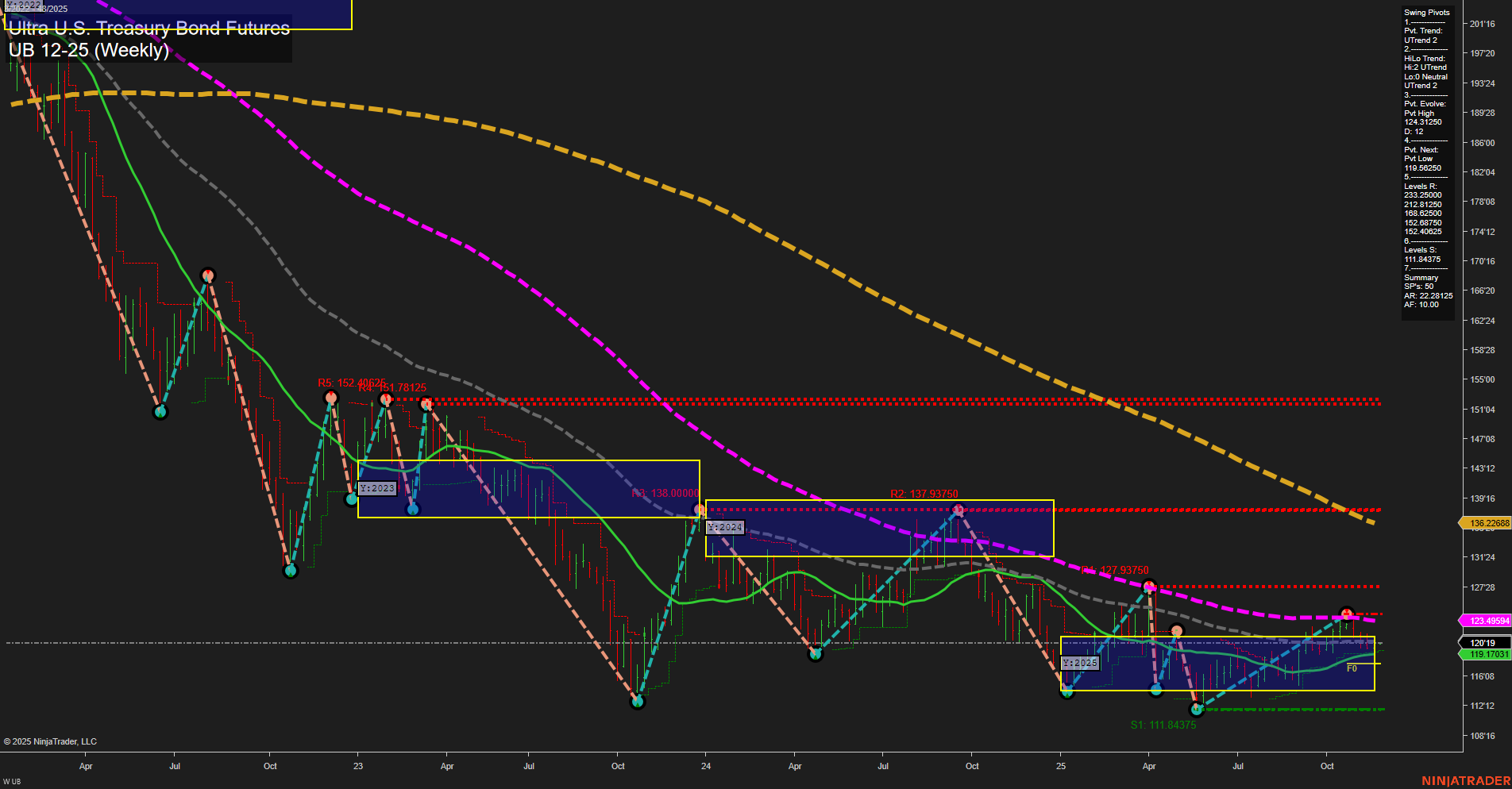

UB Ultra U.S. Treasury Bond Futures Weekly Chart Analysis: 2025-Nov-23 18:19 CT

Price Action

- Last: 120'19,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 37%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 10%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 8%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 119.56250,

- 4. Pvt. Next: Pvt high 123.49594,

- 5. Levels R: 137.93750, 138.00000, 152.40625, 157.78125, 212.81250, 223.25000,

- 6. Levels S: 119.56250, 111.84375.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 119.17031 Up Trend,

- (Intermediate-Term) 10 Week: 119.17031 Up Trend,

- (Long-Term) 20 Week: 119.17031 Up Trend,

- (Long-Term) 55 Week: 123.49594 Down Trend,

- (Long-Term) 100 Week: 136.22688 Down Trend,

- (Long-Term) 200 Week: 201.116 Down Trend.

Recent Trade Signals

- 21 Nov 2025: Long UB 12-25 @ 120.78125 Signals.USAR-MSFG

- 20 Nov 2025: Long UB 12-25 @ 120.21875 Signals.USAR-WSFG

- 18 Nov 2025: Long UB 12-25 @ 120.5625 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bearish.

Key Insights Summary

The UB Ultra U.S. Treasury Bond Futures weekly chart shows a notable shift in momentum, with price action breaking above key short- and intermediate-term Fibonacci grid levels and moving averages. The current swing structure is characterized by a series of higher lows and higher highs, supporting an uptrend in both short- and intermediate-term timeframes. The recent cluster of long trade signals aligns with this bullish momentum, as price remains above the NTZ center and key moving averages (5, 10, and 20 week) are all trending upward. However, the long-term trend remains bearish, as indicated by the 55, 100, and 200 week moving averages, which are still in decline and positioned well above current price. Resistance levels at 123.49594 and 137.93750 are key areas to watch for potential trend continuation or reversal, while support at 119.56250 and 111.84375 underpins the current advance. The market appears to be in a recovery phase, with a possible transition from a prolonged downtrend to a period of consolidation and potential base-building, as evidenced by the recent breakout from the NTZ and the alignment of multiple bullish signals in the shorter timeframes.

Chart Analysis ATS AI Generated: 2025-11-23 18:19 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.