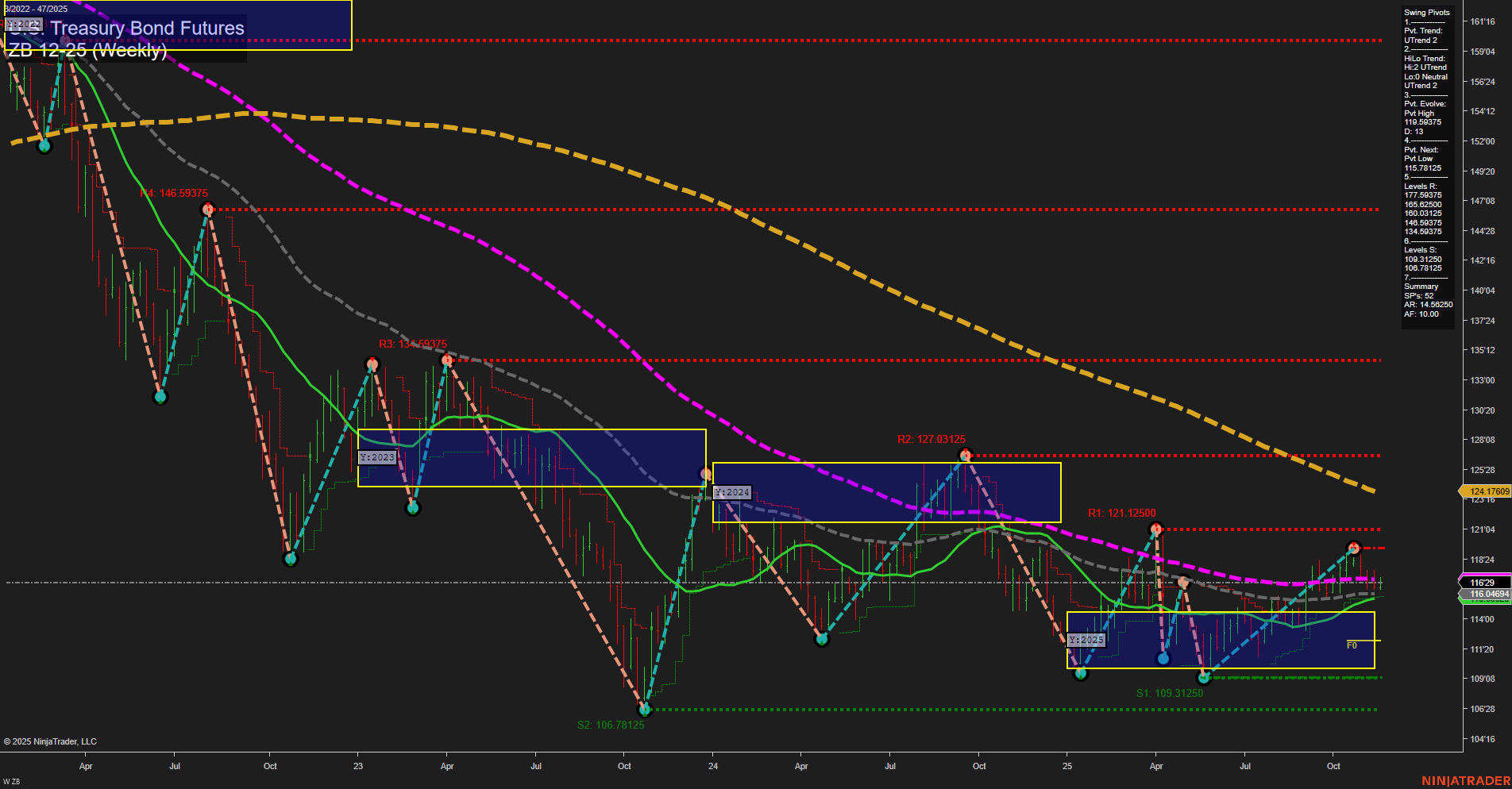

The ZB U.S. Treasury Bond Futures weekly chart shows a market in transition. Price action has recently shifted to an average momentum with medium-sized bars, indicating a move away from the previous consolidation phase. Both short-term and intermediate-term swing pivot trends have turned upward, supported by a series of higher lows and a recent pivot high at 119.59375. The price is currently trading above the 5, 10, and 20-week moving averages, all of which are in uptrends, reinforcing the bullish tone in the short and intermediate term. However, the longer-term 55, 100, and 200-week moving averages remain in downtrends, highlighting persistent overhead resistance and a broader bearish structure. The price is situated within the NTZ (neutral zone) of the yearly session fib grid, with no clear directional bias from the grid levels, suggesting a period of equilibrium. Key resistance levels are stacked above, notably at 121.12500 and 127.03125, while support is found at 110.78125 and 109.31250. The overall technical landscape points to a market attempting a recovery rally within a larger downtrend, with the potential for further upside in the short to intermediate term, but significant resistance remains overhead. The market is likely to remain sensitive to macroeconomic developments and interest rate expectations, with volatility possible around key resistance and support levels.