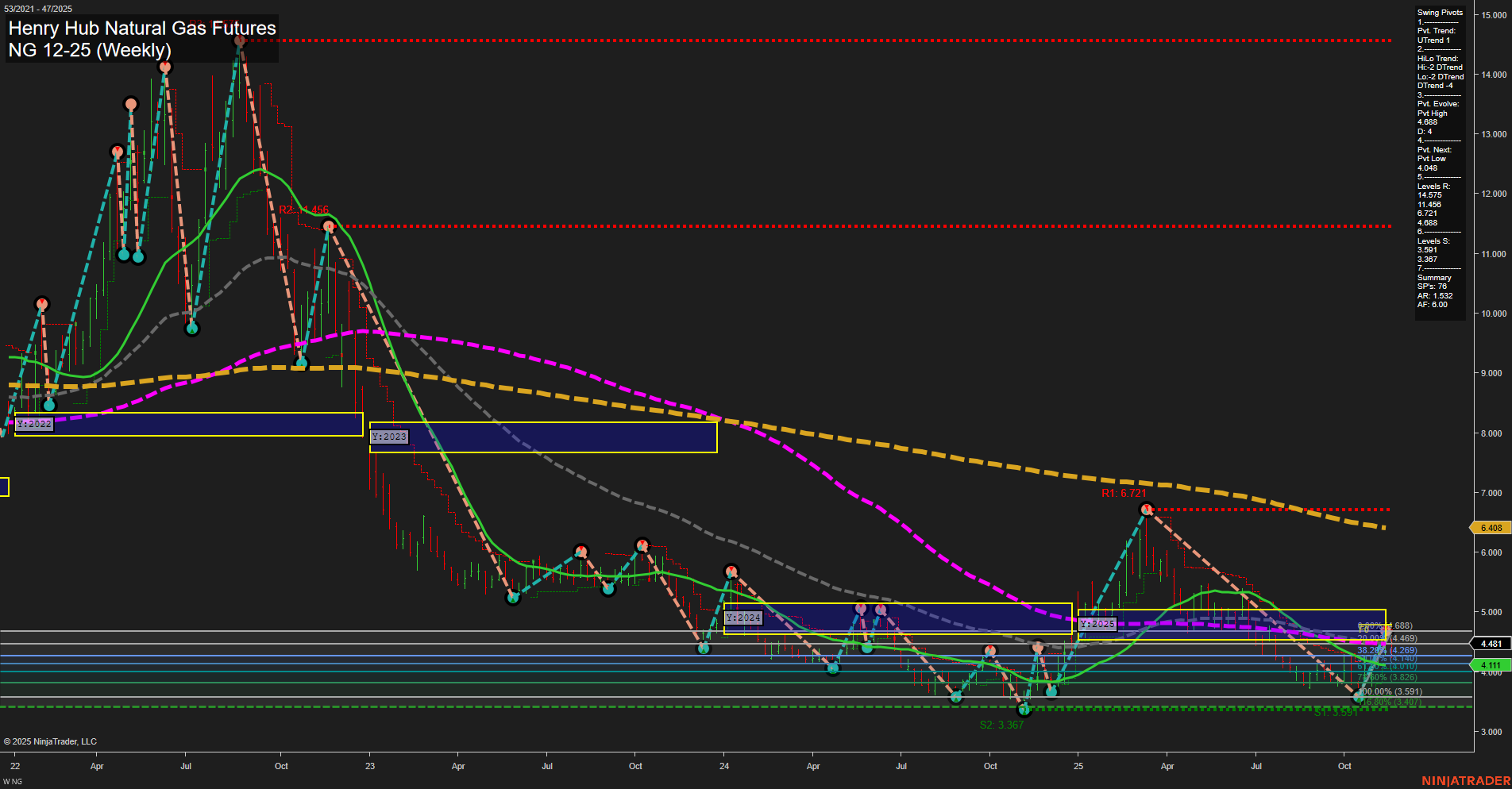

Natural gas futures are currently trading at 4.111, with price action showing medium-sized bars and slow momentum, indicating a lack of strong directional conviction in the short term. The Weekly Session Fib Grid (WSFG) trend is down, with price below the NTZ center, reinforcing a short-term bearish bias. However, the swing pivot trend is showing an emerging short-term uptrend, suggesting a possible attempt at a bounce or retracement from recent lows. Intermediate-term signals are mixed: while the Monthly Session Fib Grid (MSFG) trend is up and price is above the NTZ, the HiLo trend remains down, and both the 5- and 10-week moving averages are trending lower. This points to a market that is attempting to recover but is still facing significant resistance from prevailing bearish forces. Long-term technicals remain firmly bearish, with the Yearly Session Fib Grid (YSFG) trend down and price below the NTZ. All major long-term moving averages (20, 55, 100, 200 week) are in downtrends, and resistance levels are stacked well above current price, highlighting the overhead supply and lack of bullish momentum. Support is clustered in the 3.3–3.6 range, while resistance is much higher, starting at 6.488 and above. The recent short trade signal (14 Nov 2025) aligns with the broader bearish structure, though the short-term uptrend in pivots suggests the potential for choppy or range-bound price action as the market digests recent declines. Overall, the chart reflects a market in a long-term and intermediate-term downtrend, with only tentative signs of a short-term bounce. The environment appears to be one of consolidation after a significant selloff, with volatility likely to persist as the market tests support and resistance zones.