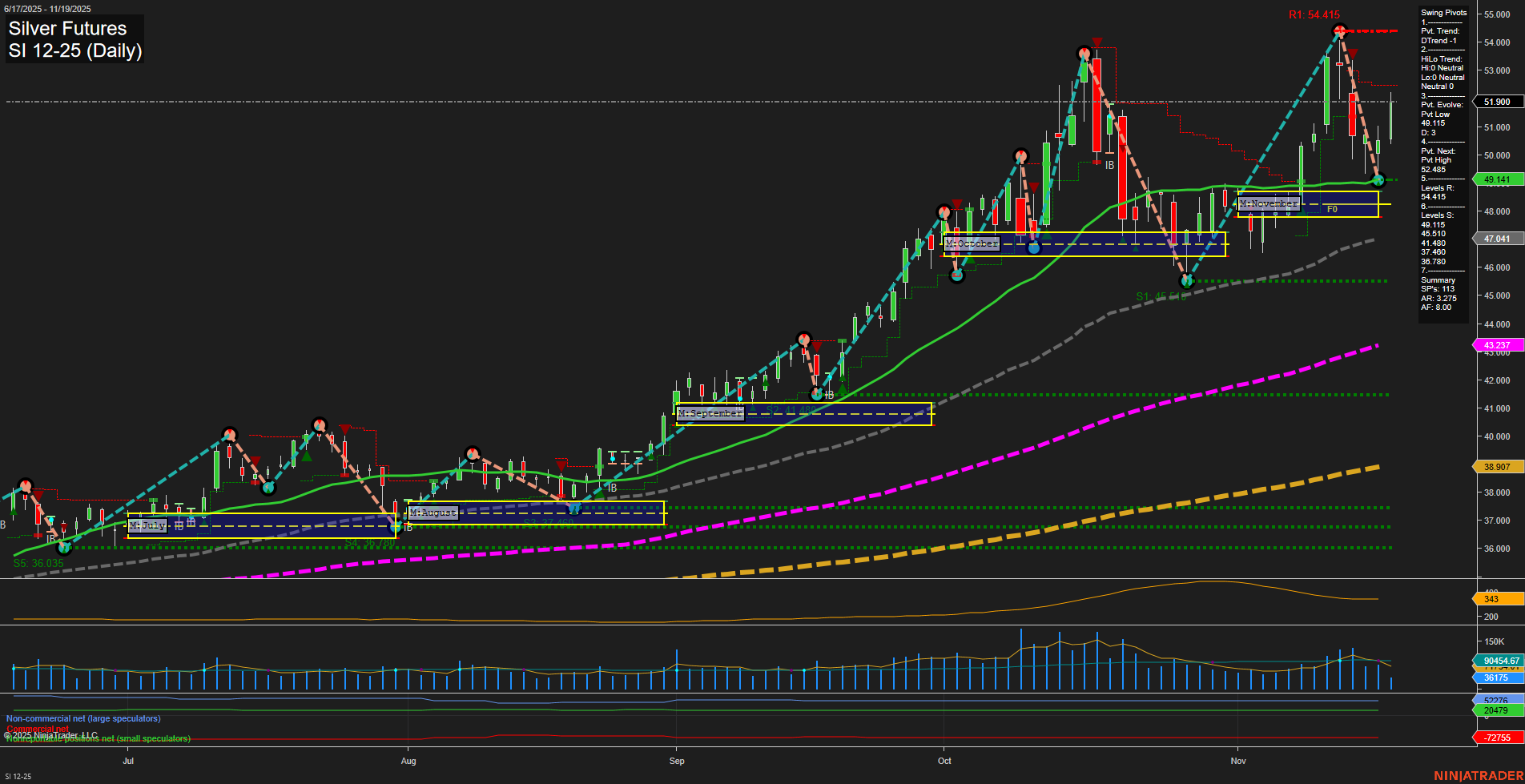

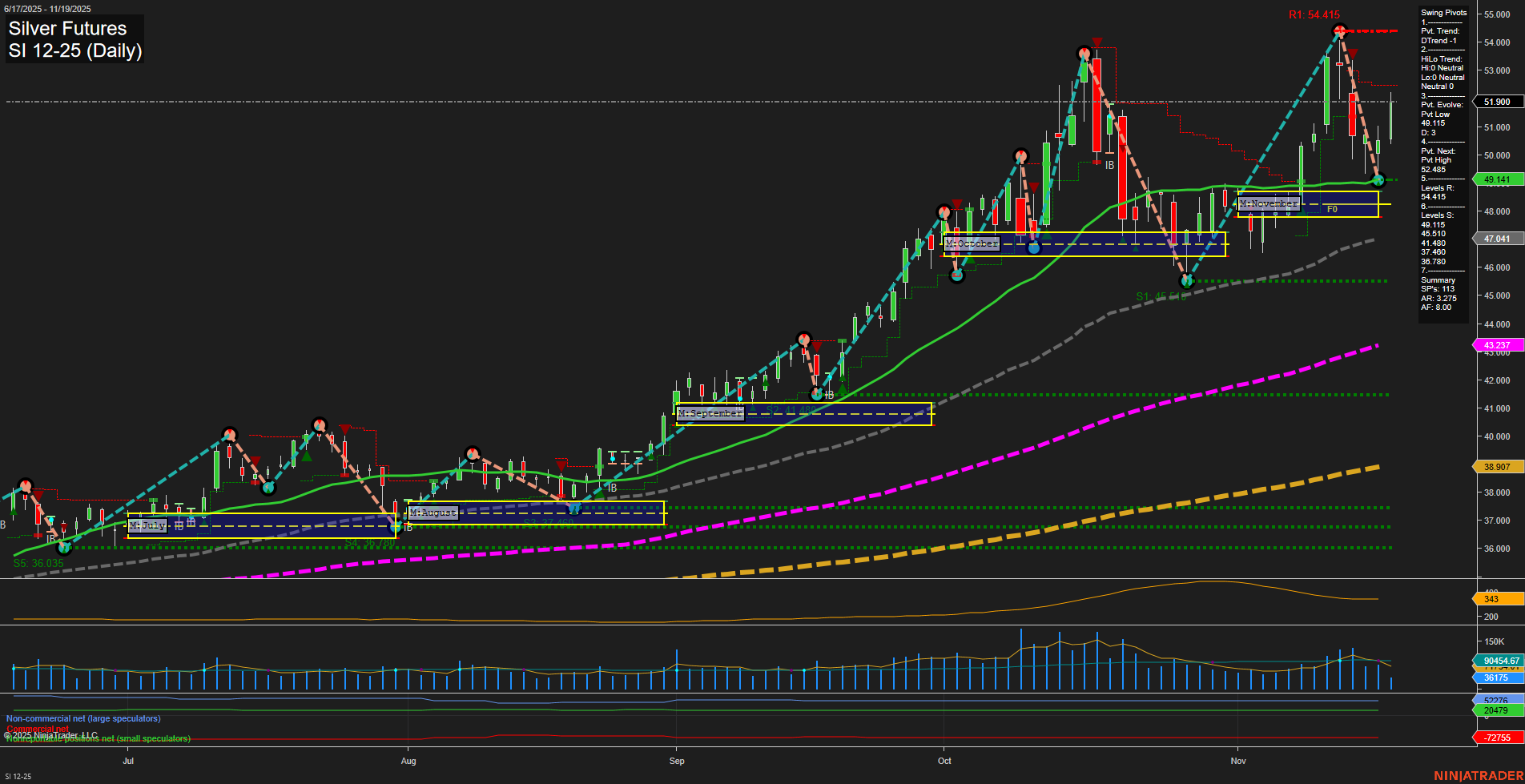

SI Silver Futures Daily Chart Analysis: 2025-Nov-19 07:16 CT

Price Action

- Last: 51.900,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 38%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 93%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 268%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: Neutral,

- 3. Pvt. Evolve: Pvt Low 49.115,

- 4. Pvt. Next: Pvt High 52.465,

- 5. Levels R: 54.415, 52.465, 51.480, 47.860, 41.460,

- 6. Levels S: 49.115, 46.015, 41.480, 36.035.

Daily Benchmarks

- (Short-Term) 5 Day: 51.175 Up Trend,

- (Short-Term) 10 Day: 50.275 Up Trend,

- (Intermediate-Term) 20 Day: 49.141 Up Trend,

- (Intermediate-Term) 55 Day: 47.041 Up Trend,

- (Long-Term) 100 Day: 43.237 Up Trend,

- (Long-Term) 200 Day: 38.907 Up Trend.

Additional Metrics

Recent Trade Signals

- 19 Nov 2025: Long SI 12-25 @ 51.155 Signals.USAR.TR120

- 19 Nov 2025: Long SI 12-25 @ 51.26 Signals.USAR-WSFG

- 18 Nov 2025: Short SI 12-25 @ 49.39 Signals.USAR.TR720

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

Silver futures are exhibiting strong bullish momentum across all timeframes, with price action characterized by large bars and fast momentum, indicating heightened volatility and active participation. The price remains well above all key moving averages, which are all trending upward, confirming a robust uptrend from short-term to long-term perspectives. The recent swing pivot structure shows a short-term corrective move (DTrend) but with a new pivot low established at 49.115 and the next potential pivot high at 52.465, suggesting the market is in a pullback phase within a broader uptrend. Multiple resistance levels overhead (notably at 52.465 and 54.415) may act as near-term targets or barriers, while support is well-defined at 49.115 and lower. The ATR and volume metrics reflect sustained volatility and liquidity. Recent trade signals have shifted back to the long side after a brief short, aligning with the prevailing trend. Overall, the technical landscape points to a market in a strong uptrend, currently experiencing a pullback or consolidation before a potential continuation higher, with the broader trend structure and moving averages supporting further upside potential.

Chart Analysis ATS AI Generated: 2025-11-19 07:16 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.