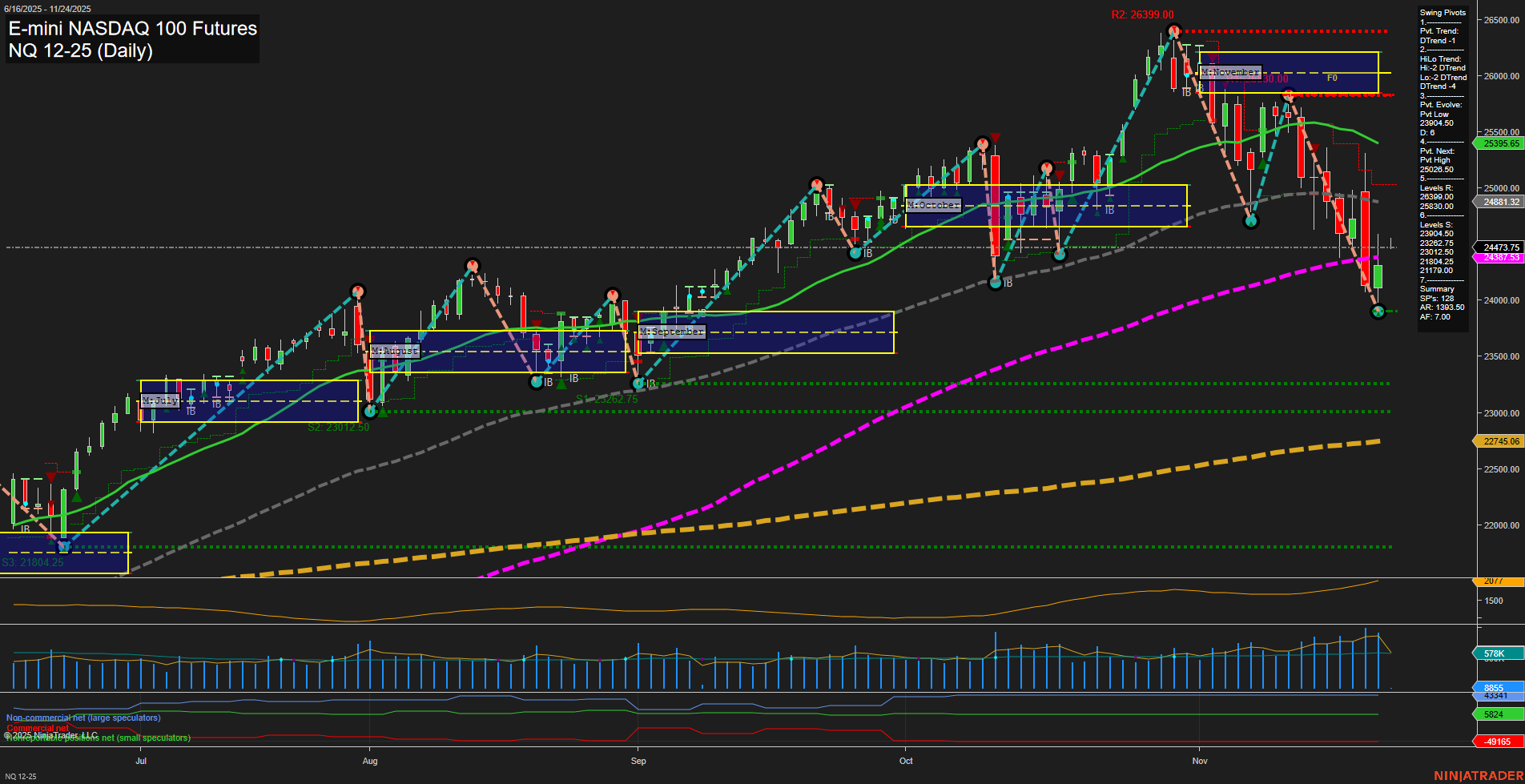

The NQ E-mini NASDAQ 100 Futures daily chart shows a market in transition. Price action has been volatile, with large bars and fast momentum reflecting heightened activity and strong directional moves. The short-term and intermediate-term trends are both down, as confirmed by the swing pivot structure (DTrend), lower highs, and a series of lower lows. All key short- and intermediate-term moving averages are trending down, reinforcing the bearish tone for swing traders in these timeframes. However, the long-term trend remains bullish, with the yearly session fib grid and the 200-day moving average both pointing up, suggesting that the broader uptrend is still intact despite the recent correction. The market is currently trading below the monthly session fib grid's neutral zone, indicating intermediate-term weakness, but remains above the yearly fib grid's neutral zone, supporting the longer-term bullish structure. Recent trade signals reflect this mixed environment, with both short and long entries triggered in close succession, highlighting the choppy and volatile nature of the current market. Volatility is elevated (ATR: 1618), and volume remains robust, suggesting active participation and potential for further large moves. In summary, the market is experiencing a corrective phase within a larger uptrend. Short- and intermediate-term traders are facing a bearish environment with potential for further downside or choppy consolidation, while long-term participants may view this as a pullback within a continuing bull market. Key levels to watch include resistance at 25,088.50 and 26,399.00, and support at 24,094.50 and 23,017.50.