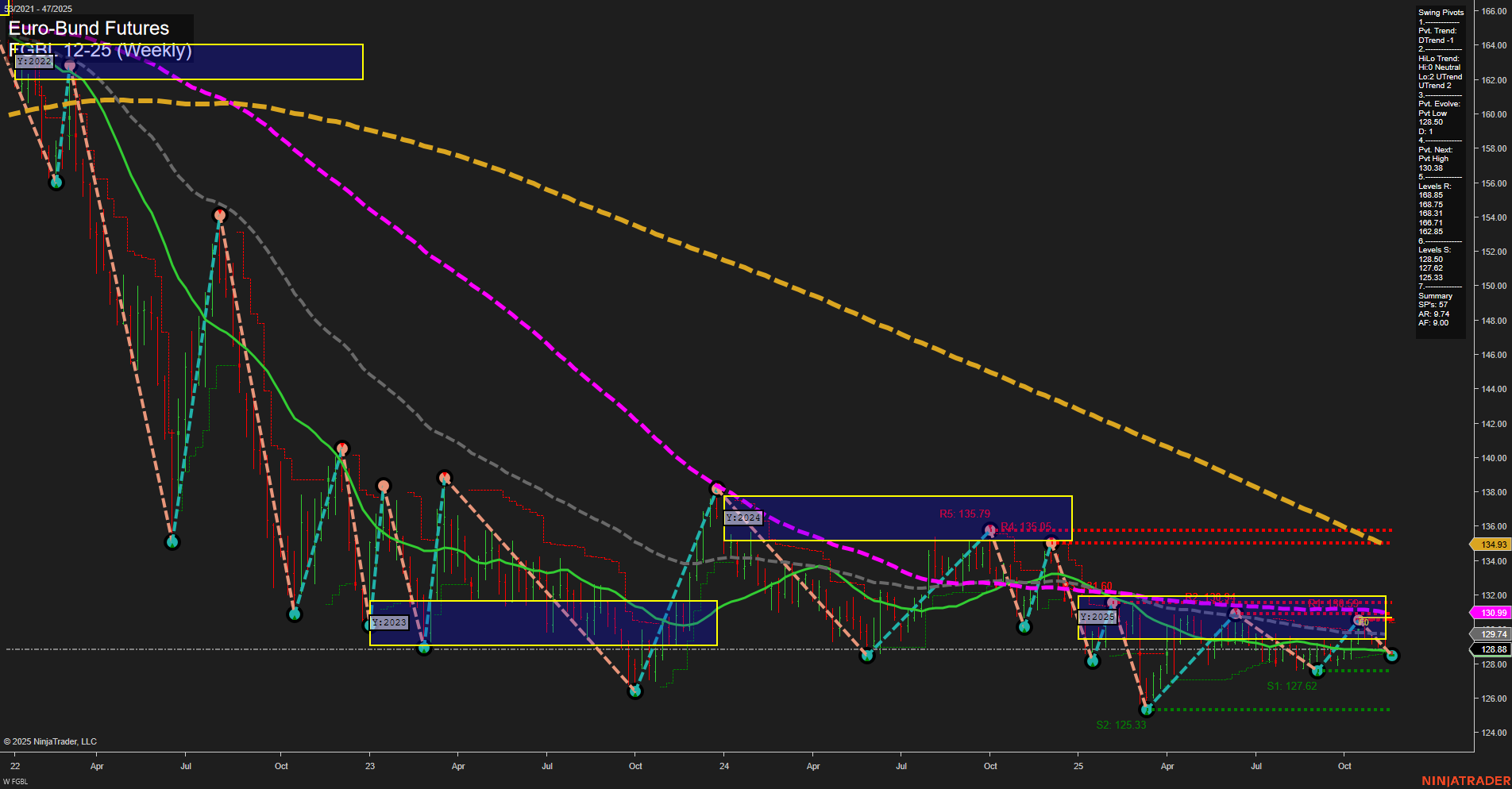

The FGBL Euro-Bund Futures weekly chart shows a market in transition. Price action is consolidating with medium-sized bars and slow momentum, reflecting indecision after a period of volatility. Short-term (WSFG) and intermediate-term (MSFG) session fib grid trends are both up, with price currently above their respective NTZ/F0% levels, suggesting a recent bullish bias. However, the long-term (YSFG) trend remains down, with price below the yearly NTZ/F0% and a negative YSFG reading, indicating persistent bearish pressure on a broader horizon. Swing pivots highlight a short-term downtrend (DTrend) but an intermediate-term uptrend (UTrend), with the most recent pivot low at 128.01 and the next resistance pivot high at 130.93. Key resistance levels cluster between 130.93 and 135.79, while support is found at 127.62 and 125.33, framing the current trading range. Weekly benchmarks show mixed signals: the 5-week MA is trending down, while the 10-week MA is up, reflecting the tug-of-war between short-term weakness and intermediate-term recovery. All long-term moving averages (20, 55, 100, 200 week) remain in downtrends, reinforcing the overarching bearish structure. Recent trade signals are mixed, with both long and short entries triggered in the past week, underscoring the choppy, range-bound nature of the current market. Overall, the short-term outlook is neutral as the market digests recent moves, the intermediate-term is bullish on improving structure, but the long-term remains bearish until major resistance levels are reclaimed and long-term MAs turn up. The market is in a consolidation phase, with potential for further range trading or a breakout should momentum return.