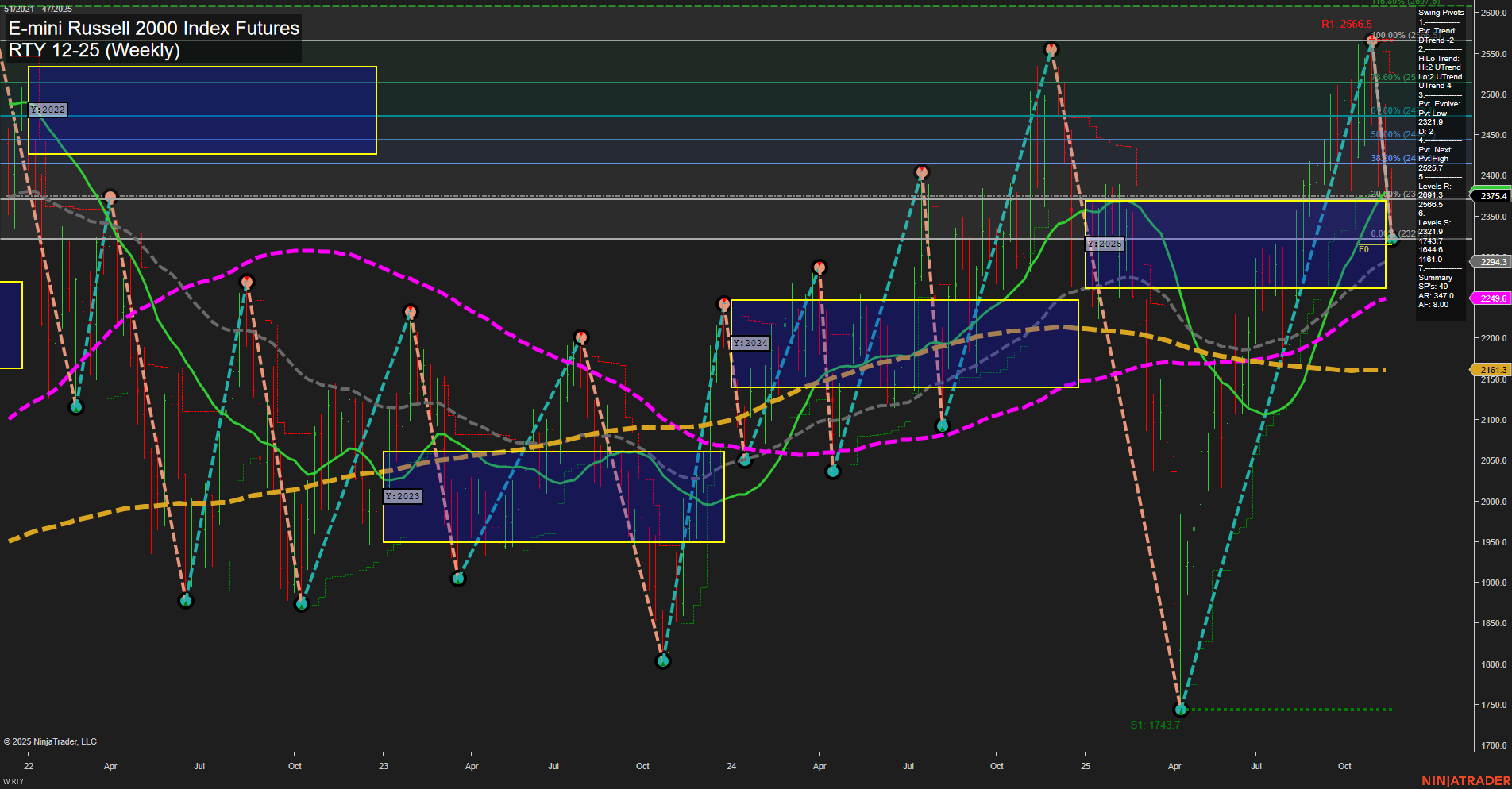

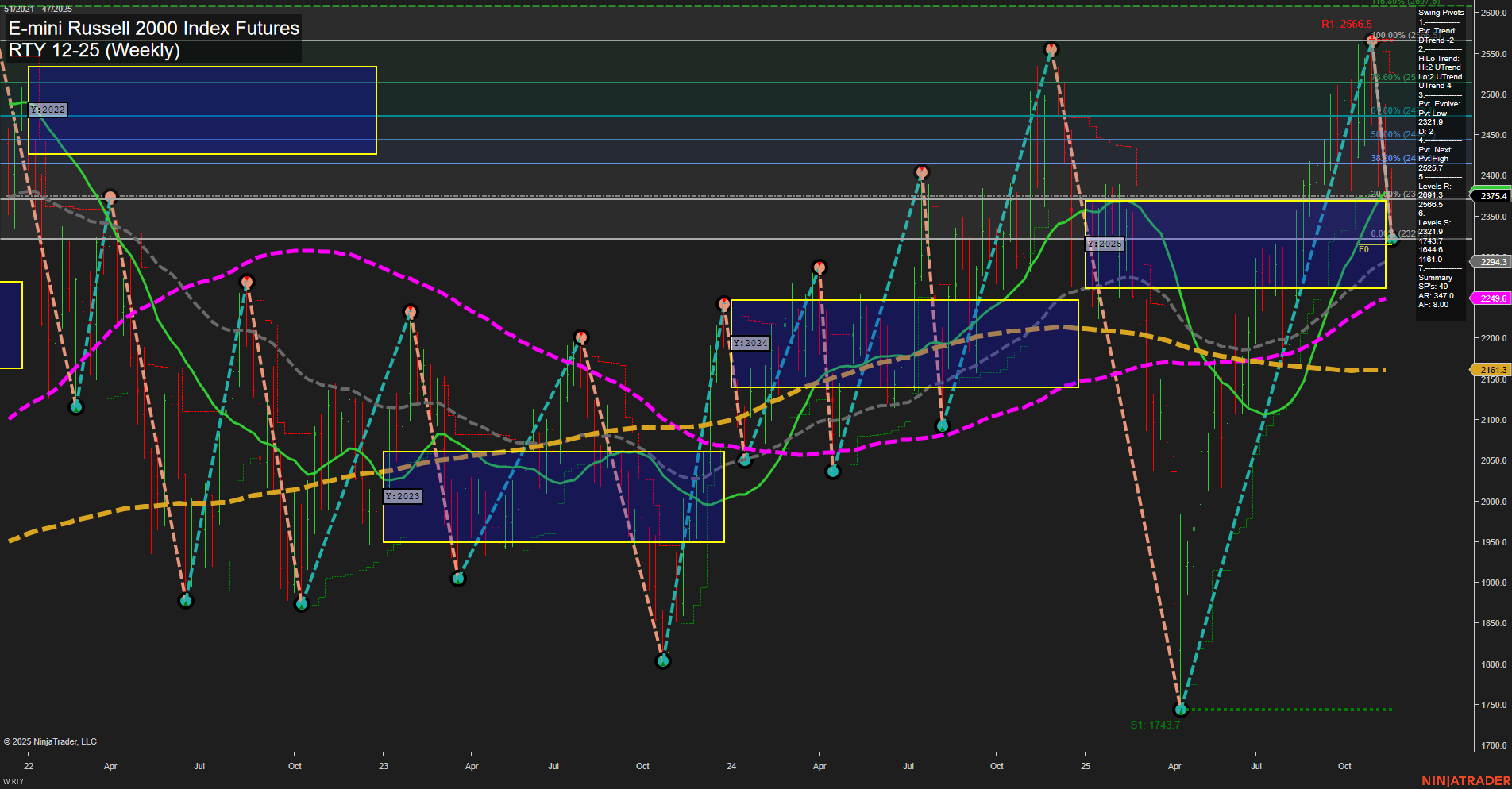

RTY E-mini Russell 2000 Index Futures Weekly Chart Analysis: 2025-Nov-20 07:16 CT

Price Action

- Last: 2374.5,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -21%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: -37%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 11%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend-2,

- (Intermediate-Term) 2. HiLo Trend: UTrend-4,

- 3. Pvt. Evolve: PvtLow 2321.0,

- 4. Pvt. Next: PvtHigh 2566.5,

- 5. Levels R: 2566.5, 2500.5, 2462.7, 2432.0,

- 6. Levels S: 2321.0, 1743.7.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 2374.7 Down Trend,

- (Intermediate-Term) 10 Week: 2347.1 Down Trend,

- (Long-Term) 20 Week: 2249.6 Up Trend,

- (Long-Term) 55 Week: 2161.3 Up Trend,

- (Long-Term) 100 Week: 2249.9 Up Trend,

- (Long-Term) 200 Week: 2161.3 Up Trend.

Recent Trade Signals

- 19 Nov 2025: Long RTY 12-25 @ 2367.1 Signals.USAR.TR120

- 17 Nov 2025: Short RTY 12-25 @ 2378.4 Signals.USAR-WSFG

- 17 Nov 2025: Short RTY 12-25 @ 2399.9 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The RTY weekly chart shows a market in transition, with short- and intermediate-term trends turning bearish as price action has broken below both the weekly and monthly session fib grid NTZ zones. Large, fast-moving bars indicate heightened volatility, likely driven by recent news or macro events. Despite this, the long-term trend remains bullish, supported by price holding above the yearly session fib grid and all major long-term moving averages (20, 55, 100, 200 week) trending upward. Swing pivots highlight a recent pivot low at 2321.0 as key support, with resistance levels stacked above at 2432.0, 2462.7, 2500.5, and 2566.5. Recent trade signals reflect this mixed environment, with both long and short entries triggered in quick succession. The market appears to be in a corrective phase within a broader uptrend, with potential for further downside in the short term before any resumption of the long-term bullish structure. Watch for reactions at key support and resistance levels to gauge the next directional move.

Chart Analysis ATS AI Generated: 2025-11-20 07:17 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.