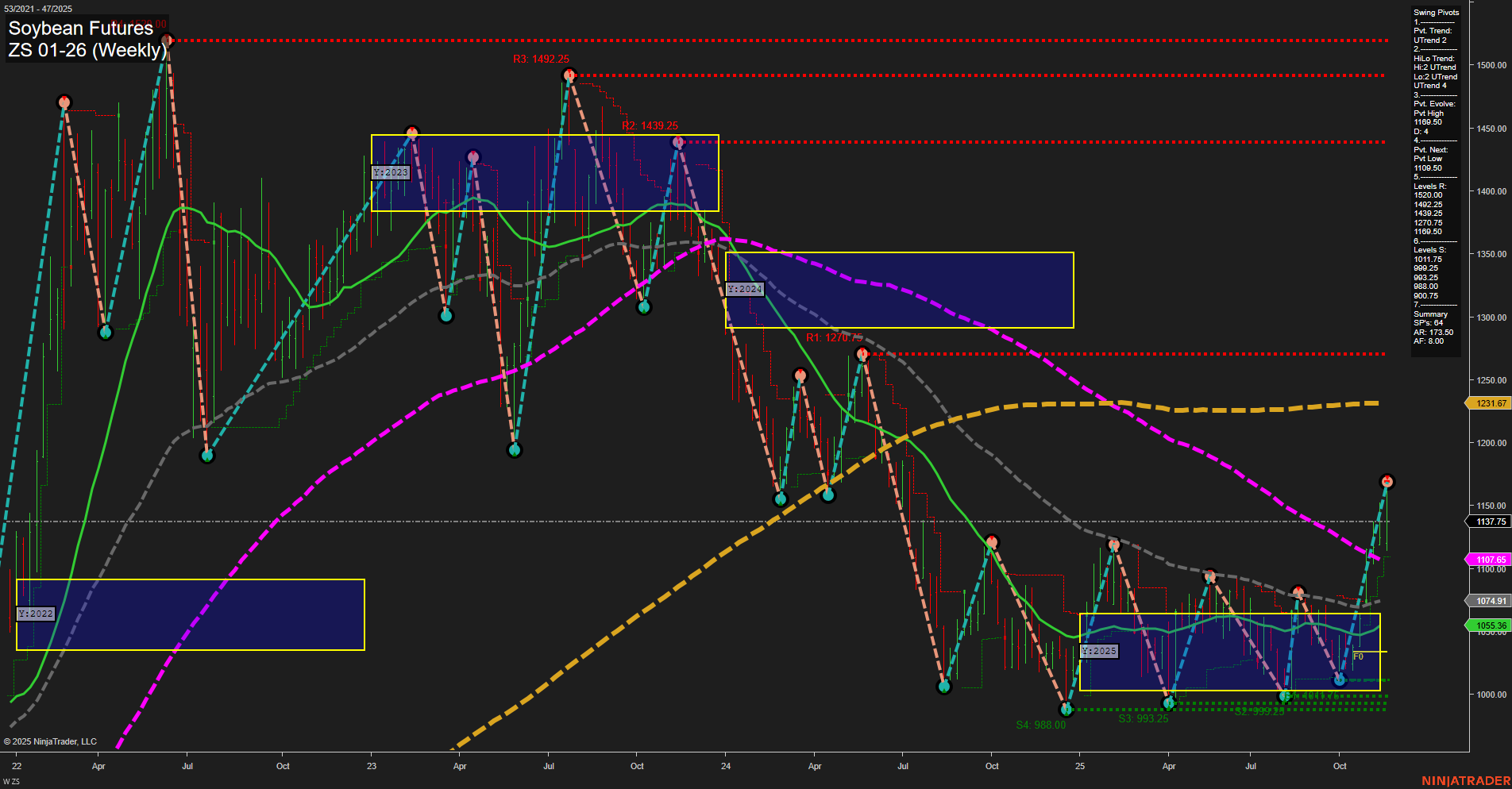

Soybean futures have staged a strong rally, with price action breaking decisively above the NTZ F0% levels across weekly, monthly, and yearly session fib grids, confirming a robust uptrend in both short- and intermediate-term timeframes. The most recent bars are large and momentum is fast, indicating aggressive buying and a potential shift in sentiment. Swing pivot analysis shows an evolving uptrend, with the latest pivot high at 1231.67 and the next key support at 1090.50. Resistance levels are stacked above, with significant historical resistance at 1270.75 and 1190.50, while support is well-defined below. All key weekly moving averages (5, 10, 20, 55) are trending up, further supporting the bullish structure, though the 100- and 200-week MAs remain in a downtrend, suggesting the long-term trend is still in transition. The recent short signal from 19 Nov 2025 appears to have been quickly overwhelmed by the current rally, highlighting the volatility and potential for sharp reversals. Overall, the market is in a bullish phase in the short and intermediate term, with the long-term trend neutral as price tests major moving average resistance. The technical landscape suggests a possible trend continuation, but with volatility and the potential for pullbacks as price approaches overhead resistance.