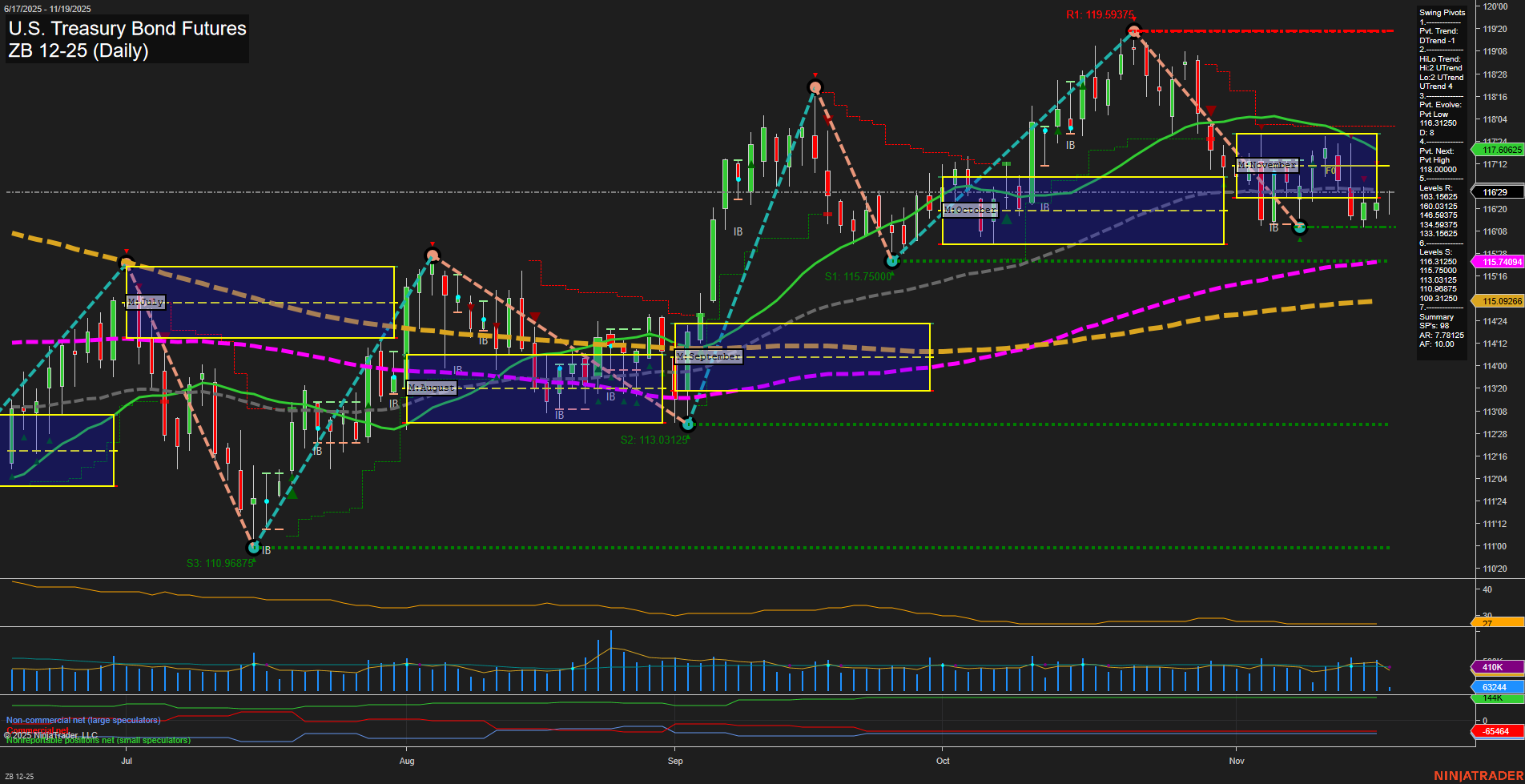

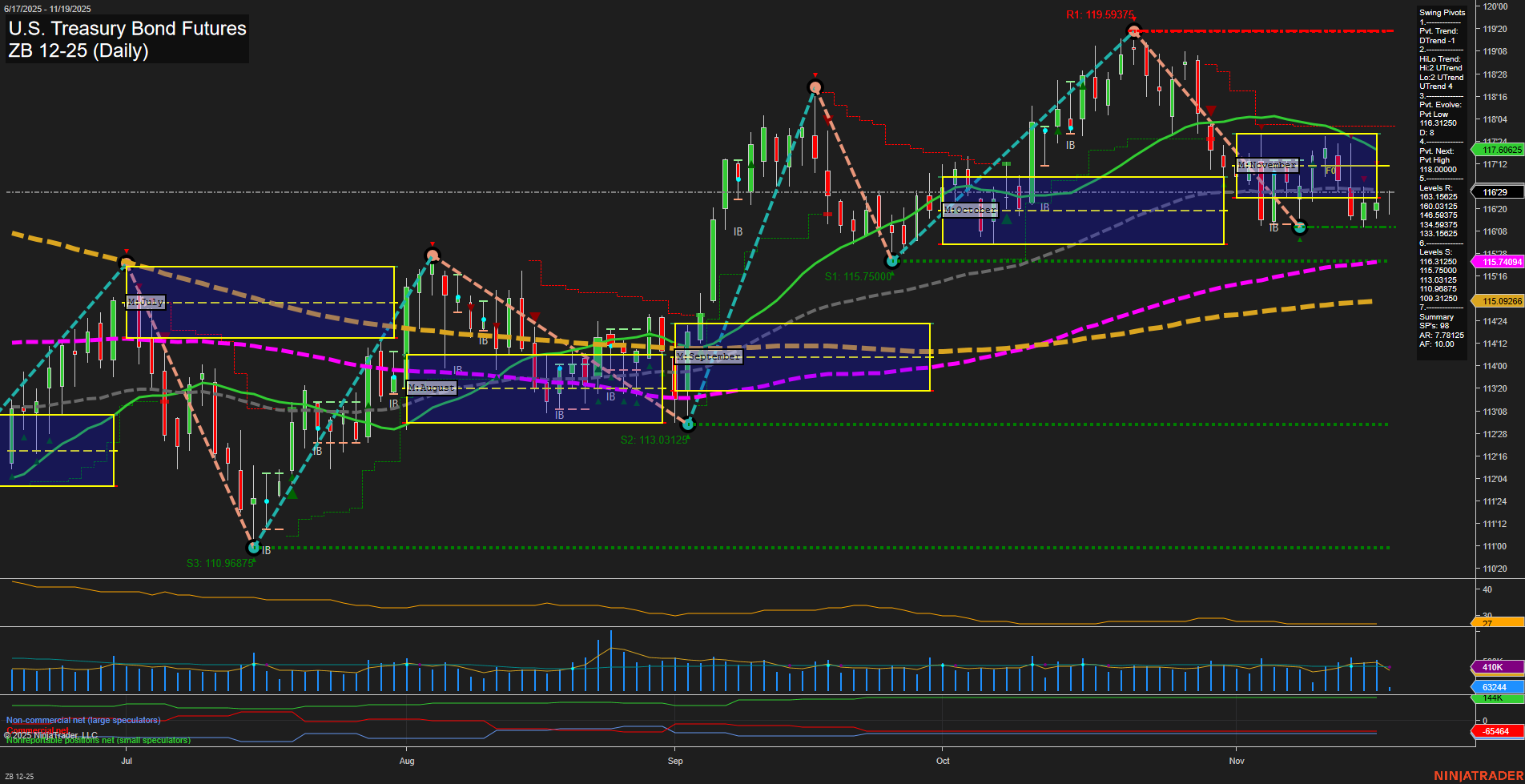

ZB U.S. Treasury Bond Futures Daily Chart Analysis: 2025-Nov-19 07:21 CT

Price Action

- Last: 116’29,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 115’13,

- 4. Pvt. Next: Pvt high 118’31,

- 5. Levels R: 119’19, 118’31, 117’31,

- 6. Levels S: 115’13, 113’03, 110’31.

Daily Benchmarks

- (Short-Term) 5 Day: 116’23 Down Trend,

- (Short-Term) 10 Day: 116’31 Down Trend,

- (Intermediate-Term) 20 Day: 117’19 Down Trend,

- (Intermediate-Term) 55 Day: 115’24 Up Trend,

- (Long-Term) 100 Day: 115’11 Up Trend,

- (Long-Term) 200 Day: 115’03 Up Trend.

Additional Metrics

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

The ZB U.S. Treasury Bond Futures daily chart is currently showing a bearish bias in both the short- and intermediate-term outlooks, as indicated by the prevailing downtrend in swing pivots and the downward direction of the 5, 10, and 20-day moving averages. Price action is consolidating near recent swing lows, with momentum remaining slow and bars of medium size, suggesting a lack of strong directional conviction. The market is trading within the lower half of the recent monthly NTZ, with no clear breakout above resistance or below support. Long-term moving averages (55, 100, 200-day) are still in uptrends, which tempers the overall bearishness and keeps the long-term outlook neutral. Volatility, as measured by ATR, is moderate, and volume remains steady. The market appears to be in a corrective or consolidative phase following a recent sell-off, with key support at 115’13 and resistance at 118’31. No strong directional signals are present from the session fib grids, and the technical environment suggests a wait-and-see approach as the market digests recent moves and awaits a catalyst for the next trend leg.

Chart Analysis ATS AI Generated: 2025-11-19 07:21 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.