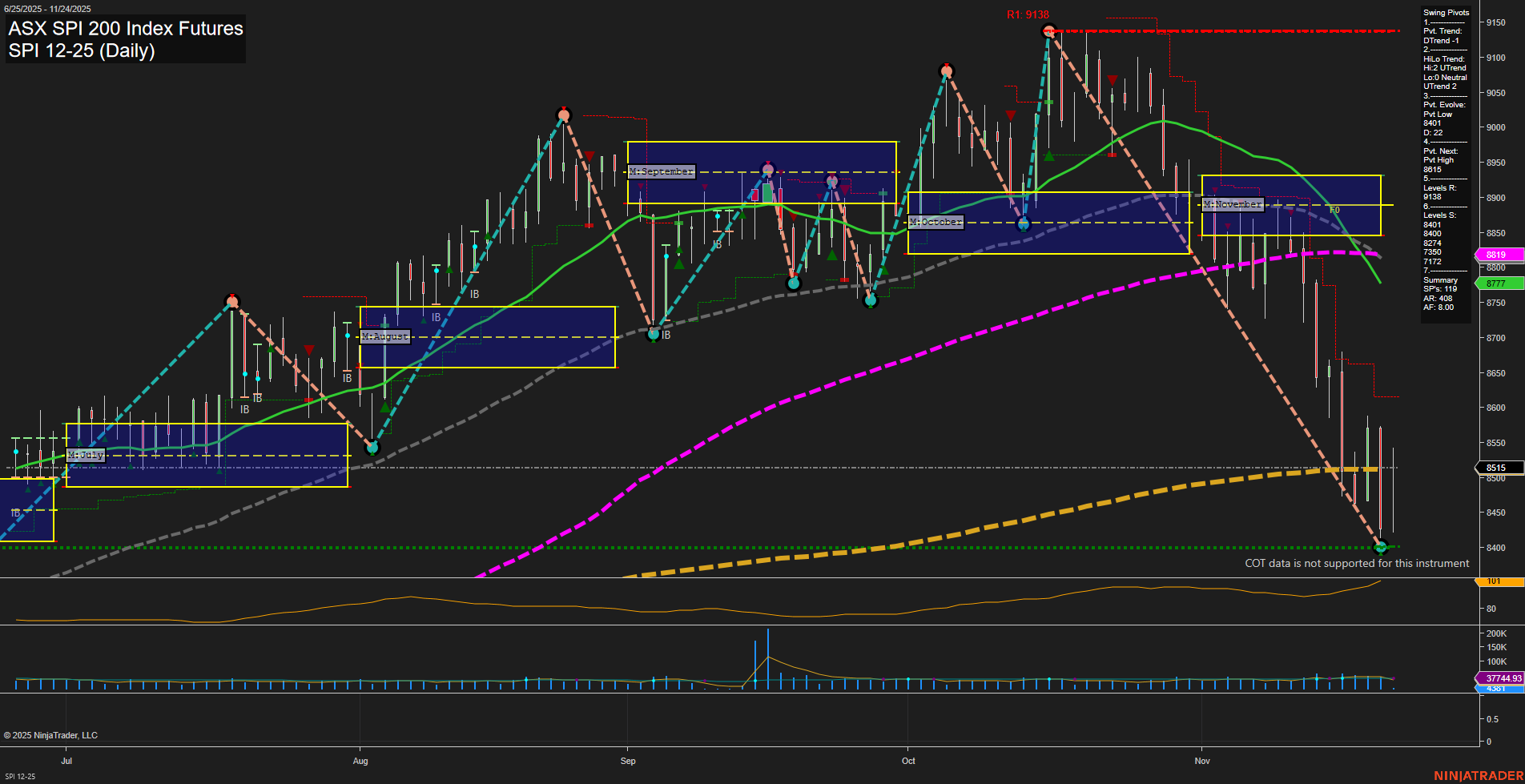

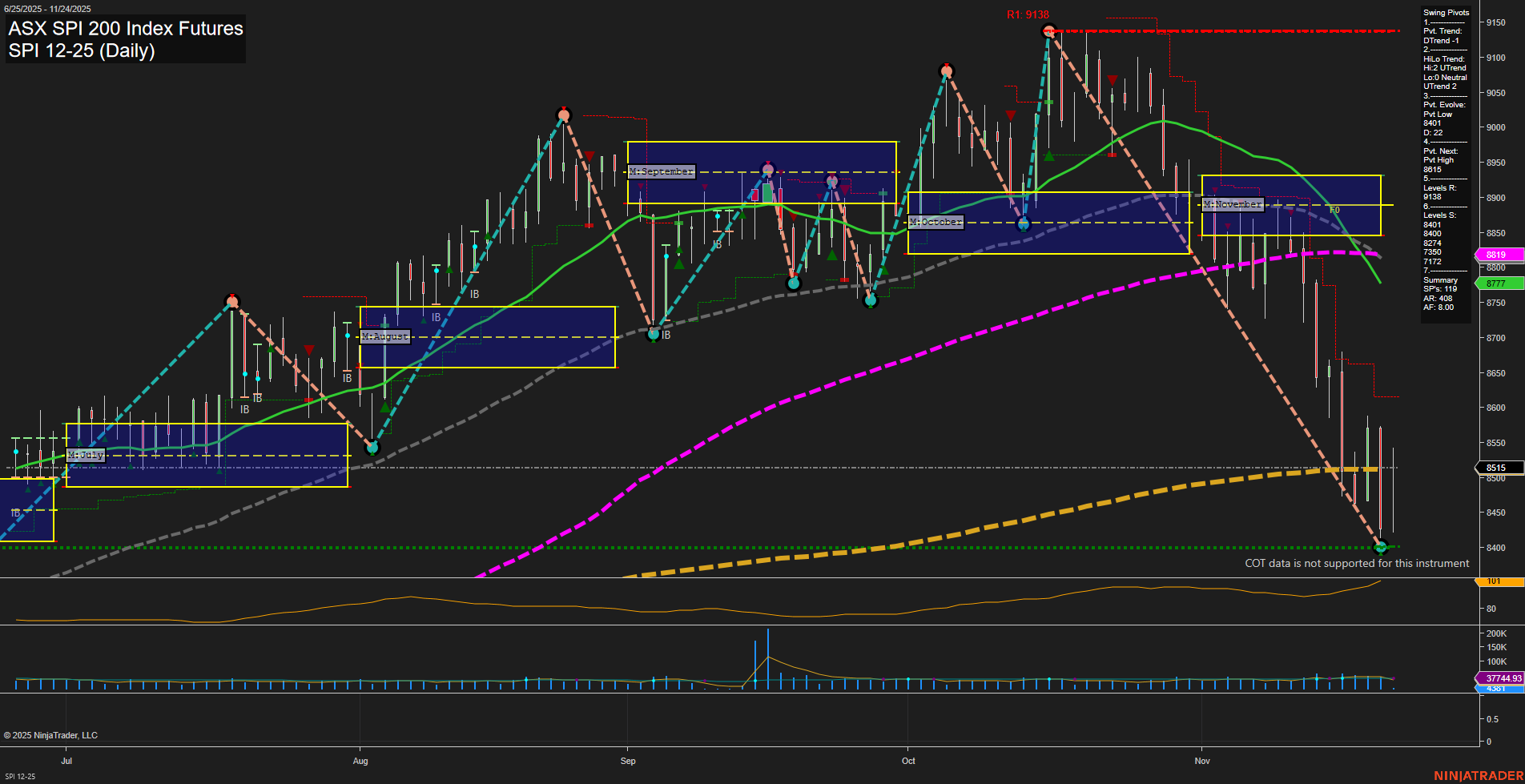

SPI ASX SPI 200 Index Futures Daily Chart Analysis: 2025-Nov-23 18:17 CT

Price Action

- Last: 8515,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt Low 8401,

- 4. Pvt. Next: Pvt High 8515,

- 5. Levels R: 9138, 9006, 8926, 8777,

- 6. Levels S: 8401.

Daily Benchmarks

- (Short-Term) 5 Day: 8608 Down Trend,

- (Short-Term) 10 Day: 8777 Down Trend,

- (Intermediate-Term) 20 Day: 8819 Down Trend,

- (Intermediate-Term) 55 Day: 8800 Down Trend,

- (Long-Term) 100 Day: 8919 Down Trend,

- (Long-Term) 200 Day: 8500 Up Trend.

Additional Metrics

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

The SPI 200 futures have experienced a sharp and accelerated decline, as indicated by large bars and fast momentum, with price currently at 8515. Both short-term and intermediate-term swing pivot trends are down, and the most recent pivot low at 8401 is now the key support, while resistance levels are stacked above, notably at 8777 and 8926. All benchmark moving averages except the 200-day are trending down, confirming broad-based weakness across timeframes. The 200-day MA is flat to slightly up, suggesting the longer-term trend has not yet fully reversed, but is under pressure. Volatility is elevated (ATR 96), and volume is above average, reflecting heightened activity during this selloff. The market is in a corrective phase, with no clear signs of reversal yet, and is currently testing major support levels after breaking down from the November MSFG range. The overall structure points to a bearish environment in the short and intermediate term, with the potential for further volatility as the market seeks to establish a new base or tests lower support.

Chart Analysis ATS AI Generated: 2025-11-23 18:18 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.