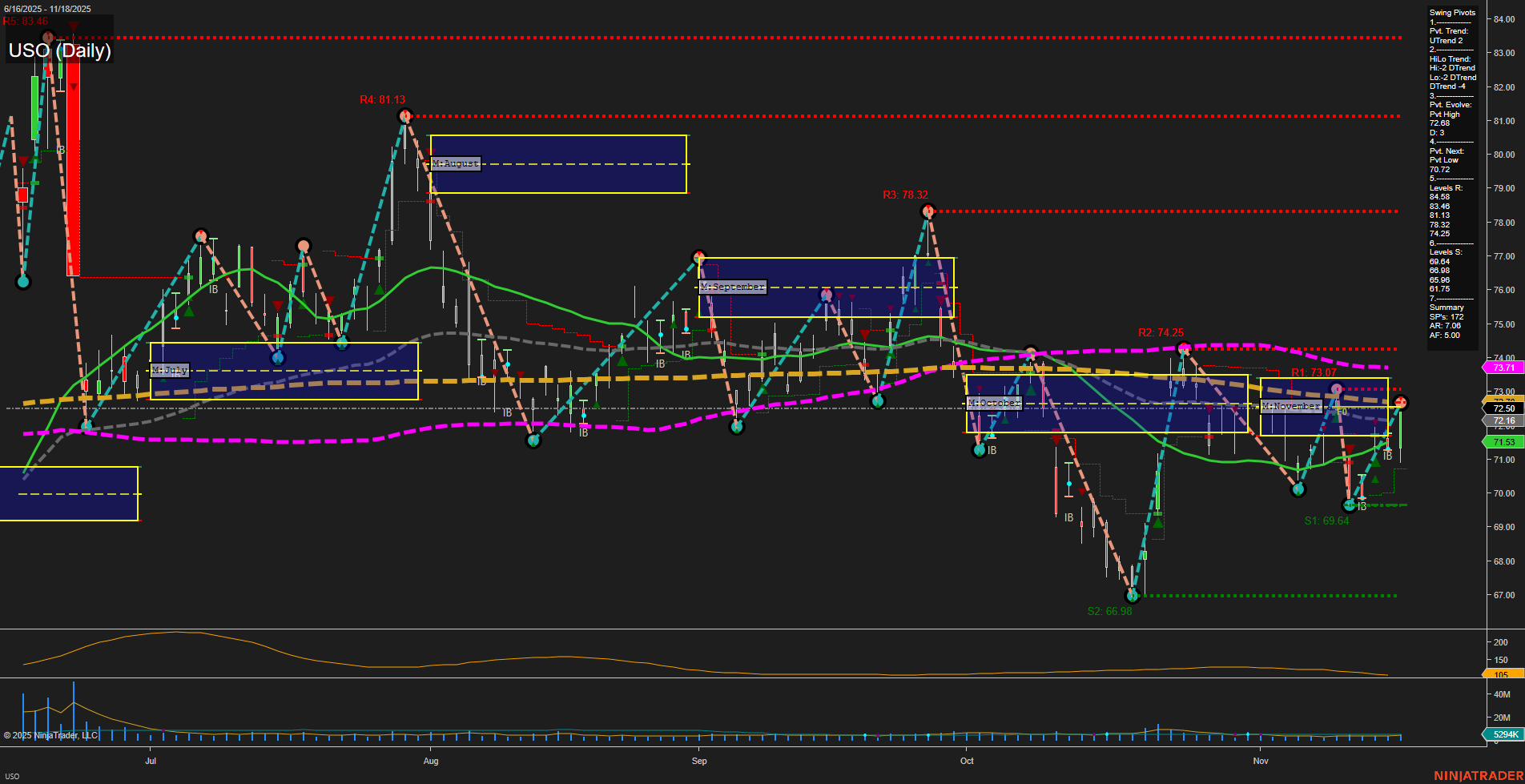

USO is currently exhibiting a mixed technical landscape. Price action is consolidating near 72.50 with medium-sized bars and average momentum, suggesting a lack of strong directional conviction. The short-term swing pivot trend is up, but the intermediate-term HiLo trend remains down, indicating a possible countertrend rally within a broader corrective phase. The most recent pivot high at 73.07 and next potential pivot low at 70.12 define the immediate trading range, with significant resistance overhead at 73.07 and 74.25, and support at 69.64 and 68.98. Benchmark moving averages show short-term uptrends (5, 10, 20-day), but intermediate and long-term averages (55, 100, 200-day) are in downtrends or flat, reflecting a market in transition or consolidation after a prior decline. ATR and volume metrics are moderate, indicating neither extreme volatility nor volume surges. Overall, the chart suggests a neutral short-term outlook with a slight bullish bias due to the uptrend in short-term pivots and moving averages, but the intermediate-term remains bearish as the broader trend has not reversed. Long-term signals are neutral, with price oscillating around key averages. The market appears to be in a consolidation phase, with no clear breakout or breakdown, and is likely awaiting a catalyst for the next directional move.