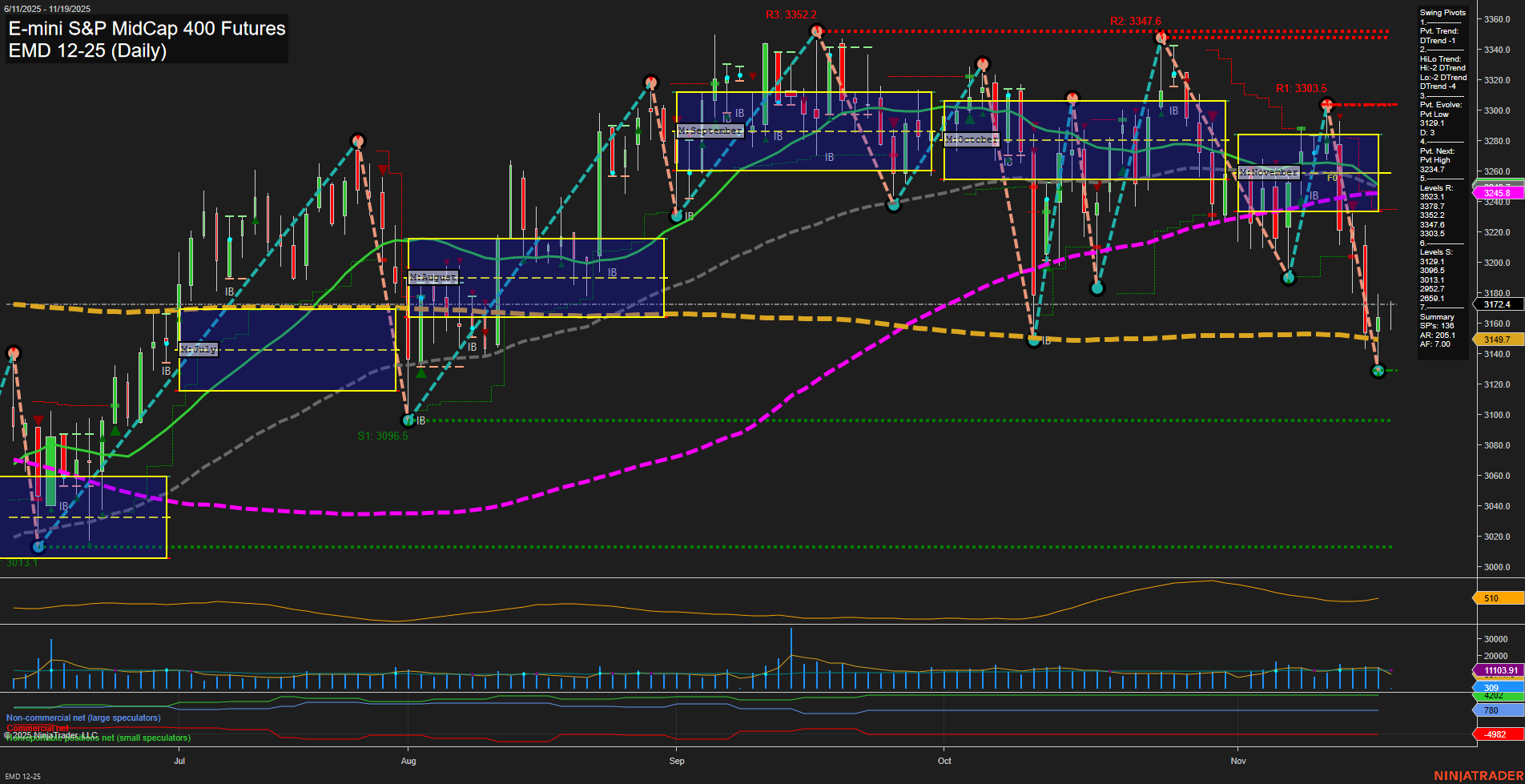

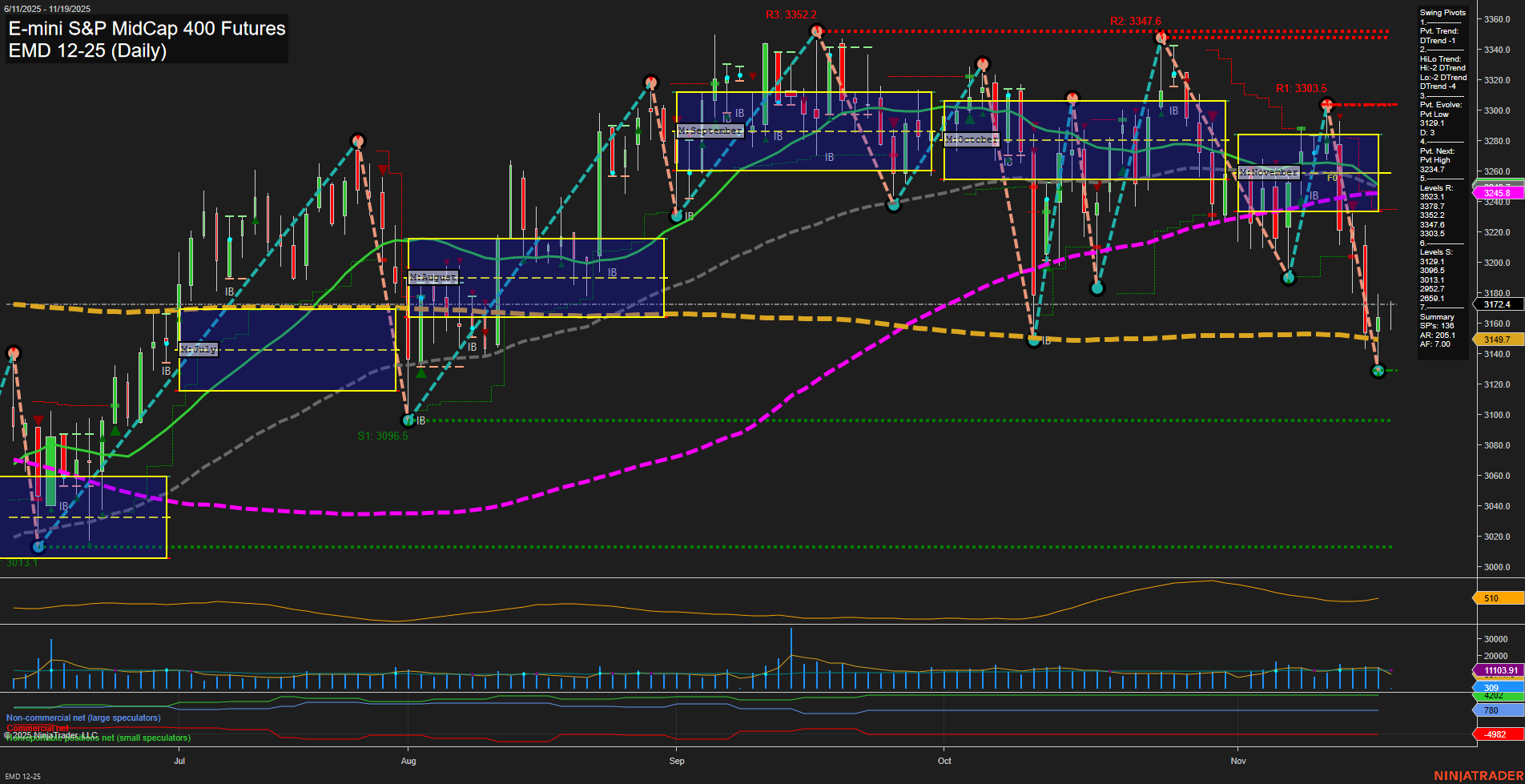

EMD E-mini S&P MidCap 400 Futures Daily Chart Analysis: 2025-Nov-19 07:06 CT

Price Action

- Last: 3172.4,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -41%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: -64%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: -9%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 3131.3,

- 4. Pvt. Next: Pvt high 3234.7,

- 5. Levels R: 3234.7, 3303.5, 3347.6, 3352.2,

- 6. Levels S: 3131.3, 3096.5, 3051.1.

Daily Benchmarks

- (Short-Term) 5 Day: 3245.6 Down Trend,

- (Short-Term) 10 Day: 3249.0 Down Trend,

- (Intermediate-Term) 20 Day: 3245.6 Down Trend,

- (Intermediate-Term) 55 Day: 3194.7 Down Trend,

- (Long-Term) 100 Day: 3149.7 Up Trend,

- (Long-Term) 200 Day: 3149.7 Up Trend.

Additional Metrics

Recent Trade Signals

- 17 Nov 2025: Short EMD 12-25 @ 3198.6 Signals.USAR-WSFG

- 13 Nov 2025: Short EMD 12-25 @ 3230.9 Signals.USAR-MSFG

- 13 Nov 2025: Short EMD 12-25 @ 3251 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

The EMD futures daily chart is showing pronounced bearish momentum across both short- and intermediate-term timeframes, with price action breaking decisively below key support levels and all major moving averages (except the 100 and 200 day, which are still trending up but close to flattening). The recent large, fast-moving bars and high ATR indicate heightened volatility, likely driven by a combination of technical breakdowns and possible macro or sector-specific news. The swing pivot structure confirms a dominant downtrend, with the next significant support at 3131.3 and resistance overhead at 3234.7 and above. Volume remains robust, supporting the strength of the current move. Multiple recent short signals reinforce the prevailing downside bias. While the long-term trend is still neutral due to the lagging nature of the 100/200 day MAs, the overall environment is characterized by strong selling pressure, failed bounces, and a lack of meaningful reversal signals at this stage.

Chart Analysis ATS AI Generated: 2025-11-19 07:06 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.