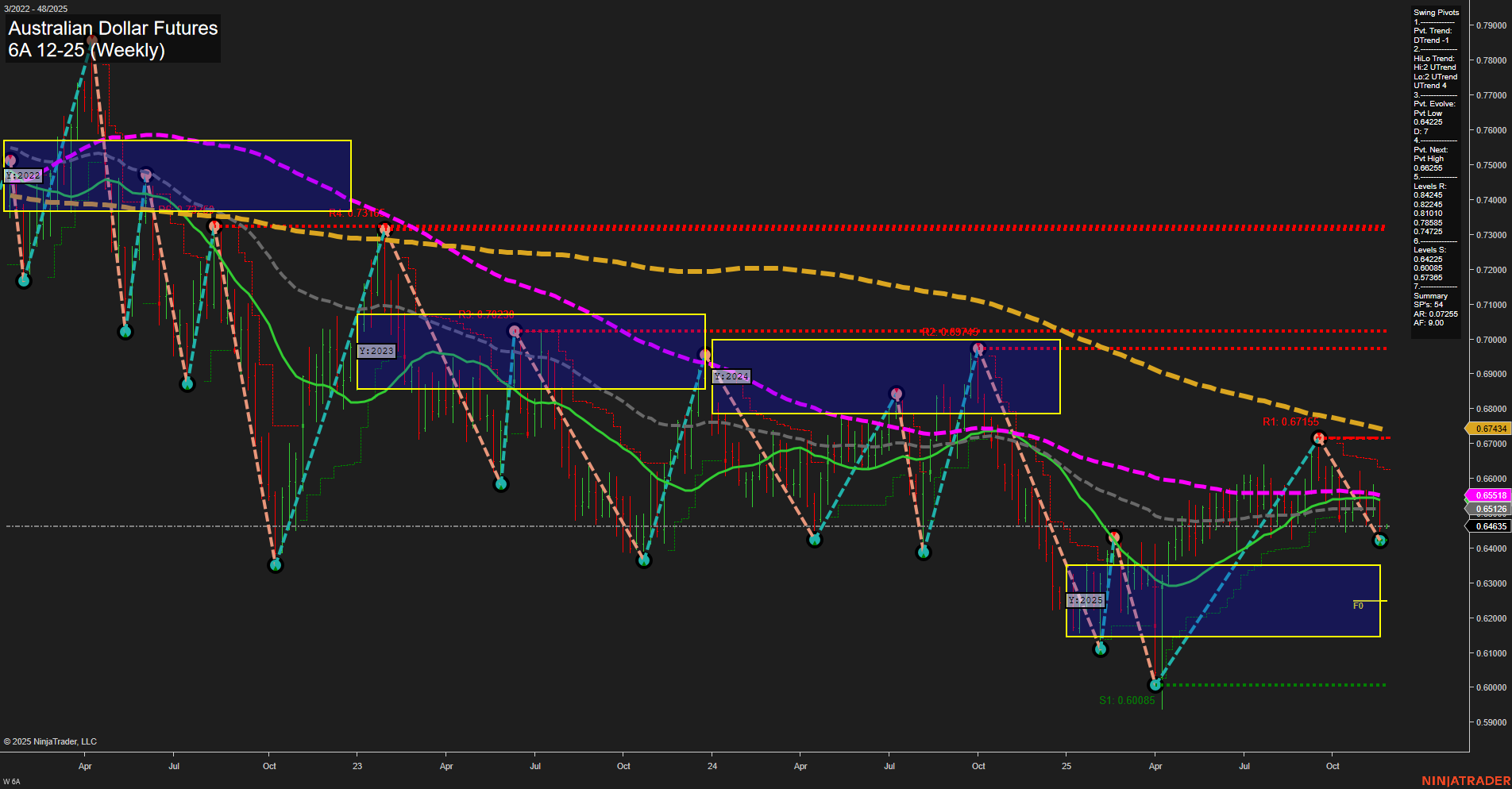

The Australian Dollar Futures (6A) weekly chart shows a market in transition, with recent price action characterized by medium-sized bars and slow momentum, suggesting a lack of strong conviction in either direction. The short-term swing pivot trend has turned down, with the most recent pivot low at 0.64252 and resistance levels stacking above, indicating sellers are currently in control. However, the intermediate-term HiLo trend remains up, reflecting a prior recovery from the yearly lows, but this is now being tested as price approaches key resistance at 0.65285 and 0.67155. All major long-term moving averages (55, 100, 200 week) are trending down, reinforcing a bearish backdrop, while the 20-week MA is the only one showing an uptrend, hinting at a possible counter-trend rally that may be losing steam. The price is currently below most benchmarks, and the neutral readings on the session fib grids (WSFG, MSFG, YSFG) suggest a market in consolidation rather than trending. Overall, the chart reflects a market that has bounced from major support but is struggling to sustain upward momentum, with resistance levels capping rallies and the broader trend still pointing lower. This environment is typical of a corrective phase within a larger downtrend, with potential for further choppy or sideways action unless a decisive breakout or breakdown occurs.