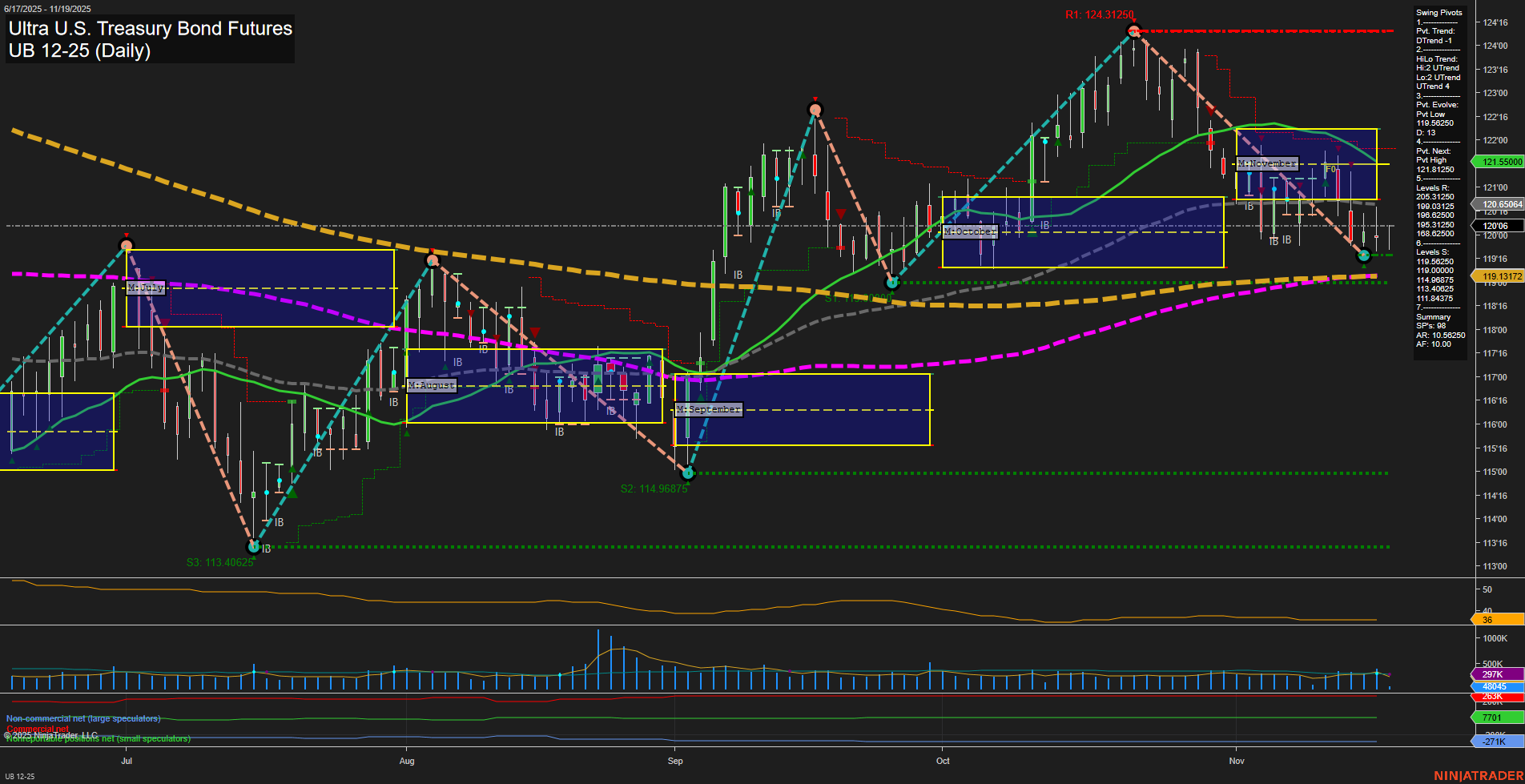

The UB Ultra U.S. Treasury Bond Futures daily chart shows a market in transition. Price action is currently consolidating above key session fib grid levels, with slow momentum and medium-sized bars indicating a pause after recent directional moves. The short-term swing pivot trend has shifted to down (DTrend), but the intermediate-term HiLo trend remains up (UTrend), suggesting a possible pullback within a broader uptrend. Price is above the NTZ center lines for weekly, monthly, and yearly fib grids, reinforcing an overall bullish bias on higher timeframes. Benchmark moving averages are mixed: short-term and intermediate-term MAs (5, 10, 20-day) are in downtrends, while the 55-day and 100-day MAs are in uptrends, and the 200-day remains in a downtrend. This blend points to a market in a corrective phase within a larger bullish structure. Key resistance levels are at 124.3125, 121.8125, and 120.5625, while support is layered at 119.6504, 119.1317, and lower. Recent trade signals have triggered long entries, aligning with the intermediate and long-term bullish trends, despite short-term consolidation. ATR and volume metrics indicate moderate volatility and steady participation. Overall, the market is digesting gains, with a short-term neutral stance, but the intermediate and long-term outlooks remain bullish as price holds above major support and session grid levels. The current environment favors monitoring for a potential resumption of the uptrend after this consolidation phase.