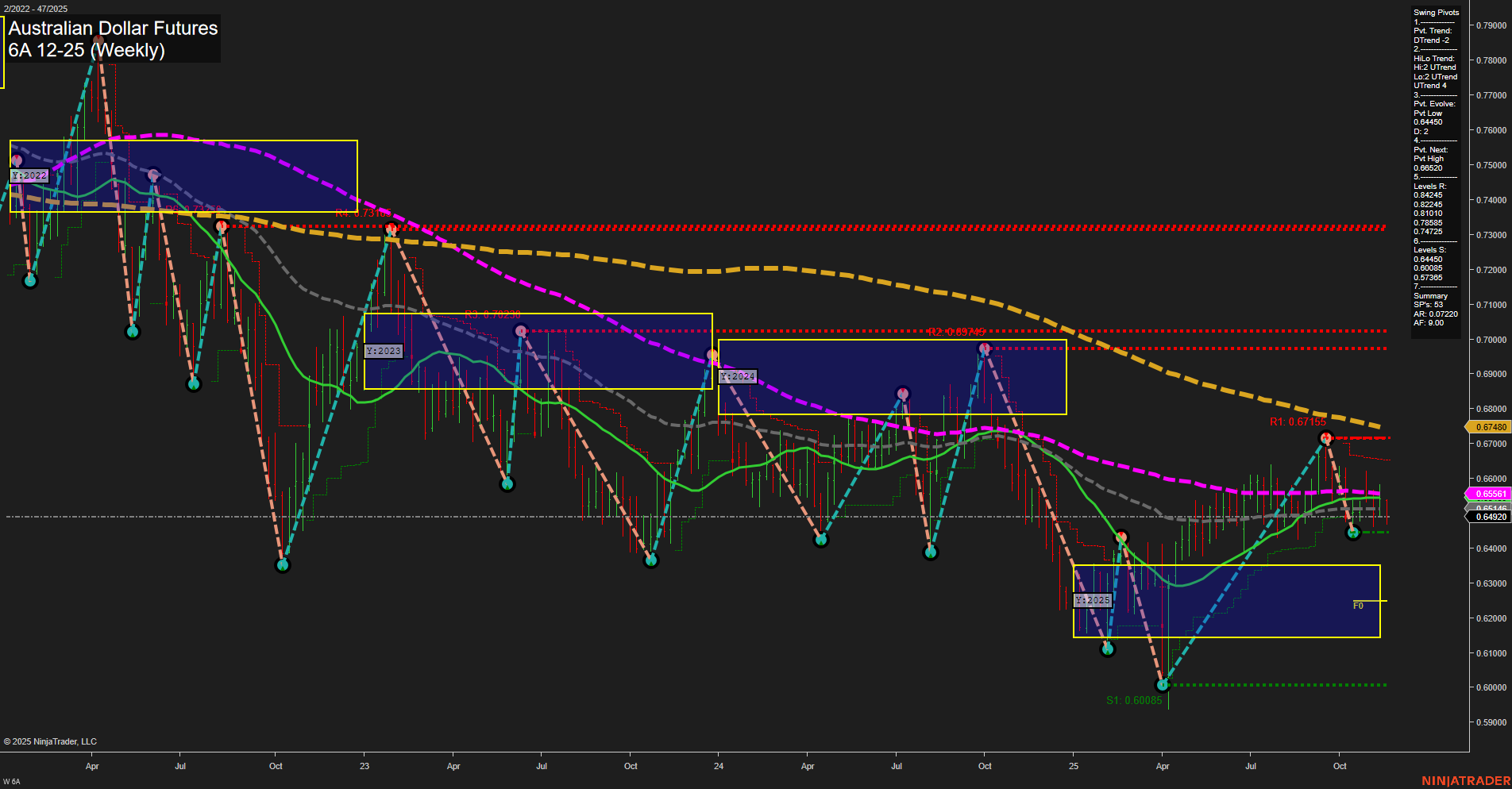

The Australian Dollar Futures (6A) weekly chart shows a market in transition, with recent price action characterized by medium-sized bars and slow momentum, indicating a lack of strong directional conviction. The short-term swing pivot trend has shifted to a downtrend, with the most recent pivot low at 0.64920 and resistance levels overhead at 0.65561 and 0.67155. Intermediate-term HiLo trend remains up, suggesting some underlying support, but this is countered by the majority of moving averages (5, 10, 55, 100, and 200 week) trending down, reinforcing a bearish long-term structure. The 20-week moving average is the only benchmark showing an uptrend, but price is currently below most key averages, highlighting ongoing pressure. The Fib grid zones (WSFG, MSFG, YSFG) all indicate a neutral bias, with price consolidating near the center of the yearly NTZ. Overall, the market is in a corrective or consolidative phase after a prior rally, with a bearish tilt in the short and long term, while the intermediate-term remains neutral as the market digests recent moves. No clear breakout or breakdown is evident, and the chart reflects a choppy, range-bound environment with potential for further tests of support or resistance as the market seeks direction.