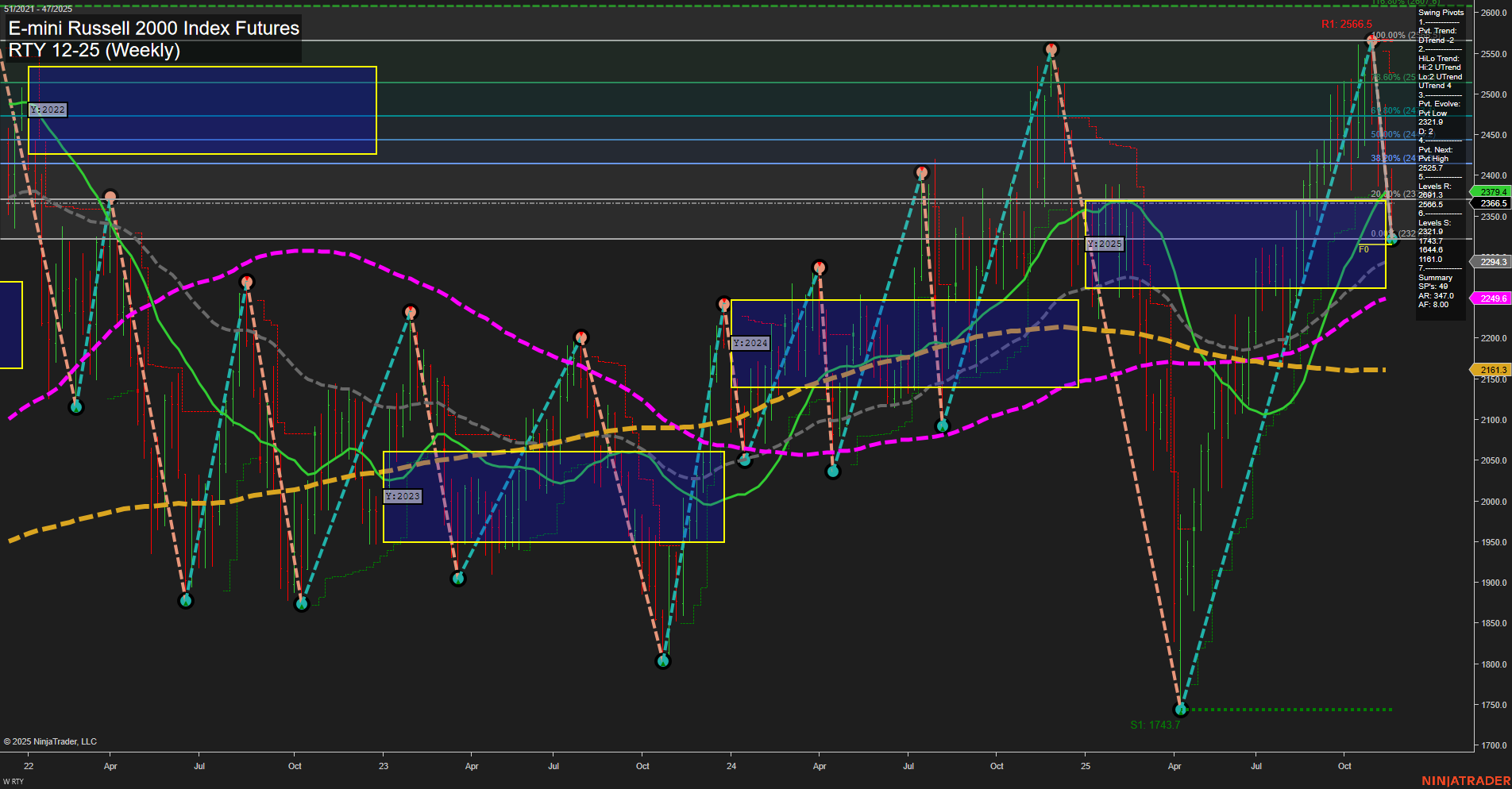

The RTY E-mini Russell 2000 Index Futures weekly chart shows a market in transition. Price action is volatile with large bars and fast momentum, reflecting heightened activity and possible news or macro catalysts. Short-term and intermediate-term Fib grid trends are both down, with price trading below their respective NTZ/F0% levels, indicating recent weakness and a short-term bearish bias. However, the yearly grid remains positive, with price above the long-term NTZ/F0% and an uptrend in place, suggesting underlying strength on a broader time frame. Swing pivots highlight a short-term downtrend, but the intermediate-term HiLo trend is up, showing mixed signals and potential for choppy or range-bound trading. Resistance levels cluster above current price, while the nearest support is at 2321.0, with a major swing low at 1743.7. Weekly benchmarks show most moving averages trending up, especially on longer time frames, reinforcing the long-term bullish structure despite short-term pullbacks. Recent trade signals reflect this mixed environment, with both short and long entries triggered in close succession. Overall, the short-term outlook is bearish, the intermediate-term is neutral as the market digests recent moves, and the long-term remains bullish. The market appears to be in a corrective phase within a larger uptrend, with potential for further volatility and mean reversion as it tests key support and resistance levels.