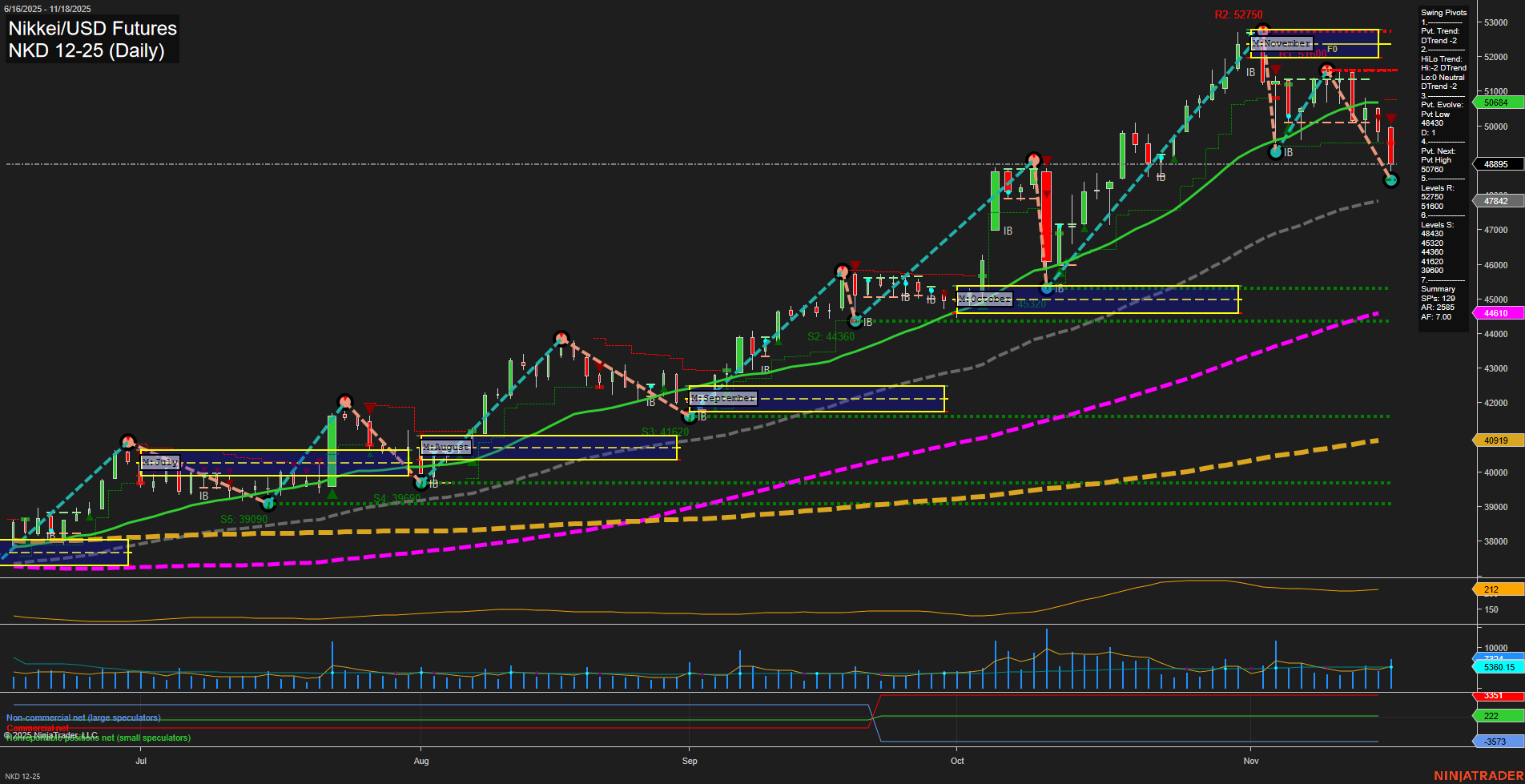

The NKD Nikkei/USD Futures daily chart shows a recent shift in short-term momentum to the downside, with large, fast-moving bars indicating heightened volatility and a strong bearish impulse. The WSFG (Weekly Session Fib Grid) trend is down, and price is trading below the weekly NTZ, reinforcing the short-term bearish bias. Both the short-term and intermediate-term swing pivot trends have turned down, with the most recent pivot low at 48430 and resistance levels overhead at 50780 and 51600. Despite this short-term weakness, the intermediate-term (MSFG) and long-term (YSFG) session fib grids remain in uptrends, with price still above their respective NTZs, suggesting the broader trend is intact. The 55, 100, and 200-day moving averages are all trending higher, providing underlying support and indicating that the longer-term structure remains bullish. However, the 5, 10, and 20-day moving averages have turned down, confirming the current pullback phase. ATR and volume metrics point to increased activity, which often accompanies key inflection points or trend transitions. The recent short signal (14 Nov) aligns with the short-term bearish setup, but the presence of strong support at 48430 and the rising long-term MAs suggest that any further downside could encounter buying interest. In summary, the market is experiencing a corrective phase within a larger uptrend. Short-term traders are facing a bearish environment with potential for further downside, while intermediate and long-term participants may view this as a pullback within a bullish structure. Key levels to watch are the support at 48430 and resistance at 50780/51600, as a break of either could signal the next directional move.