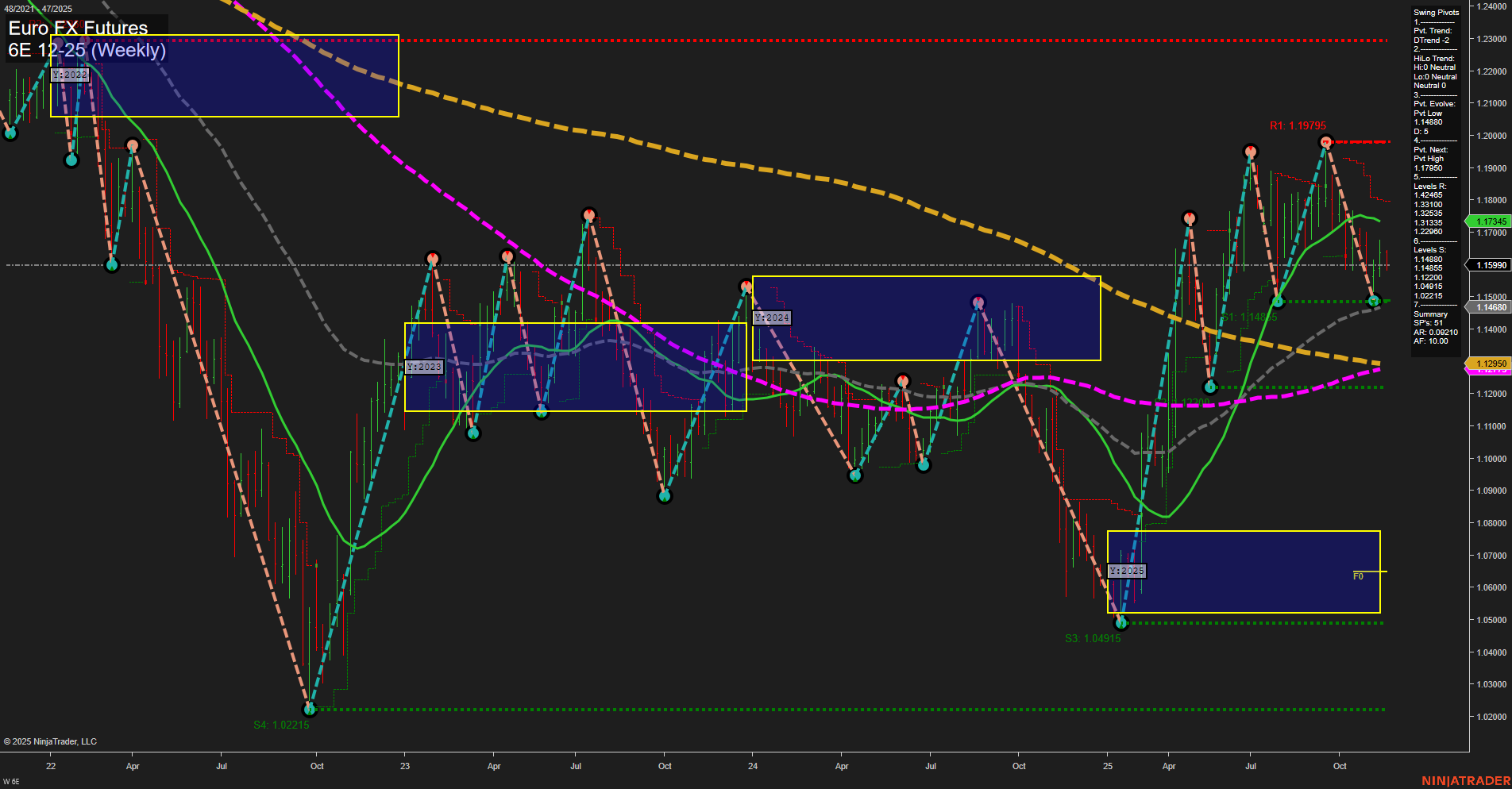

The 6E Euro FX Futures weekly chart shows a market in transition. Short-term and intermediate-term trends are both bearish, as indicated by the WSFG and MSFG readings, with price action below their respective NTZ/F0% levels and recent short trade signals. Momentum is slow, and the most recent bars are of medium size, suggesting a lack of strong conviction in either direction. The swing pivot structure confirms a short-term downtrend, with the next key resistance at 1.17985 and support at 1.12950. Intermediate-term HiLo trend is neutral, reflecting some indecision or consolidation after recent moves. Long-term, the YSFG remains bullish with price above the yearly NTZ/F0% and a strong 76% reading, supported by the 55 and 100 week moving averages trending up. However, the 20 and 200 week benchmarks are still in a downtrend, highlighting a mixed long-term technical landscape. The market appears to be in a corrective phase within a larger bullish yearly structure, with recent price action testing lower support levels after failing to break higher resistance. This environment is characterized by choppy, range-bound trading with potential for volatility as the market seeks direction. Swing traders should note the potential for further downside in the short to intermediate term, while keeping an eye on long-term support levels for signs of a reversal or continuation of the broader uptrend.