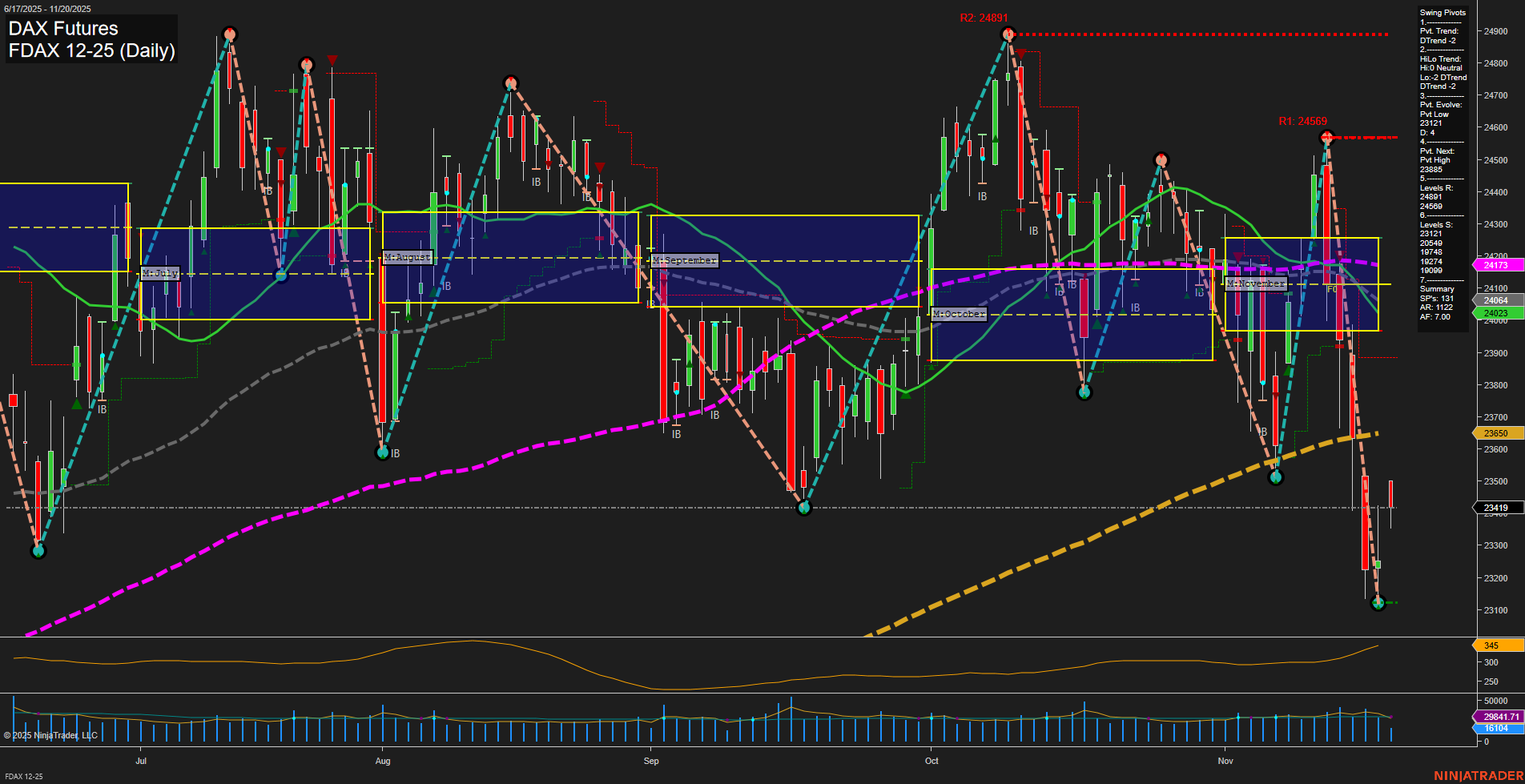

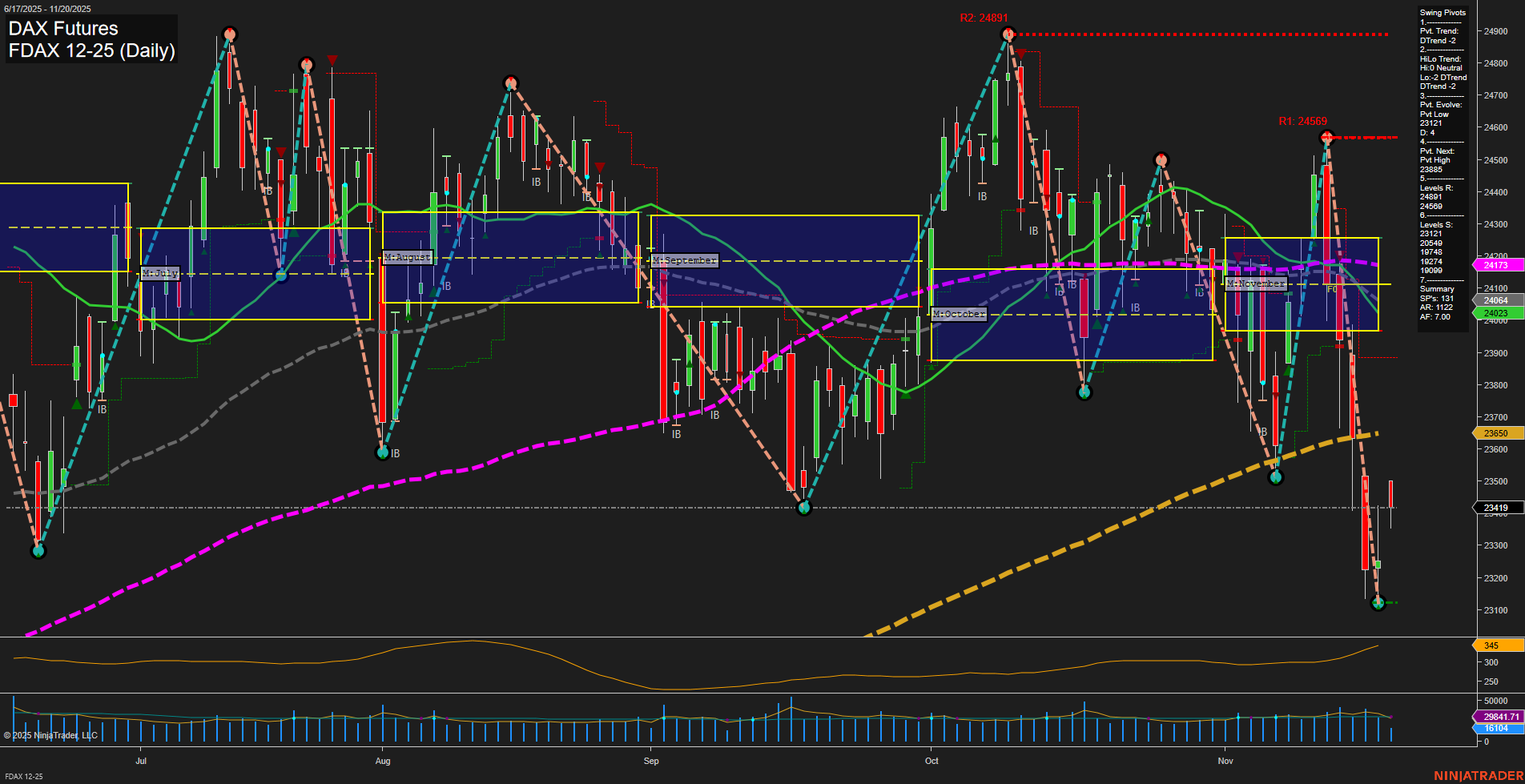

FDAX DAX Futures Daily Chart Analysis: 2025-Nov-20 07:08 CT

Price Action

- Last: 23419,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -65%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: -62%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 90%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 23419,

- 4. Pvt. Next: Pvt high 23885,

- 5. Levels R: 24569, 24891,

- 6. Levels S: 23419, 23054, 22914, 19802.

Daily Benchmarks

- (Short-Term) 5 Day: 24171 Down Trend,

- (Short-Term) 10 Day: 24064 Down Trend,

- (Intermediate-Term) 20 Day: 24023 Down Trend,

- (Intermediate-Term) 55 Day: 23650 Down Trend,

- (Long-Term) 100 Day: 24173 Down Trend,

- (Long-Term) 200 Day: 23650 Down Trend.

Additional Metrics

Recent Trade Signals

- 20 Nov 2025: Long FDAX 12-25 @ 23471 Signals.USAR.TR120

- 17 Nov 2025: Short FDAX 12-25 @ 23798 Signals.USAR-WSFG

- 17 Nov 2025: Short FDAX 12-25 @ 23917 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The FDAX daily chart shows a pronounced short- and intermediate-term downtrend, with price action breaking decisively below both the weekly and monthly session fib grid neutral zones. Large, fast-momentum bars highlight recent volatility and a strong directional move lower, confirmed by all short- and intermediate-term moving averages trending down. Swing pivot analysis reinforces the bearish tone, with the current trend and HiLo trend both down, and the most recent pivot low established at 23419. Resistance levels are well above current price, while support is being tested at recent lows. Despite this, the long-term yearly trend remains up, suggesting the broader bull market is intact, but currently under pressure from a significant retracement or correction. Recent trade signals reflect this volatility, with both short and long entries triggered in rapid succession. The environment is characterized by high volatility (elevated ATR and volume), with price action exhibiting potential for sharp reversals or further downside extension. The market is in a corrective phase within a larger uptrend, with the potential for either a continuation of the sell-off or a technical bounce from oversold conditions.

Chart Analysis ATS AI Generated: 2025-11-20 07:08 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.