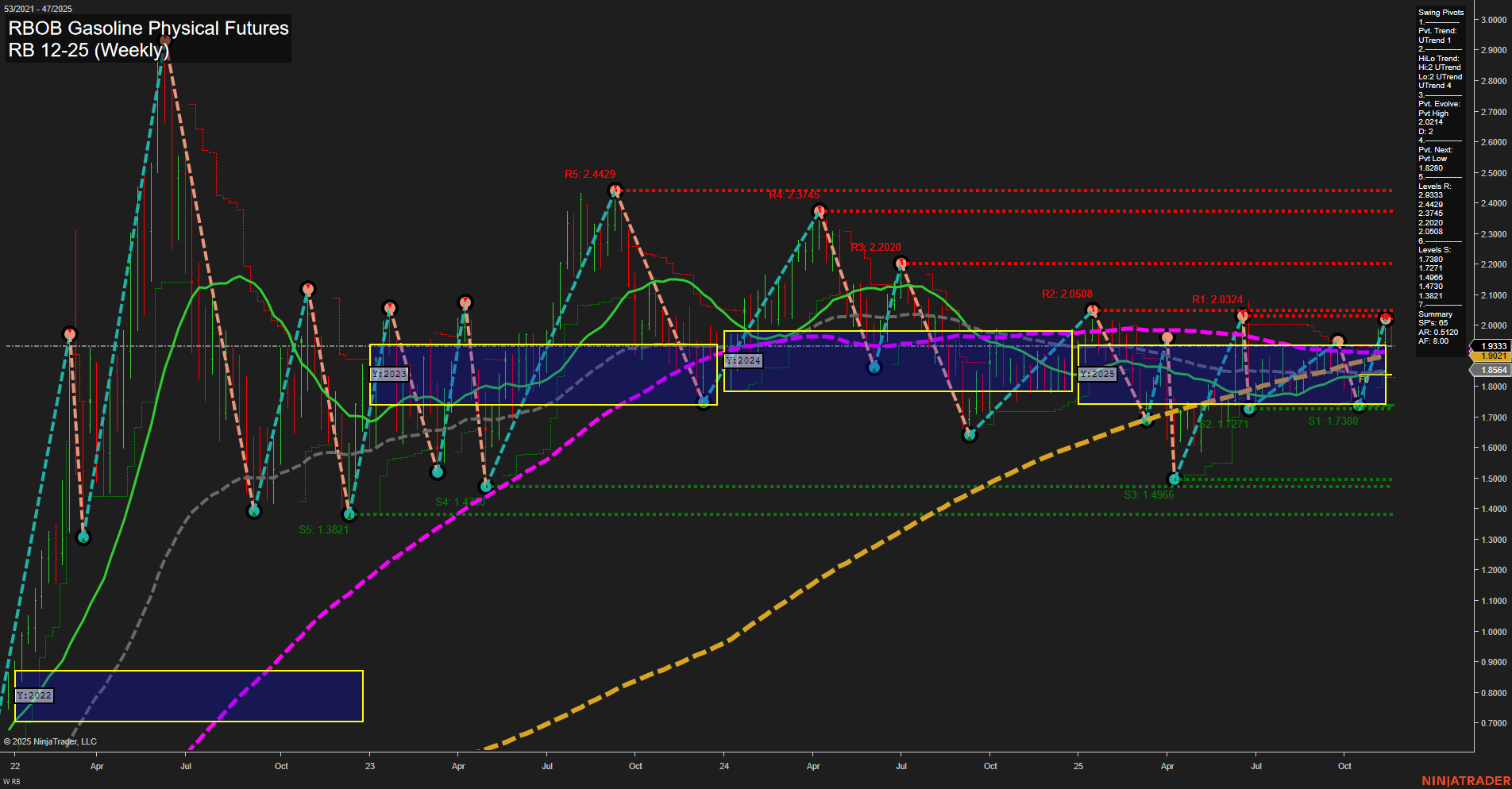

The RBOB Gasoline futures weekly chart shows a market in transition. Price action is currently at 1.9333 with medium-sized bars and average momentum, indicating neither strong acceleration nor deceleration. The short-term WSFG trend is down, with price below the NTZ center, but the swing pivot trend has shifted to an uptrend, suggesting a possible short-term base or bounce attempt. Intermediate and long-term trends are both up, supported by the MSFG and YSFG grids, and confirmed by the 5, 10, 20, and 200-week moving averages all trending higher. However, the 55 and 100-week MAs remain in a downtrend, reflecting residual longer-term resistance. Swing pivot resistance levels are clustered above, with significant resistance at 2.0324, 2.20508, and 2.2200, while support is well-defined at 1.7380 and below. Recent trade signals have triggered short entries, reflecting the short-term WSFG downtrend, but the broader structure is showing signs of recovery with higher lows and a potential shift toward bullish continuation if resistance levels are overcome. The market is currently navigating a consolidation zone, with the potential for breakout or further choppy action as it tests key resistance and support levels. Overall, the setup favors a neutral short-term outlook, but with bullish bias building in the intermediate and long-term timeframes.