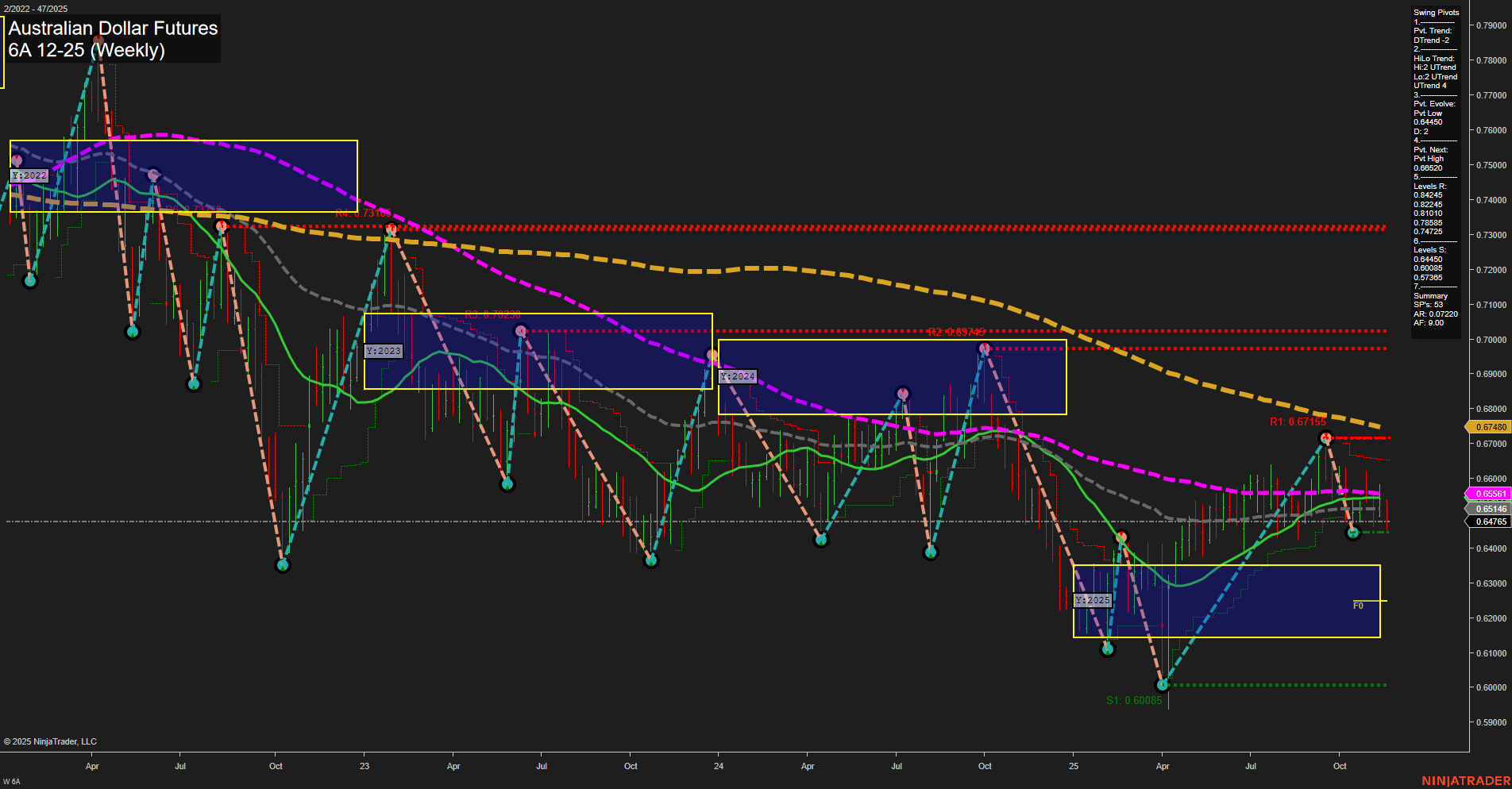

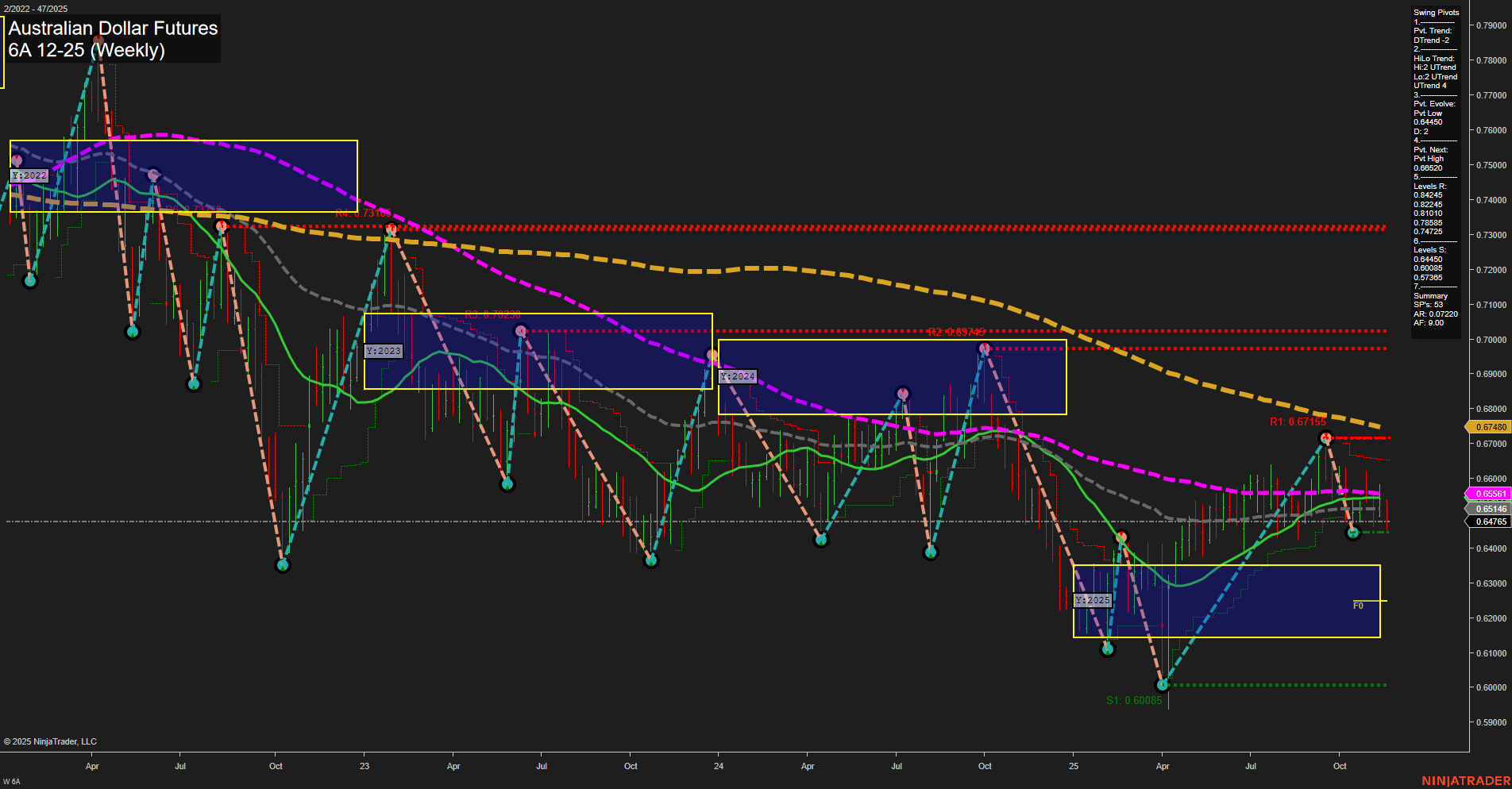

6A Australian Dollar Futures Weekly Chart Analysis: 2025-Nov-20 07:00 CT

Price Action

- Last: 0.64765,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 0.64765,

- 4. Pvt. Next: Pvt high 0.66520,

- 5. Levels R: 0.67155, 0.66520, 0.66125, 0.64845,

- 6. Levels S: 0.60085, 0.57365.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.65146 Down Trend,

- (Intermediate-Term) 10 Week: 0.65561 Down Trend,

- (Long-Term) 20 Week: 0.65478 Down Trend,

- (Long-Term) 55 Week: 0.66125 Down Trend,

- (Long-Term) 100 Week: 0.67480 Down Trend,

- (Long-Term) 200 Week: 0.71535 Down Trend.

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The Australian Dollar Futures (6A) weekly chart shows a market in a corrective phase after a recent swing high, with price currently at 0.64765. Price action is characterized by medium-sized bars and slow momentum, indicating a lack of strong directional conviction. The short-term swing pivot trend has turned down, while the intermediate-term HiLo trend remains up, suggesting a possible retracement within a broader recovery attempt. All key moving averages (5, 10, 20, 55, 100, and 200 week) are trending down, reinforcing a bearish long-term structure. Resistance levels are clustered above at 0.67155 and 0.66520, while support is well below at 0.60085 and 0.57365, highlighting a wide trading range. The Fib Grid (WSFG, MSFG, YSFG) trends are neutral, reflecting consolidation and indecision. Overall, the chart suggests a market in transition, with short-term weakness prevailing against a backdrop of longer-term bearishness, while the intermediate-term trend is attempting to stabilize. No clear breakout or reversal is evident, and the market appears to be digesting prior moves, possibly awaiting new catalysts.

Chart Analysis ATS AI Generated: 2025-11-20 07:00 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.