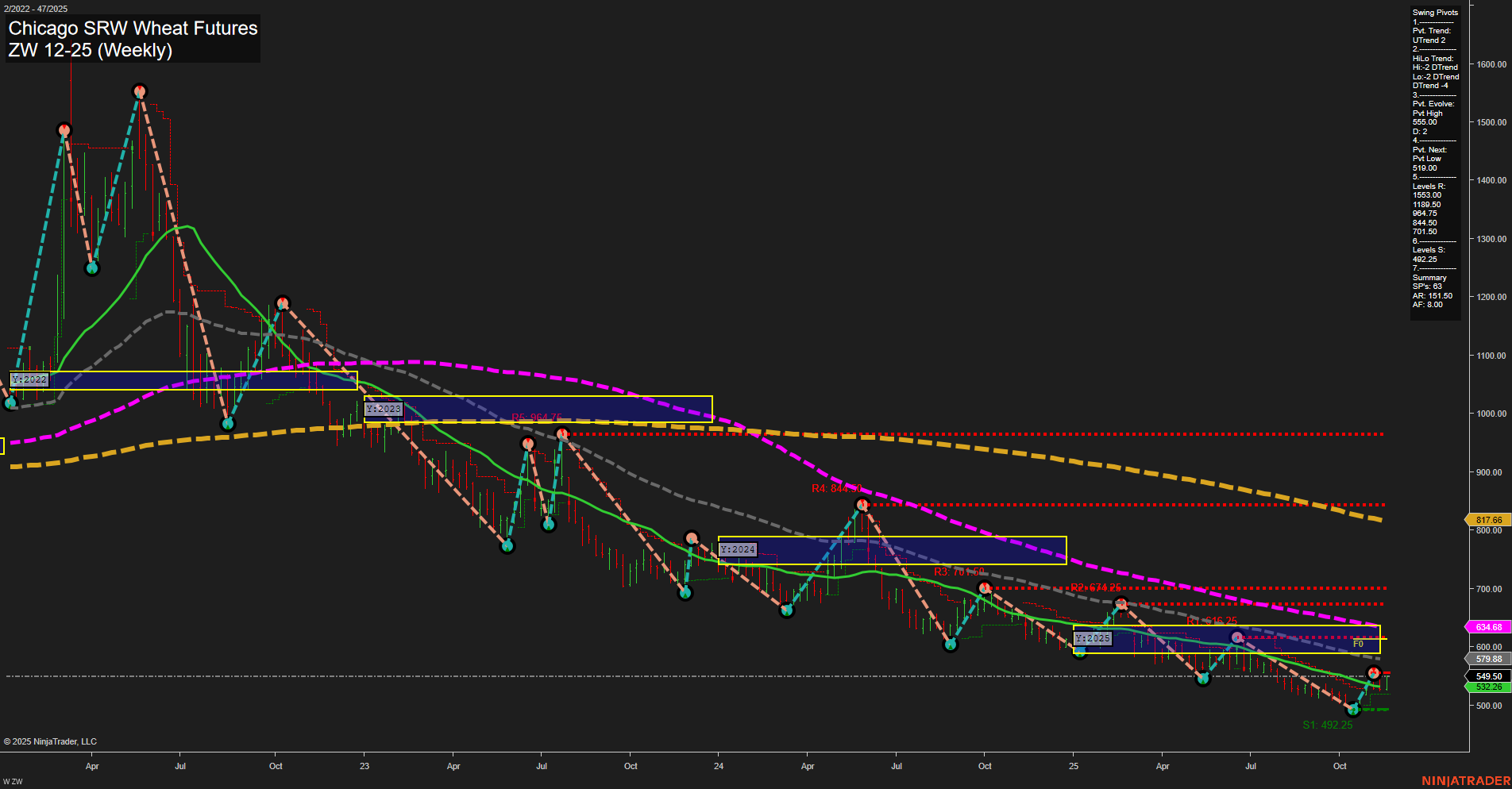

The ZW Chicago SRW Wheat Futures weekly chart shows a market that has been in a persistent downtrend, as evidenced by the dominant downward trends in both swing pivots and all major moving averages. The price is currently trading at 545.25, with small bars and slow momentum, indicating a lack of strong directional conviction in the very short term. Short-term WSFG and intermediate-term MSFG both show the price above their respective NTZ/F0% levels and are trending up, suggesting a potential for a short-term bounce or retracement. However, the long-term YSFG remains negative, with price below the yearly NTZ/F0% and the trend still down, reinforcing the broader bearish structure. Swing pivot analysis highlights a recent pivot high at 605.00 and a next potential pivot low at 519.00, with significant resistance levels overhead and only one major support at 492.25. All benchmark moving averages (from 5-week to 200-week) are trending down, confirming the prevailing bearish sentiment across all timeframes. A recent long signal (USAR.TR120) at 545.25 suggests some short-term tactical interest, but this is set against a backdrop of longer-term weakness. The market appears to be in a phase of consolidation or a possible short-term corrective rally within a larger downtrend. Volatility remains subdued, and the price is testing lower support levels after a prolonged decline, with no clear evidence yet of a sustained reversal. Overall, the technical landscape remains bearish for intermediate and long-term horizons, with only neutral short-term signals as the market attempts to stabilize or retrace after extended selling pressure.