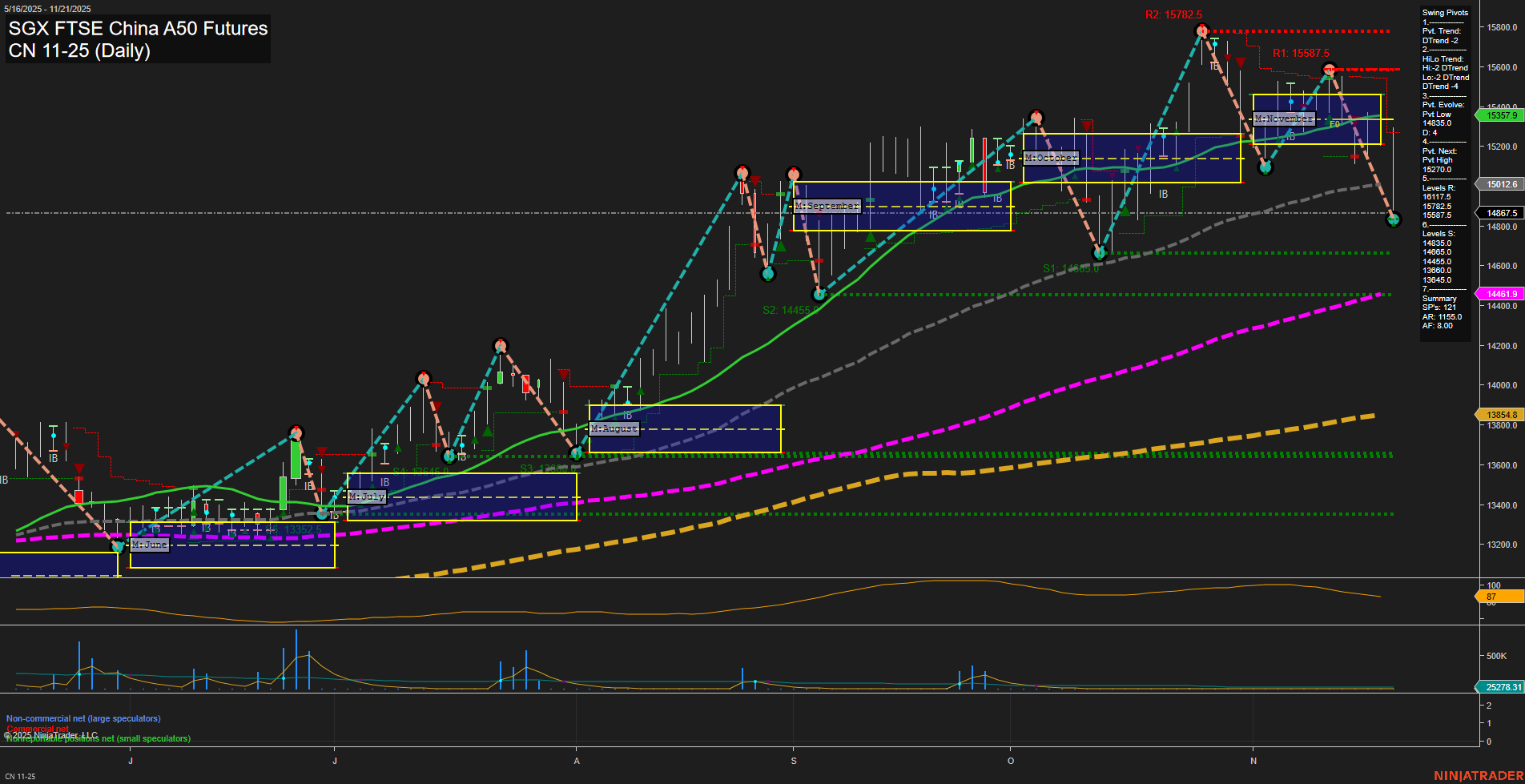

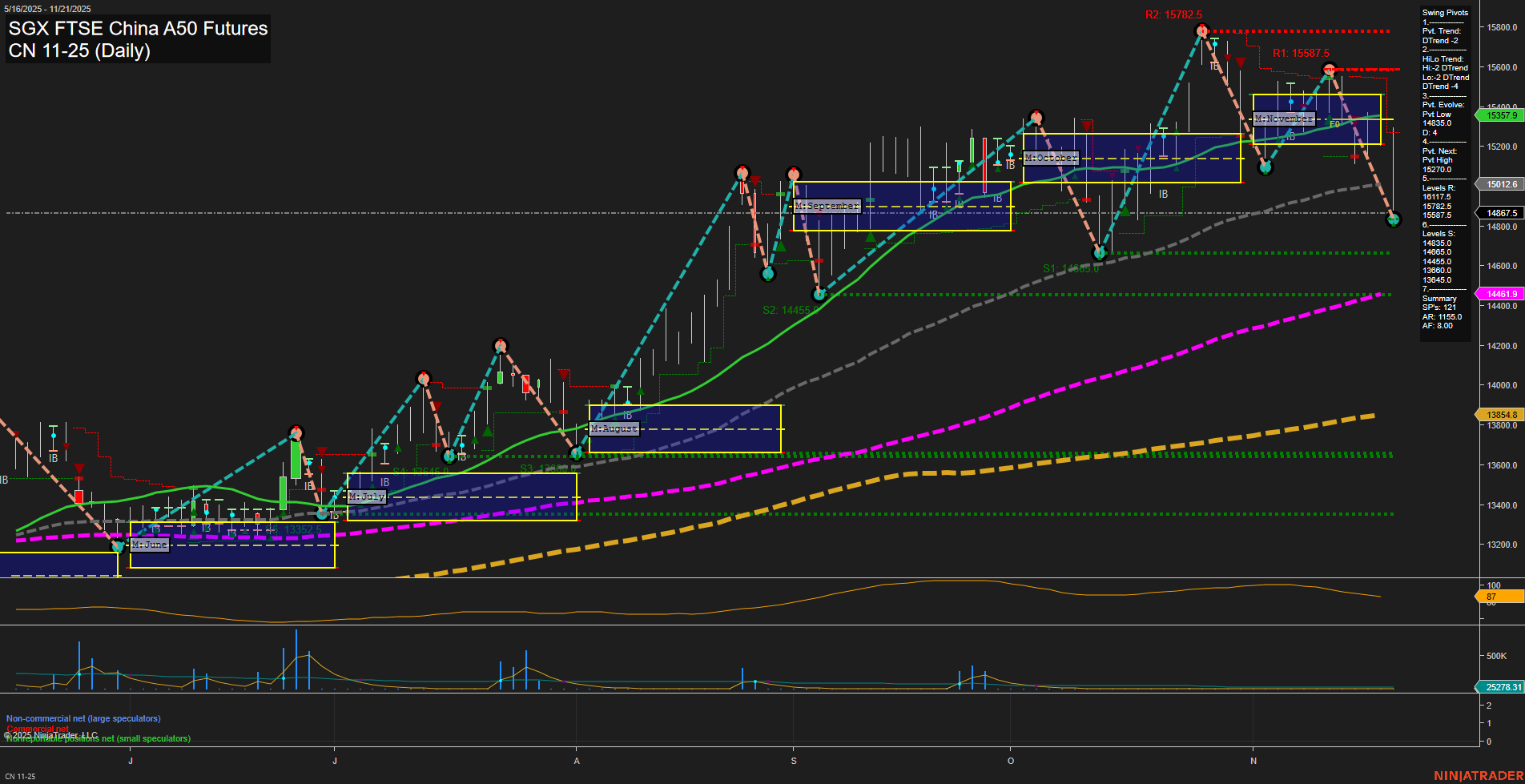

CN SGX FTSE China A50 Futures Daily Chart Analysis: 2025-Nov-23 18:05 CT

Price Action

- Last: 15357.9,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 15782.5,

- 4. Pvt. Next: Pvt Low 14843.0,

- 5. Levels R: 15782.5, 15587.5,

- 6. Levels S: 14843.0, 14455.0, 13854.8.

Daily Benchmarks

- (Short-Term) 5 Day: 15172.5 Down Trend,

- (Short-Term) 10 Day: 15175.5 Down Trend,

- (Intermediate-Term) 20 Day: 15357.9 Down Trend,

- (Intermediate-Term) 55 Day: 15012.6 Up Trend,

- (Long-Term) 100 Day: 14461.9 Up Trend,

- (Long-Term) 200 Day: 13854.8 Up Trend.

Additional Metrics

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The CN SGX FTSE China A50 Futures daily chart shows a recent shift in momentum, with price action rolling over from a swing high at 15782.5 and currently trending down toward the next key support at 14843.0. Both short-term and intermediate-term swing pivot trends have turned bearish, confirmed by the downtrend in the 5, 10, and 20-day moving averages. However, the longer-term 55, 100, and 200-day moving averages remain in an uptrend, indicating that the broader bullish structure is still intact despite the current pullback. The ATR suggests moderate volatility, and volume remains steady. The market appears to be in a corrective phase within a larger uptrend, with price consolidating between established resistance and support levels. No clear breakout or breakdown is evident, and the neutral bias on the session fib grids supports a wait-and-see approach for trend confirmation. The chart reflects a typical swing retracement after a strong rally, with the potential for either a deeper correction or a resumption of the primary uptrend depending on how price reacts at the next support zone.

Chart Analysis ATS AI Generated: 2025-11-23 18:05 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.