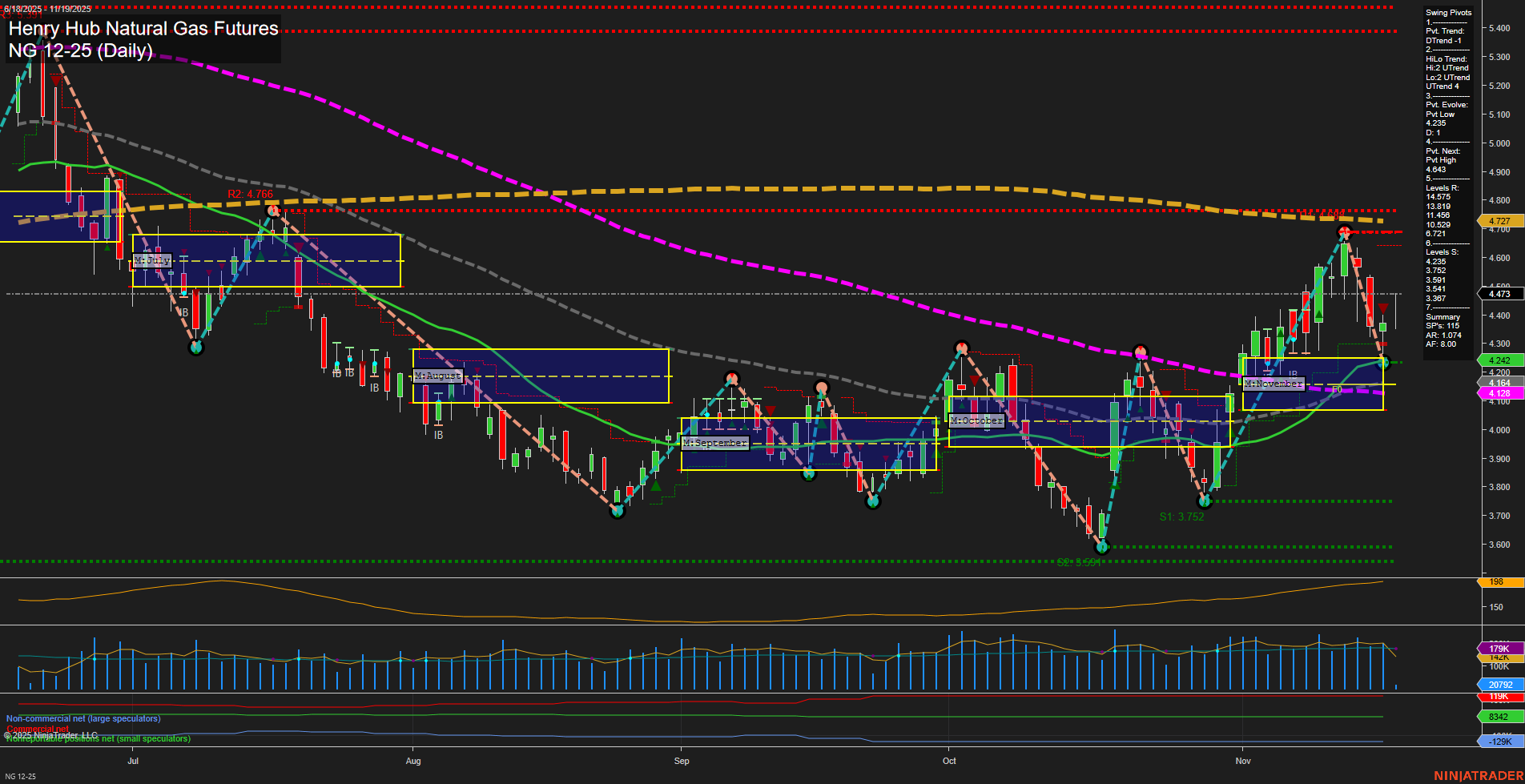

The current daily chart for NG Henry Hub Natural Gas Futures shows a market in transition. Price action has recently seen large, fast-moving bars, indicating heightened volatility and strong momentum. The short-term trend has shifted bearish, with price now below the weekly session fib grid and both the 5-day and 10-day moving averages trending down. However, the intermediate-term (monthly) trend remains bullish, as price is above the November MSFG and the 20, 55, and 100-day moving averages are all in uptrends. The long-term (yearly) trend is still bearish, with price below the annual fib grid and the 200-day moving average trending down. Swing pivot analysis highlights a recent pivot high at 4.725, with the next key support at 4.125. Resistance levels are stacked above, suggesting overhead supply, while support levels below could attract buyers if tested. The recent short signal (14 Nov) aligns with the short-term bearish momentum, but the intermediate-term uptrend suggests potential for a counter-trend bounce or consolidation phase. Volatility remains elevated (ATR 285), and volume is robust, reflecting active participation. Overall, the market is experiencing a pullback within a broader intermediate-term uptrend, but the dominant short- and long-term trends are bearish. This environment may favor tactical swing trading strategies that adapt to both trend continuation and mean reversion setups, especially as price approaches key support or resistance zones.