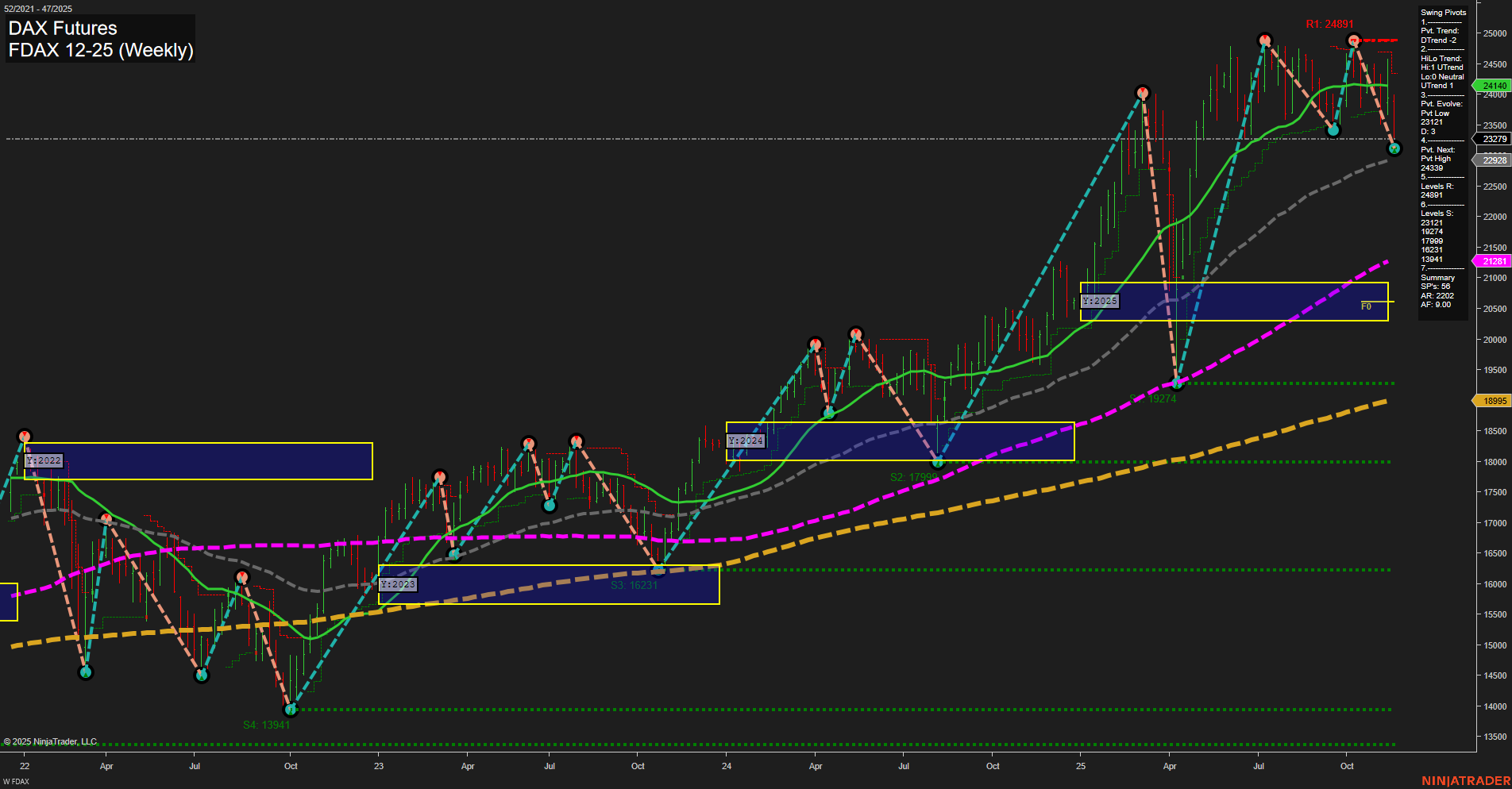

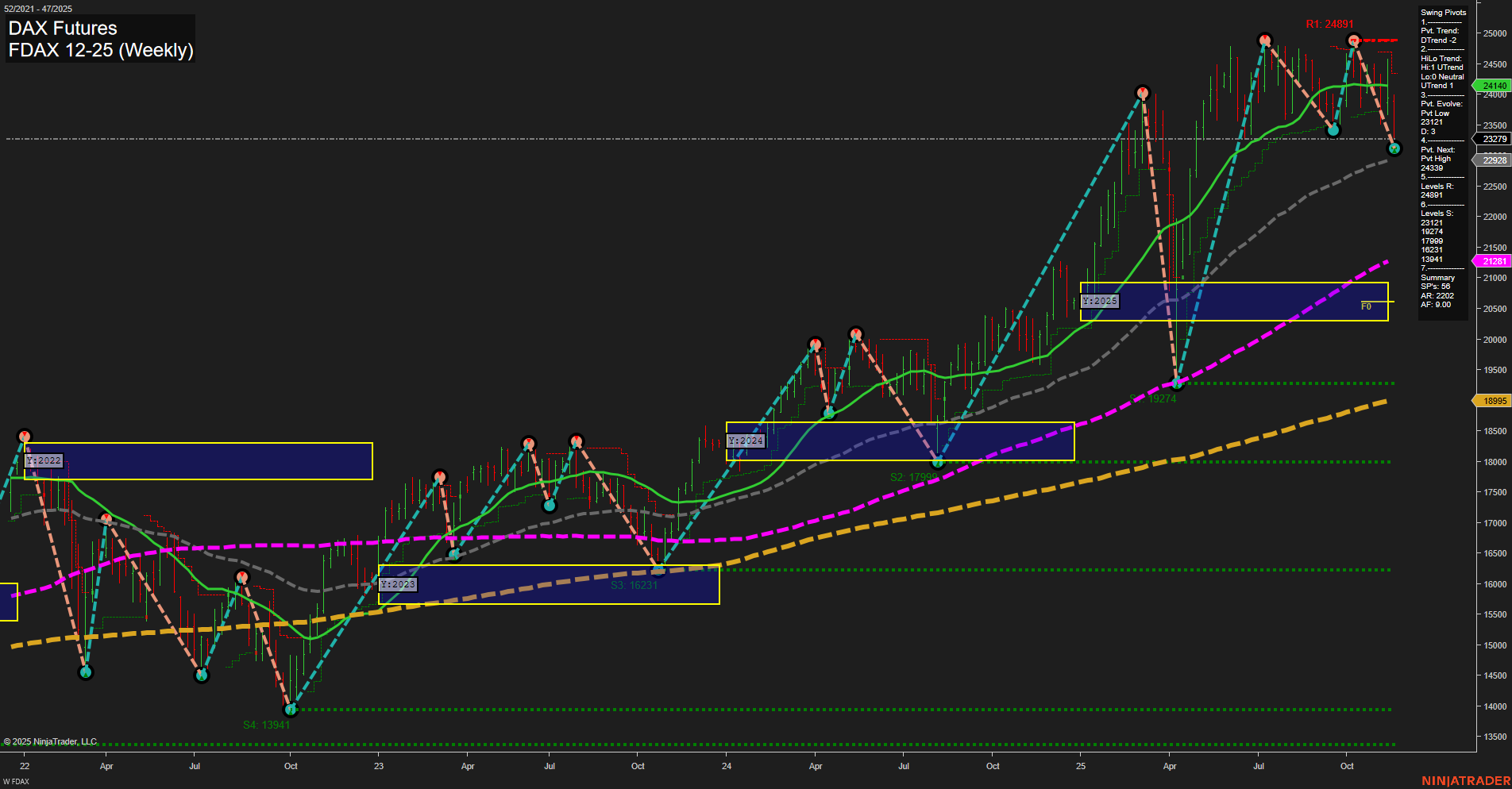

FDAX DAX Futures Weekly Chart Analysis: 2025-Nov-19 07:09 CT

Price Action

- Last: 23,779,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -93%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: -83%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 84%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 23,179,

- 4. Pvt. Next: Pvt high 24,891,

- 5. Levels R: 24,891,

- 6. Levels S: 23,179, 21,821, 19,274, 17,904, 16,231, 13,941.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 24,393 Down Trend,

- (Intermediate-Term) 10 Week: 24,393 Down Trend,

- (Long-Term) 20 Week: 23,926 Down Trend,

- (Long-Term) 55 Week: 21,500 Up Trend,

- (Long-Term) 100 Week: 21,821 Up Trend,

- (Long-Term) 200 Week: 18,995 Up Trend.

Recent Trade Signals

- 17 Nov 2025: Short FDAX 12-25 @ 23,798 Signals.USAR-WSFG

- 17 Nov 2025: Short FDAX 12-25 @ 23,917 Signals.USAR-MSFG

- 13 Nov 2025: Short FDAX 12-25 @ 24,314 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The FDAX DAX Futures weekly chart shows a clear short-term and intermediate-term bearish environment, with price action below both the weekly and monthly session fib grid neutral zones and a series of lower highs and lower lows confirmed by swing pivots. Momentum is slow, and recent bars are of medium size, indicating a controlled but persistent downward move. All short- and intermediate-term moving averages are trending down, reinforcing the current weakness. However, the long-term trend remains bullish, as price is still above the yearly session fib grid neutral zone and supported by rising 55, 100, and 200-week moving averages. The market is currently testing a key support at 23,179, with further downside levels at 21,821 and 19,274. Resistance is defined at 24,891. Recent trade signals have all been to the short side, aligning with the prevailing short- and intermediate-term downtrends. The overall structure suggests a corrective phase within a larger uptrend, with the potential for further downside in the near term before any significant long-term reversal or continuation of the primary bullish trend.

Chart Analysis ATS AI Generated: 2025-11-19 07:09 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.