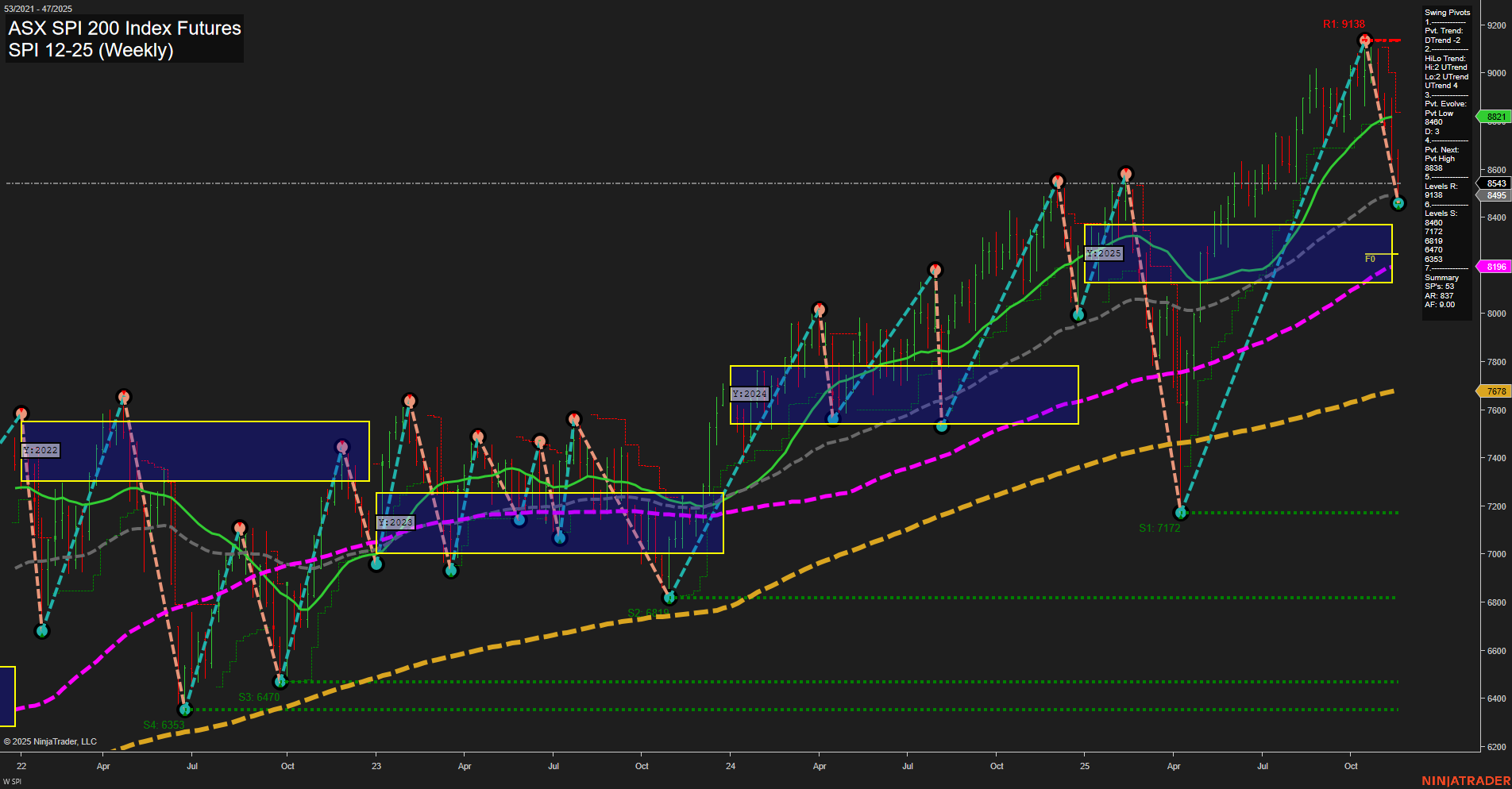

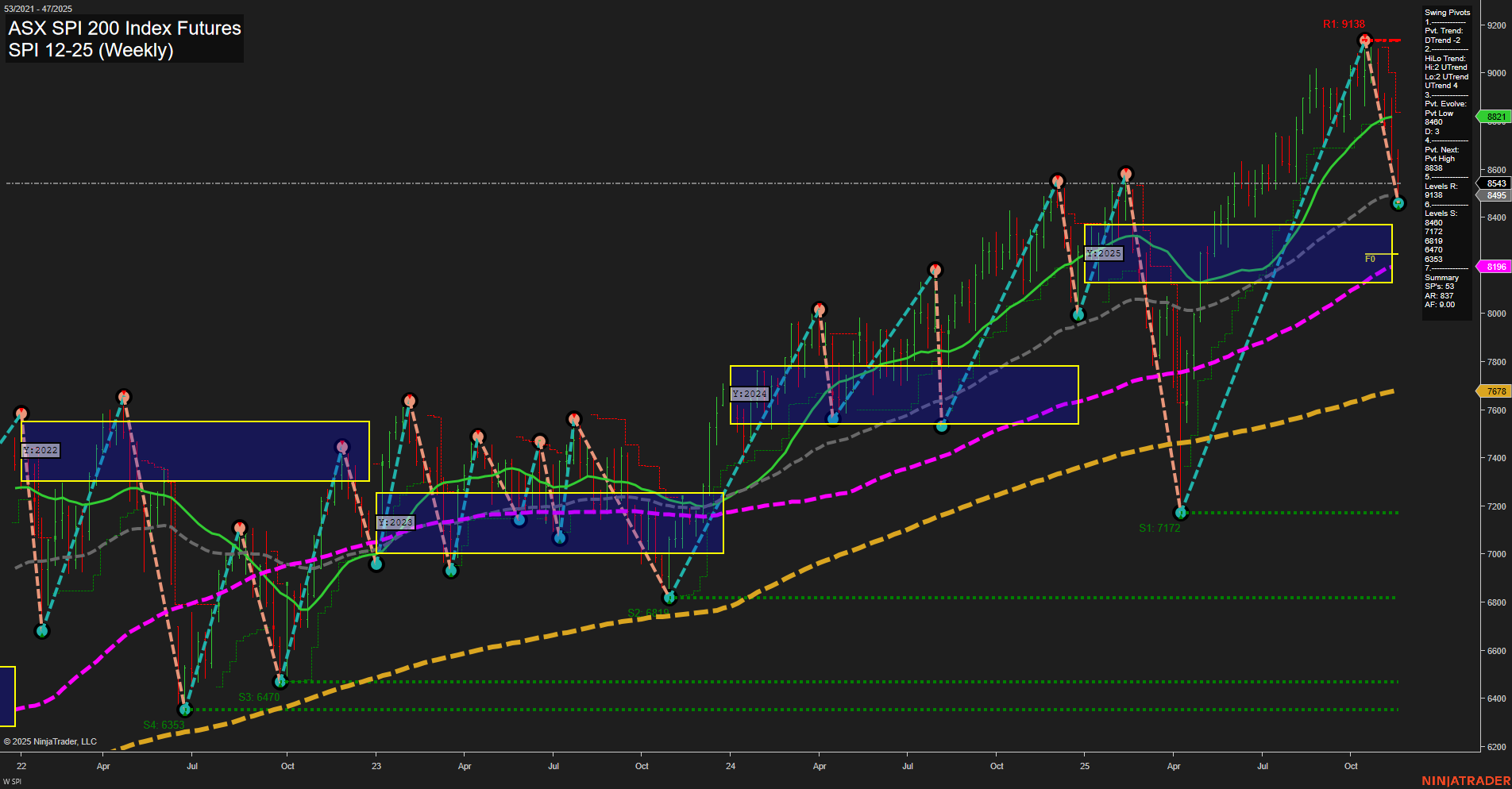

SPI ASX SPI 200 Index Futures Weekly Chart Analysis: 2025-Nov-20 07:18 CT

Price Action

- Last: 8821,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 8400,

- 4. Pvt. Next: Pvt high 9138,

- 5. Levels R: 9138, 8838, 8543,

- 6. Levels S: 8400, 8170, 7172, 6470, 6353.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 8543 Up Trend,

- (Intermediate-Term) 10 Week: 8459 Up Trend,

- (Long-Term) 20 Week: 8196 Up Trend,

- (Long-Term) 55 Week: 7678 Up Trend,

- (Long-Term) 100 Week: 7678 Up Trend,

- (Long-Term) 200 Week: 7678 Up Trend.

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The SPI 200 Index Futures weekly chart shows a recent sharp pullback from the swing high at 9138, with price currently at 8821. The short-term swing pivot trend has shifted to down (DTrend), indicating a corrective phase after a strong rally. However, the intermediate and long-term trends remain bullish, supported by all key moving averages trending upward and price holding well above major support levels. The market has experienced large, fast-moving bars, suggesting heightened volatility and active swing cycles. The current move appears to be a retracement within a broader uptrend, with the next key support at 8400 and resistance at 9138. The neutral bias in the session fib grids across all timeframes suggests a consolidation phase, with the market digesting recent gains. Overall, the structure favors a bullish outlook on higher timeframes, while the short-term correction may offer mean reversion or trend continuation opportunities as the market tests support and resistance zones.

Chart Analysis ATS AI Generated: 2025-11-20 07:18 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.