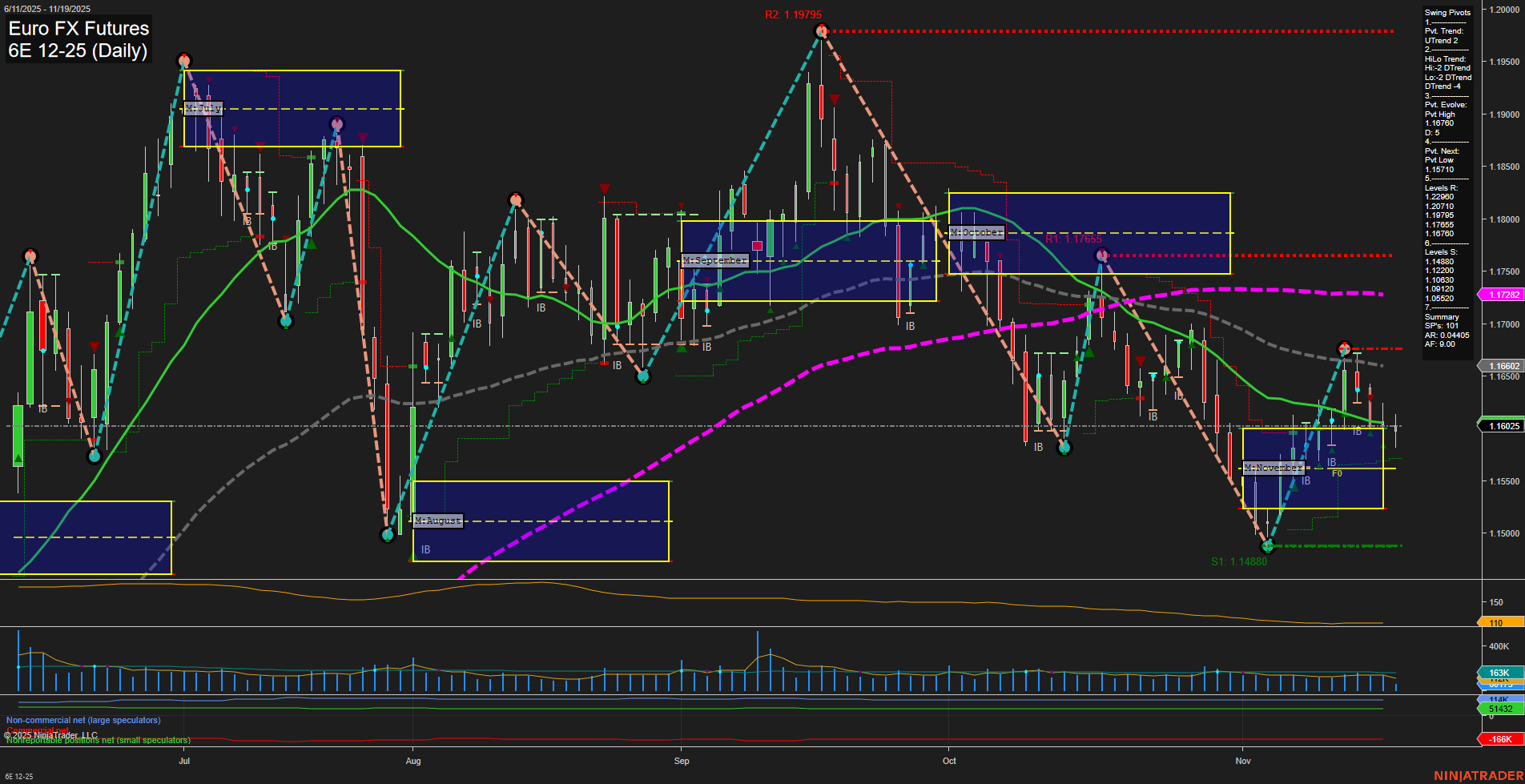

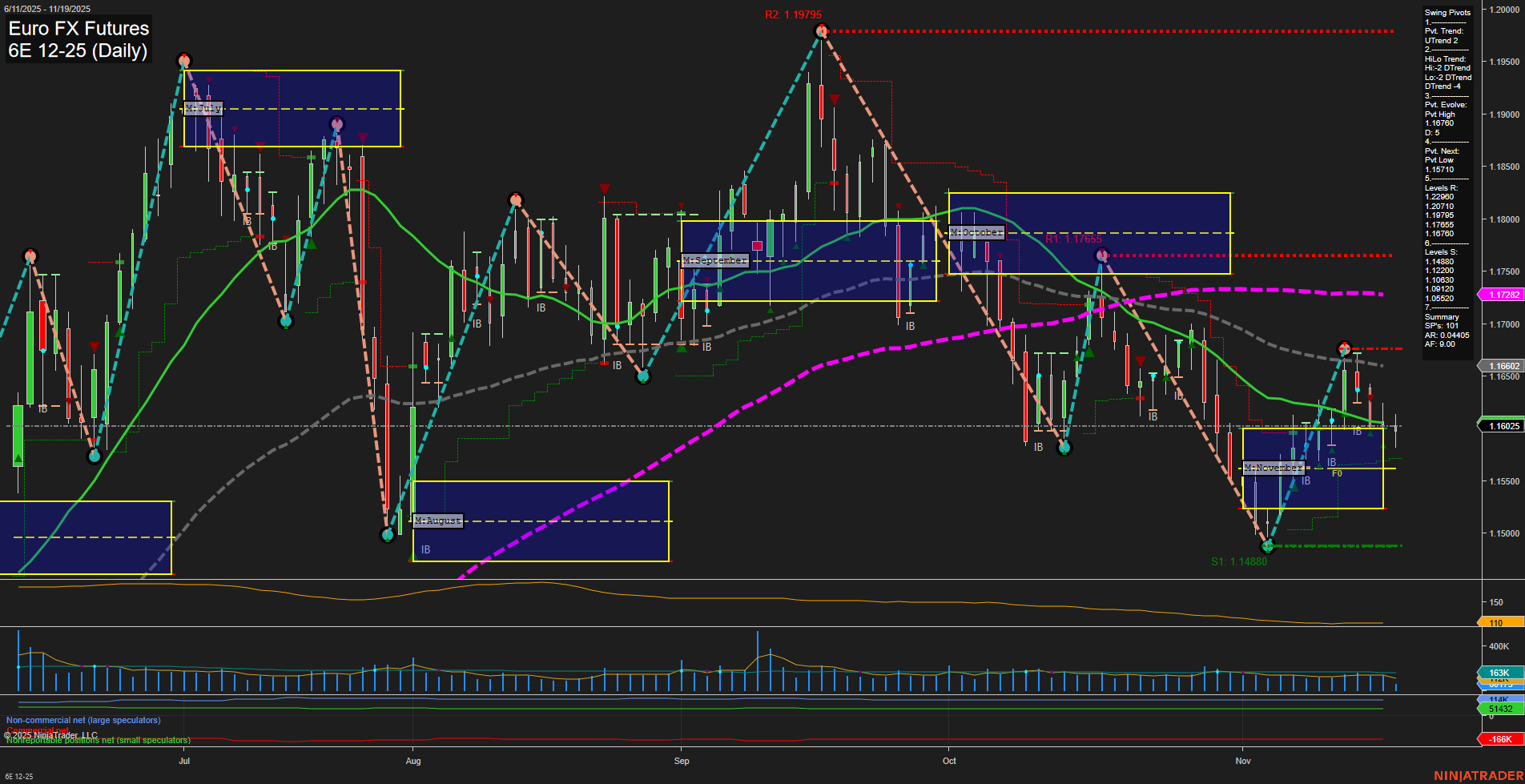

6E Euro FX Futures Daily Chart Analysis: 2025-Nov-19 07:01 CT

Price Action

- Last: 1.16025,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -36%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: -56%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 76%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt High 1.17655,

- 4. Pvt. Next: Pvt Low 1.14880,

- 5. Levels R: 1.17655, 1.17019, 1.16220, 1.15710,

- 6. Levels S: 1.14880, 1.05229.

Daily Benchmarks

- (Short-Term) 5 Day: 1.1620 Down Trend,

- (Short-Term) 10 Day: 1.1650 Down Trend,

- (Intermediate-Term) 20 Day: 1.1662 Down Trend,

- (Intermediate-Term) 55 Day: 1.1722 Down Trend,

- (Long-Term) 100 Day: 1.1729 Down Trend,

- (Long-Term) 200 Day: 1.1702 Down Trend.

Additional Metrics

Recent Trade Signals

- 18 Nov 2025: Short 6E 12-25 @ 1.1615 Signals.USAR-WSFG

- 17 Nov 2025: Short 6E 12-25 @ 1.16145 Signals.USAR.TR120

- 13 Nov 2025: Long 6E 12-25 @ 1.1668 Signals.USAR.TR720

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

The 6E Euro FX Futures daily chart is currently dominated by a bearish short- and intermediate-term structure, as evidenced by the downward trends in both the weekly and monthly session fib grids (WSFG and MSFG), and confirmed by the swing pivot summary showing both short-term and intermediate-term downtrends. Price is trading below all key moving averages, with the 5, 10, 20, 55, 100, and 200-day benchmarks all trending down, reinforcing the prevailing downside momentum. The most recent swing pivot is a high at 1.17655, with the next key support at the swing low of 1.14880. Recent trade signals have shifted to the short side, aligning with the broader technical picture. However, the long-term yearly fib grid remains in an uptrend, suggesting that while the dominant move is currently down, the larger cycle may still be intact. Volatility (ATR) and volume (VOLMA) are moderate, indicating a controlled but persistent move lower rather than a panic-driven selloff. The market is in a corrective phase within a larger uptrend, with the potential for further downside until a significant support or reversal pattern emerges.

Chart Analysis ATS AI Generated: 2025-11-19 07:02 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.