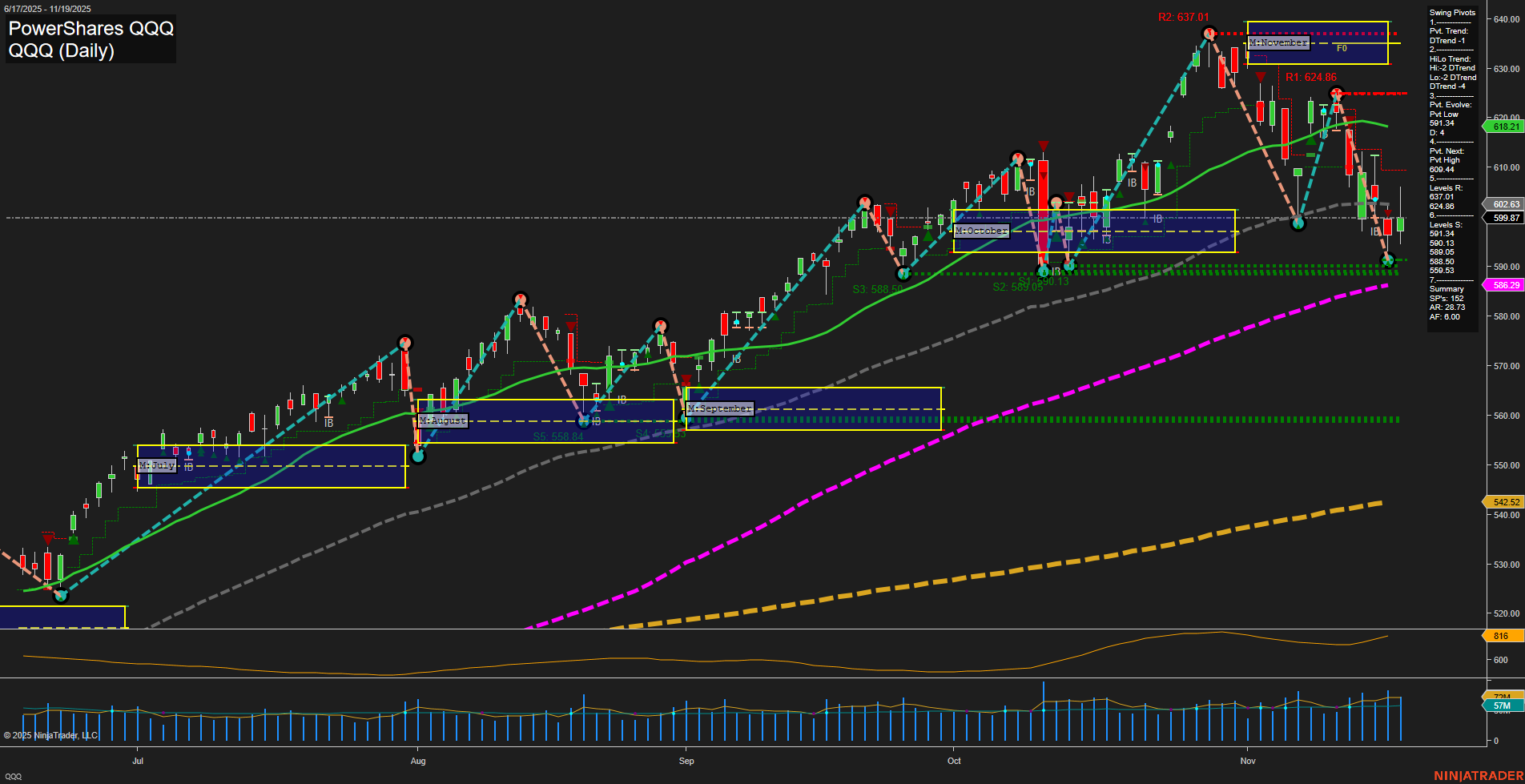

The QQQ daily chart currently reflects a notable shift in momentum, with price action showing a medium-sized bar structure and slow momentum, indicating a cooling off from previous volatility. Both the short-term and intermediate-term swing pivot trends have turned decisively bearish, with the most recent pivot high at 624.86 and the next key support at 588.53. Resistance is stacked above at 624.86 and 637.01, while support levels are layered at 588.53, 568.05, and 558.84, suggesting a potential for further downside probing if selling persists. All short- and intermediate-term moving averages (5, 10, 20, 55-day) are trending down, confirming the prevailing bearish sentiment in the near term. However, the 100-day and 200-day moving averages remain in uptrends, highlighting that the longer-term structure is still intact and bullish, with the 200-day MA well below current price, acting as a major support reference. ATR remains elevated, reflecting ongoing volatility, while volume metrics are robust, indicating active participation during this corrective phase. The neutral readings on the session fib grids (weekly, monthly, yearly) suggest a lack of clear directional bias from a broader cyclical perspective, reinforcing the idea of a consolidation or corrective environment rather than a full trend reversal. In summary, the QQQ is in a corrective pullback within a longer-term uptrend, with short- and intermediate-term signals pointing to continued caution as the market tests lower support zones. The structure is consistent with a swing high rejection and a move toward key support, with the potential for a base-building phase if buyers step in at lower levels. The overall environment is characterized by heightened volatility, active rotation, and a wait-and-see approach for confirmation of either a deeper retracement or a resumption of the primary uptrend.