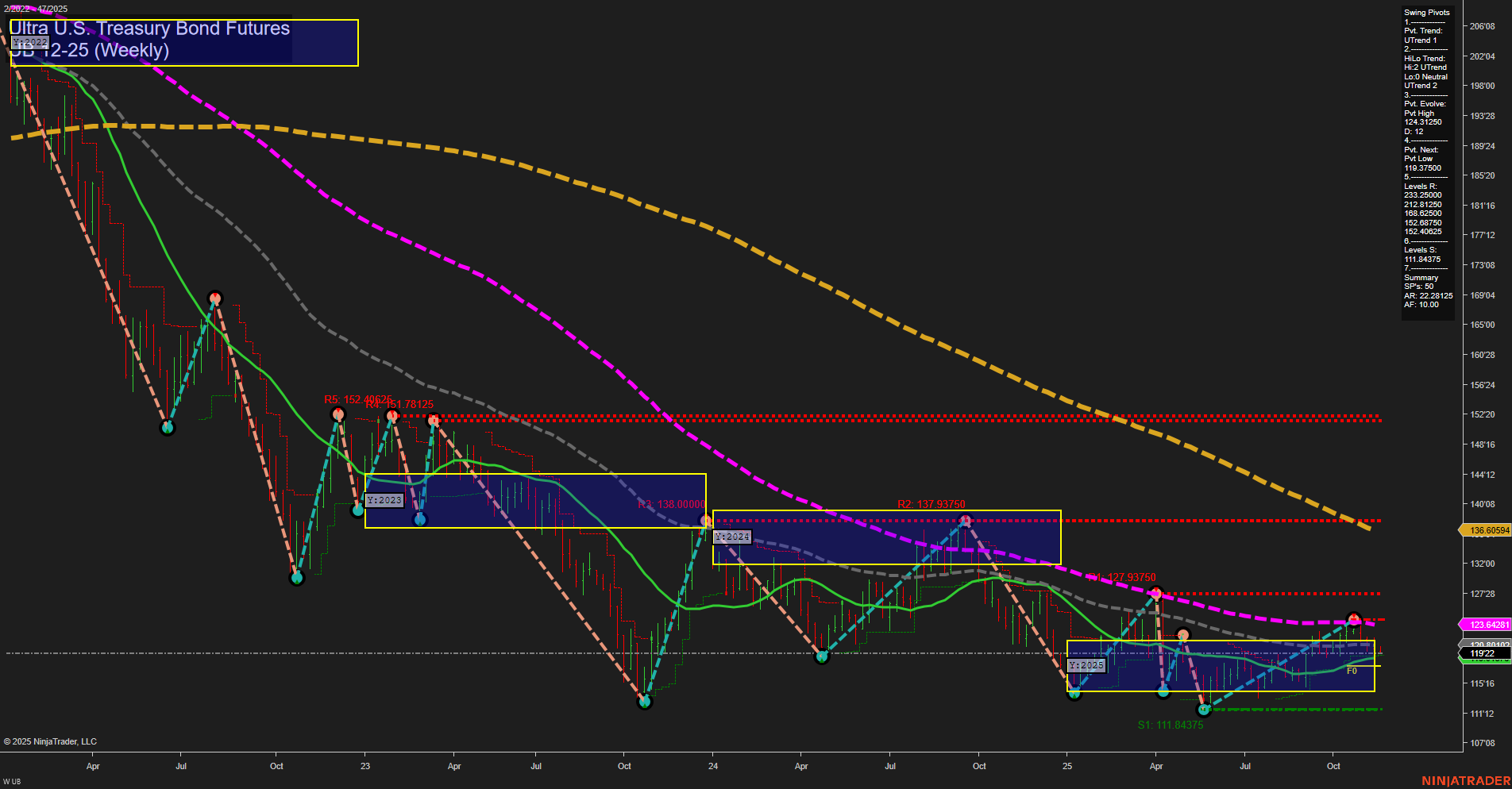

The UB Ultra U.S. Treasury Bond Futures weekly chart shows a market in transition. Price action is currently consolidating just below the NTZ center line, with medium-sized bars and average momentum, indicating a lack of strong directional conviction in the short term. Both the weekly and monthly session fib grids (WSFG, MSFG) are trending down, with price below their respective NTZ zones, reflecting persistent short- and intermediate-term weakness. However, the yearly session fib grid (YSFG) shows a mild upward bias, with price above the NTZ, suggesting some long-term support or a potential base forming. Swing pivots indicate an evolving uptrend in both short- and intermediate-term metrics, with the most recent pivot high at 124'13.5 and the next key support at 119'13.5. Resistance levels remain well above current price, highlighting the overhead supply and the challenge for bulls to break higher. The moving averages reinforce the longer-term bearish structure, as all major long-term benchmarks (20, 55, 100, 200 week) are trending down and positioned above current price, while short-term averages are showing a slight upward turn, hinting at a possible short-term bounce or retracement. Recent trade signals have triggered long entries, aligning with the short-term uptrend in pivots, but the overall environment remains mixed. The market is currently in a consolidation phase, with potential for a counter-trend rally, but significant resistance and the dominant long-term downtrend suggest that any upside may be limited unless a breakout above key resistance levels occurs. Volatility remains moderate, and the market is likely to remain choppy until a decisive move emerges.