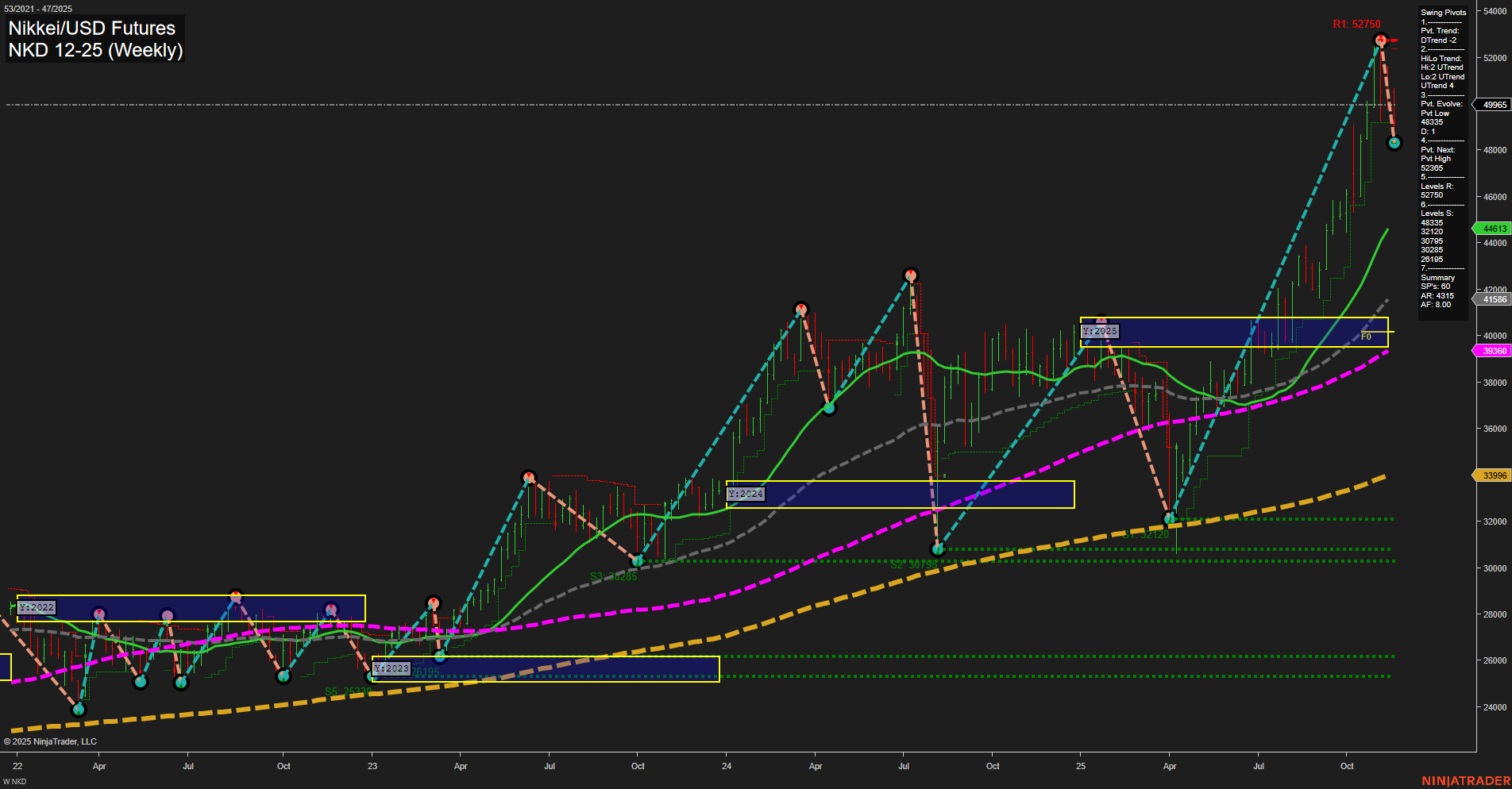

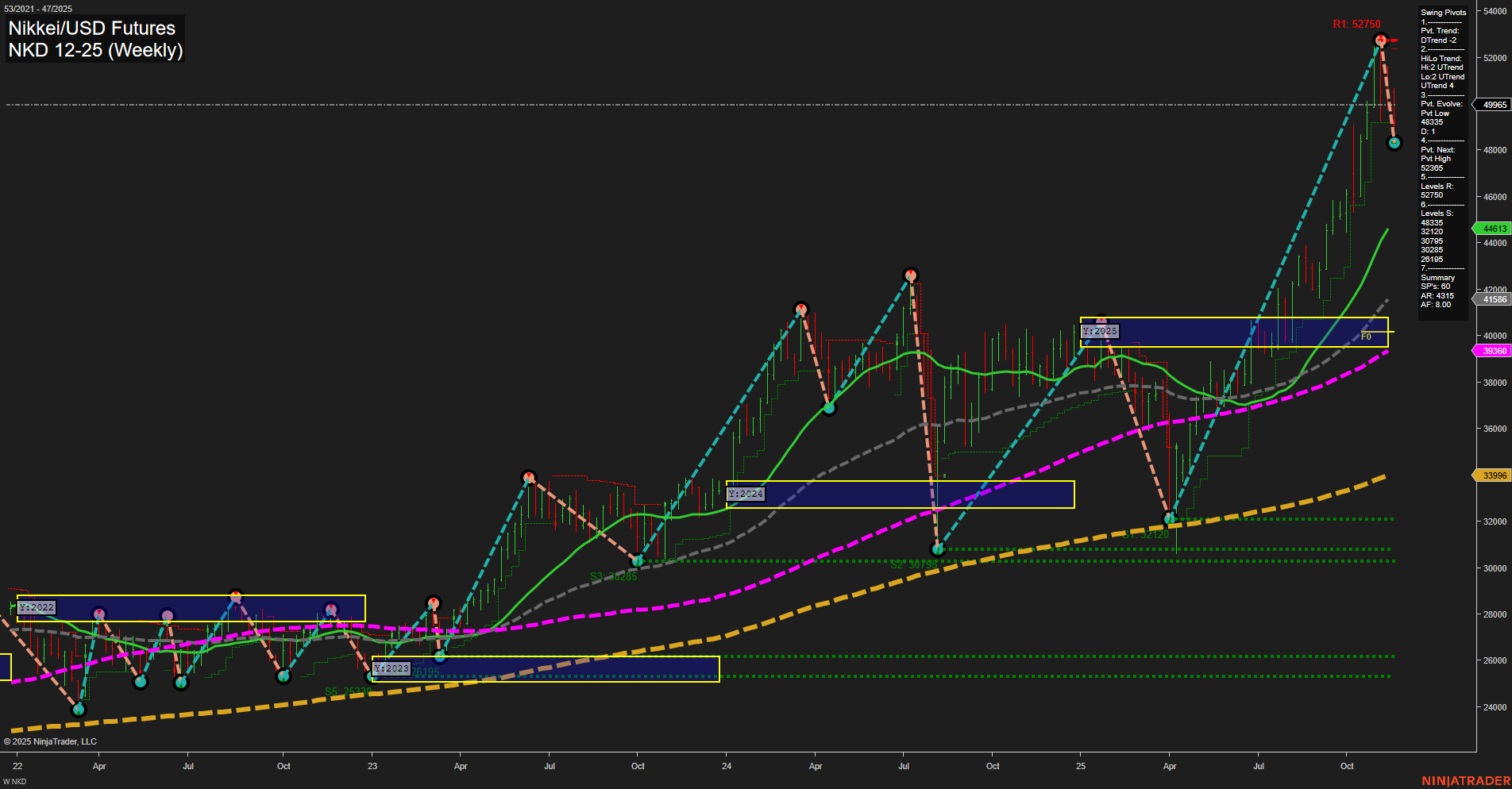

NKD Nikkei/USD Futures Weekly Chart Analysis: 2025-Nov-20 07:13 CT

Price Action

- Last: 49985,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -22%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 160%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 153%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt Low 48435,

- 4. Pvt. Next: Pvt High 52750,

- 5. Levels R: 52750,

- 6. Levels S: 48435, 43210, 40705, 39765, 37025, 30795, 27285.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 49985 Up Trend,

- (Intermediate-Term) 10 Week: 48435 Up Trend,

- (Long-Term) 20 Week: 44613 Up Trend,

- (Long-Term) 55 Week: 41568 Up Trend,

- (Long-Term) 100 Week: 39596 Up Trend,

- (Long-Term) 200 Week: 33996 Up Trend.

Recent Trade Signals

- 19 Nov 2025: Long NKD 12-25 @ 49900 Signals.USAR.TR120

- 14 Nov 2025: Short NKD 12-25 @ 50270 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The NKD Nikkei/USD Futures market is showing a strong long-term and intermediate-term uptrend, as evidenced by the upward momentum in the 20, 55, 100, and 200 week moving averages, as well as the bullish YSFG and MSFG trends. Price is well above the yearly and monthly NTZ F0% levels, confirming the dominant bullish structure. However, the short-term picture has shifted to a bearish tone, with the WSFG trend down and the most recent swing pivot indicating a developing downtrend (DTrend) after a sharp rally to new highs. The last two trade signals reflect this short-term volatility, with a recent long entry quickly followed by a short signal, suggesting choppy or corrective action at these elevated levels. Key support is clustered around 48435 and below, while resistance is defined at the recent high of 52750. Overall, the market is in a strong uptrend on higher timeframes, but short-term traders should be aware of potential pullbacks or consolidation as the market digests recent gains.

Chart Analysis ATS AI Generated: 2025-11-20 07:13 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.