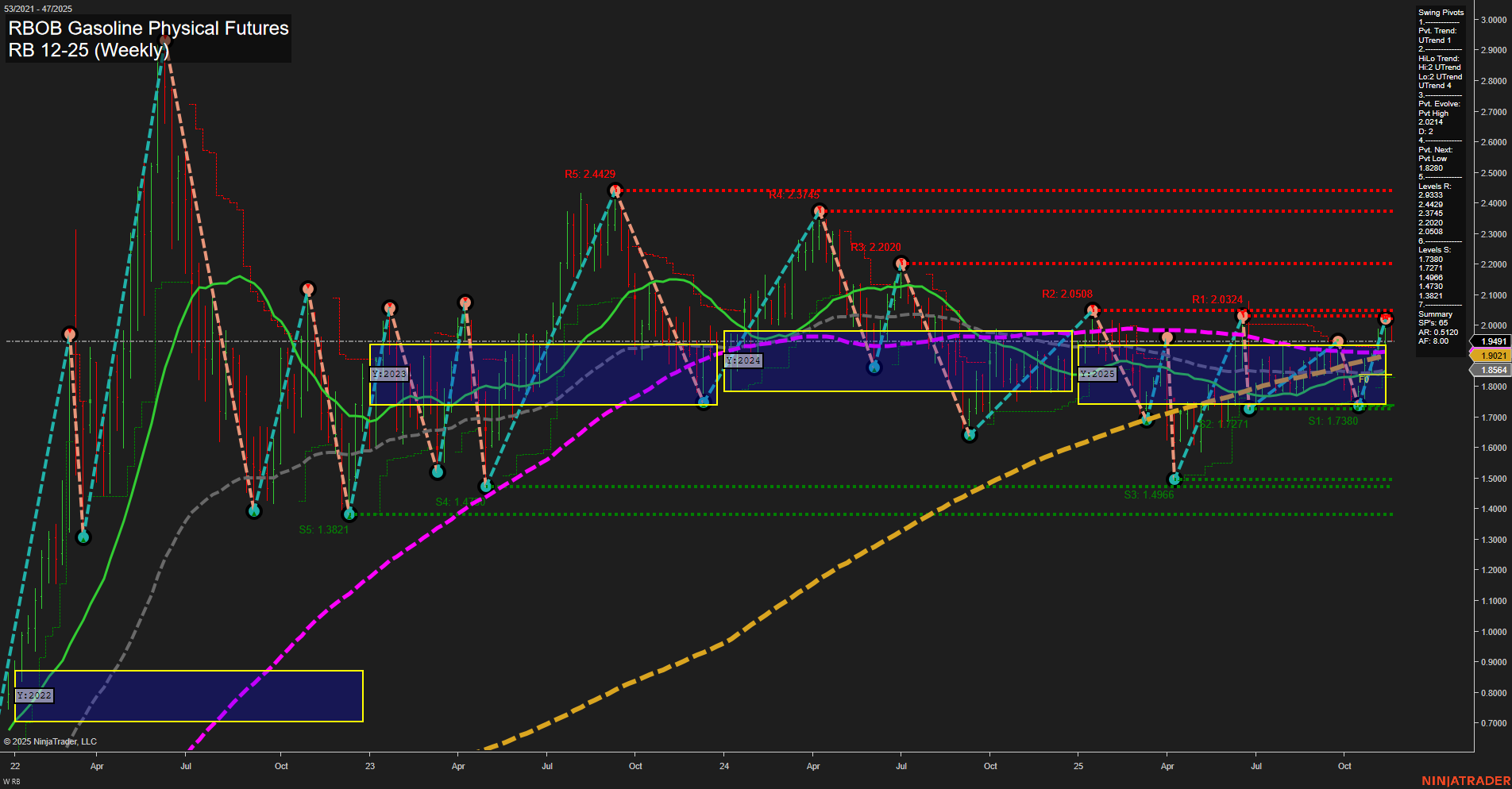

The RBOB Gasoline Physical Futures weekly chart shows a market in transition. Price action is currently near the upper end of the recent range, with medium-sized bars and average momentum, suggesting a balanced but active market. The short-term WSFG trend is down, with price below the NTZ center, indicating some near-term weakness or consolidation. However, both the intermediate-term (MSFG) and long-term (YSFG) trends are up, with price above their respective NTZ centers, reflecting underlying bullish structure. Swing pivots confirm this mixed environment: the short-term pivot trend is up, and the intermediate-term HiLo trend is also up, with the most recent pivot high at 2.124 and next key support at 1.828. Resistance levels are stacked above, with significant levels at 2.4429 and 2.31745, while support is well-defined at 1.7380 and below. All benchmark moving averages are trending up, reinforcing the bullish bias for the intermediate and long-term outlooks. Recent trade signals show both a short and a long in close succession, highlighting the choppy, range-bound nature of the short-term action. Overall, the market is consolidating after a period of volatility, with a bullish tilt for swing traders looking at the intermediate and long-term horizons. The setup suggests watching for a breakout or sustained move above resistance for trend continuation, or a pullback toward support for potential mean reversion.