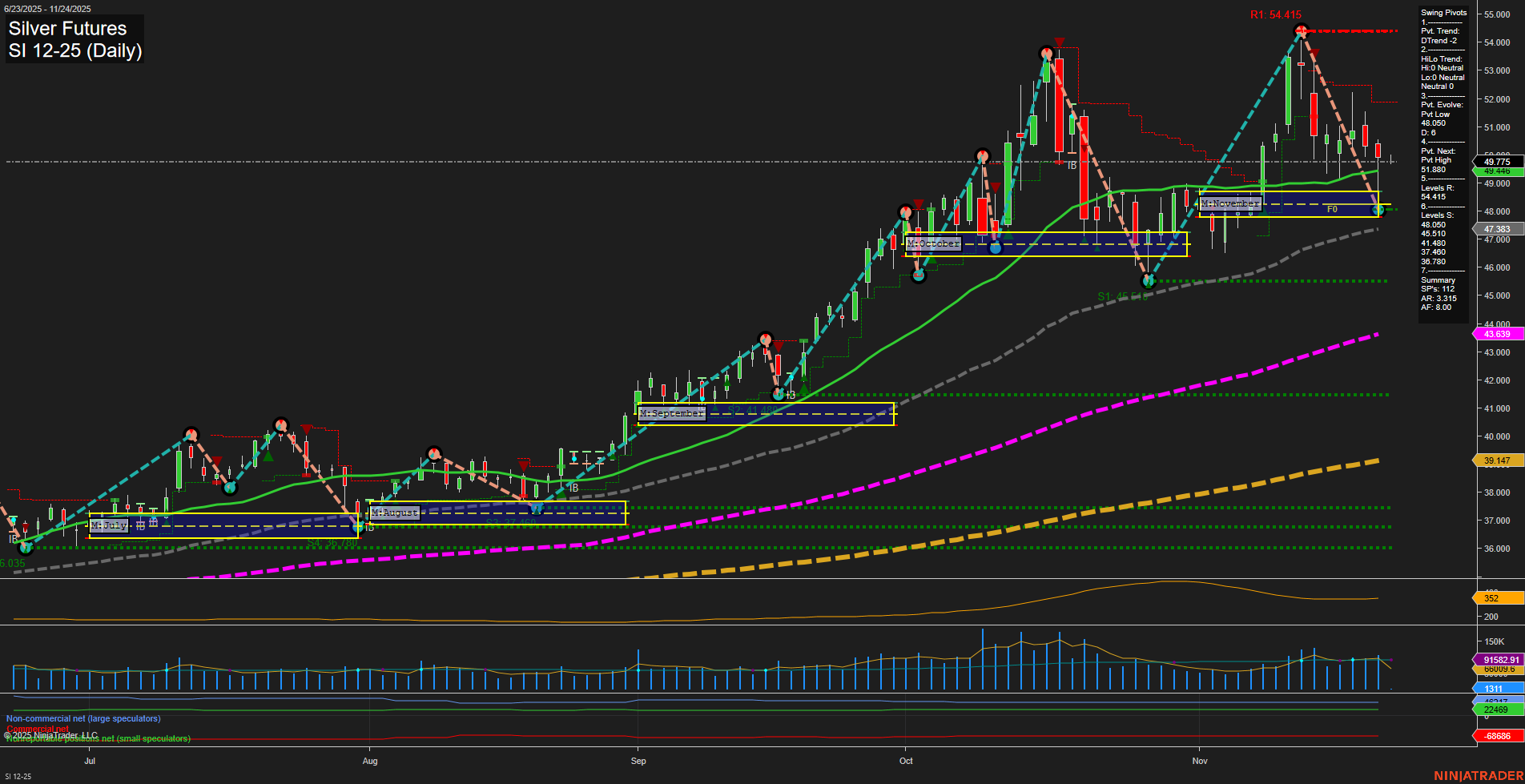

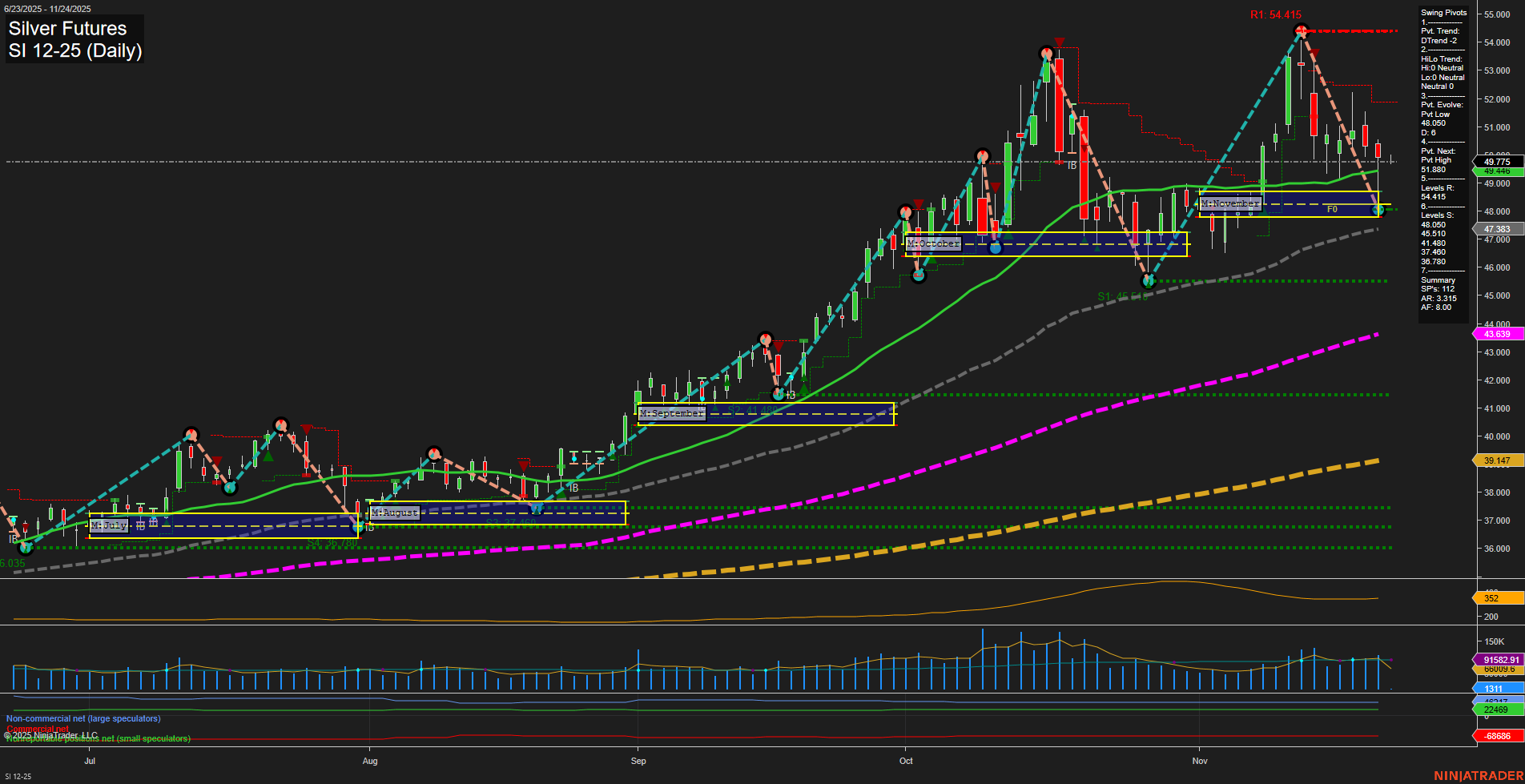

SI Silver Futures Daily Chart Analysis: 2025-Nov-23 18:16 CT

Price Action

- Last: 49.775,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -2%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 55%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 241%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 48.06,

- 4. Pvt. Next: Pvt high 51.88,

- 5. Levels R: 54.415, 51.88, 51.46, 49.91,

- 6. Levels S: 48.06, 47.383, 46.415, 45.035.

Daily Benchmarks

- (Short-Term) 5 Day: 49.915 Down Trend,

- (Short-Term) 10 Day: 50.415 Down Trend,

- (Intermediate-Term) 20 Day: 49.900 Down Trend,

- (Intermediate-Term) 55 Day: 48.415 Up Trend,

- (Long-Term) 100 Day: 43.639 Up Trend,

- (Long-Term) 200 Day: 39.147 Up Trend.

Additional Metrics

Recent Trade Signals

- 21 Nov 2025: Short SI 12-25 @ 49.595 Signals.USAR-WSFG

- 20 Nov 2025: Short SI 12-25 @ 50.05 Signals.USAR.TR120

- 18 Nov 2025: Short SI 12-25 @ 49.39 Signals.USAR.TR720

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

Silver futures are currently experiencing a short-term pullback, with price action showing slow momentum and medium-sized bars. The short-term trend is down, confirmed by both the WSFG and swing pivot metrics, as well as recent short trade signals. Price is trading below the weekly NTZ center, and short-term moving averages (5, 10, 20-day) are all trending down, reinforcing the bearish short-term outlook. However, the intermediate-term picture is more mixed: while the monthly MSFG trend remains up and price is above the monthly NTZ, the intermediate-term swing pivot trend has shifted to down, suggesting a possible retracement or consolidation phase. Long-term structure remains bullish, with price well above the 100- and 200-day moving averages and the yearly session fib grid showing strong upside extension. Key resistance levels are clustered near recent highs, while support is found at 48.06 and below. Volatility (ATR) is moderate, and volume remains steady. Overall, the market is in a corrective phase within a larger uptrend, with short-term pressure to the downside but underlying long-term strength still intact.

Chart Analysis ATS AI Generated: 2025-11-23 18:17 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.