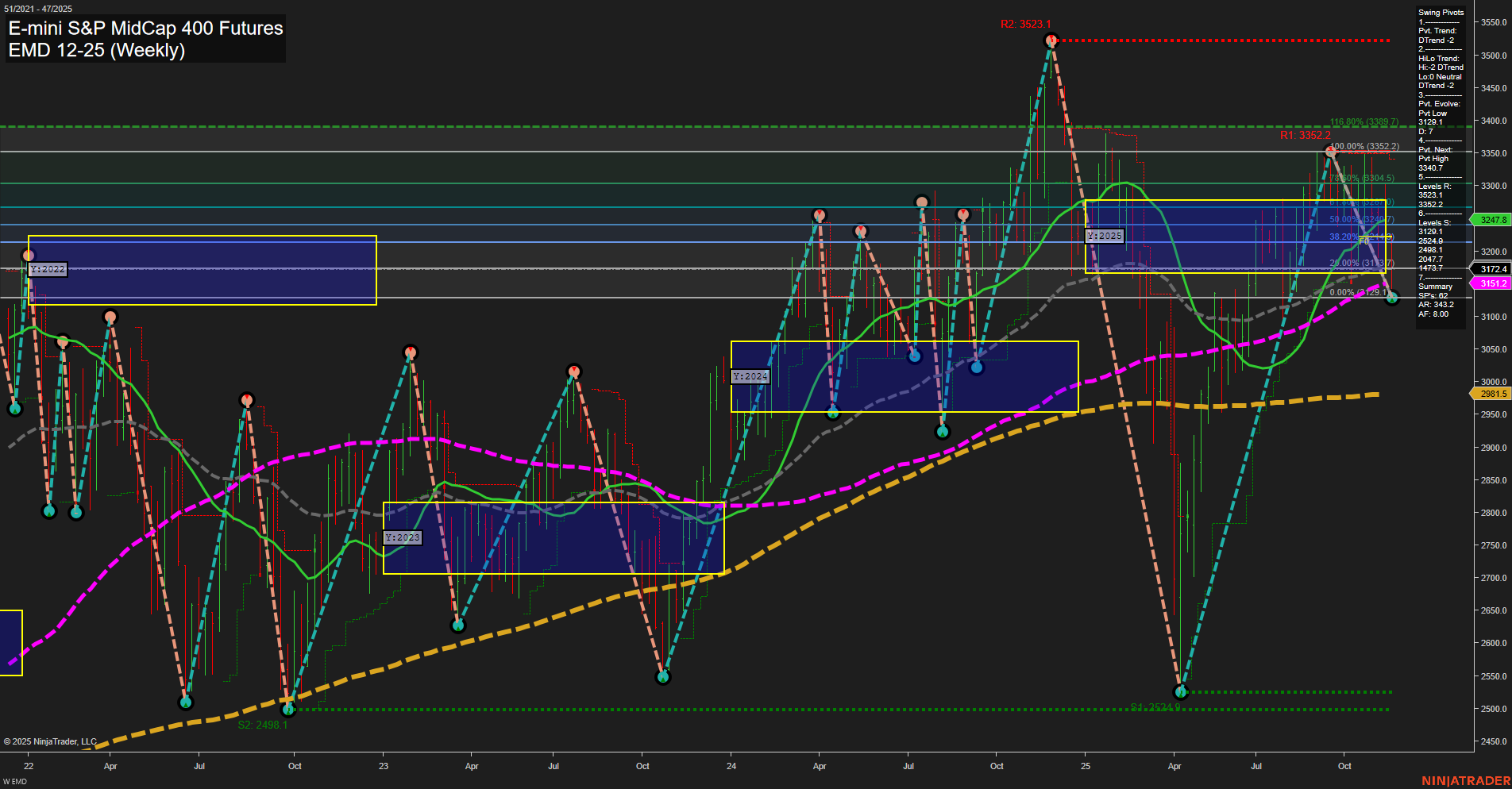

The EMD E-mini S&P MidCap 400 Futures weekly chart is currently showing a clear bearish bias in both the short- and intermediate-term timeframes. Price is trading below the key F0%/NTZ levels across the weekly, monthly, and yearly session fib grids, confirming persistent downside momentum. Both the short-term swing pivot trend and the intermediate-term HiLo trend are in a downtrend, with the most recent pivots highlighting resistance at 3352.2 and 3523.1, and support at 3110.1 and 2524.4. Recent trade signals have all triggered on the short side, reinforcing the prevailing downward pressure. The 5- and 10-week moving averages are trending down, while the longer-term 20-, 55-, 100-, and 200-week moving averages remain in uptrends, suggesting that the broader structure is still intact but under threat if the current weakness persists. Momentum is slow, and price action is characterized by medium-sized bars, indicating a controlled but persistent sell-off rather than panic-driven volatility. The market is in a corrective phase, with the potential for further downside if support levels fail, but the long-term trend remains neutral as price is still above the major long-term moving averages. This environment is typical of a market in retracement or consolidation after a prior rally, with swing traders watching for either a continuation of the downtrend or signs of stabilization at key support.