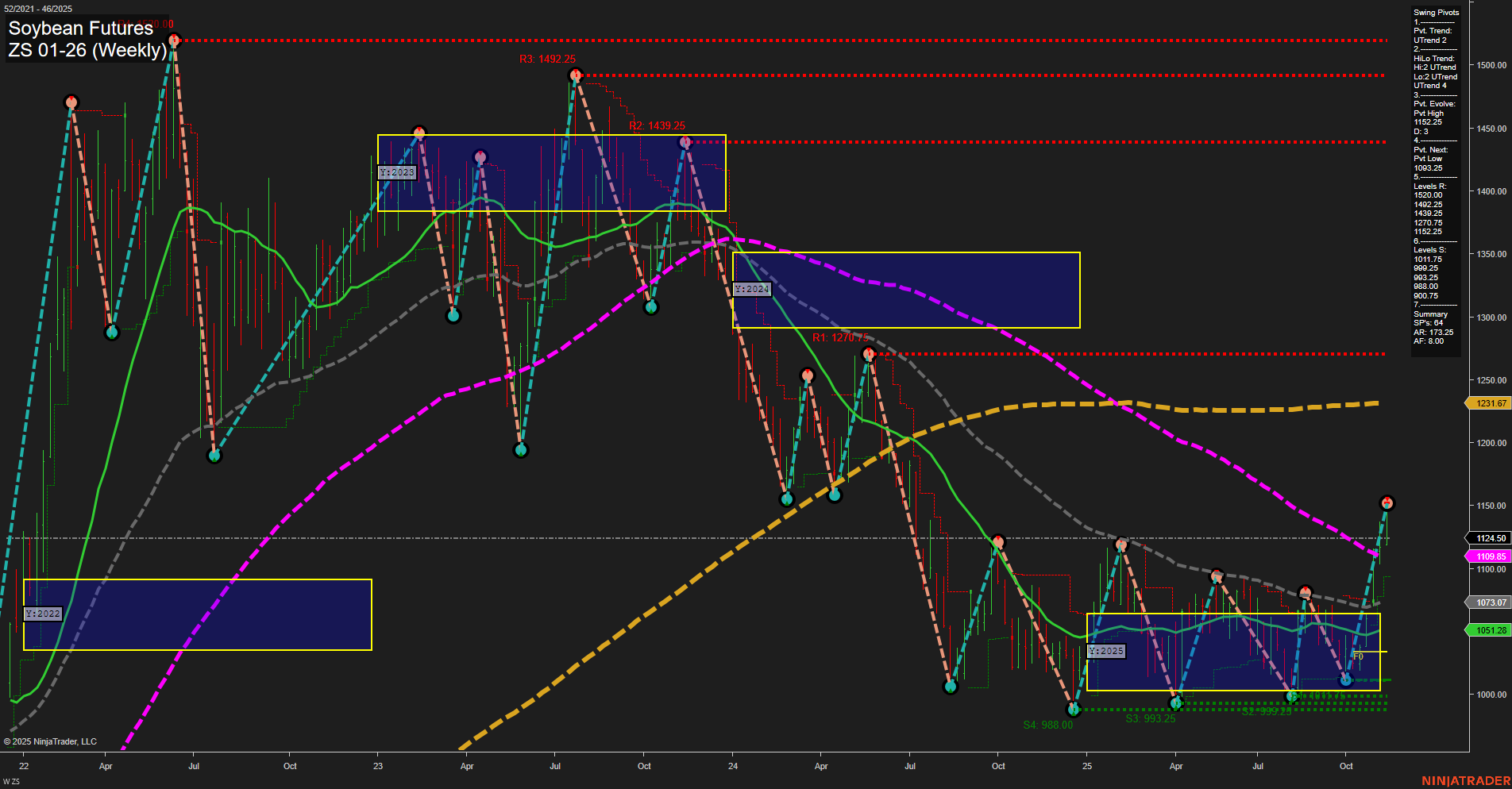

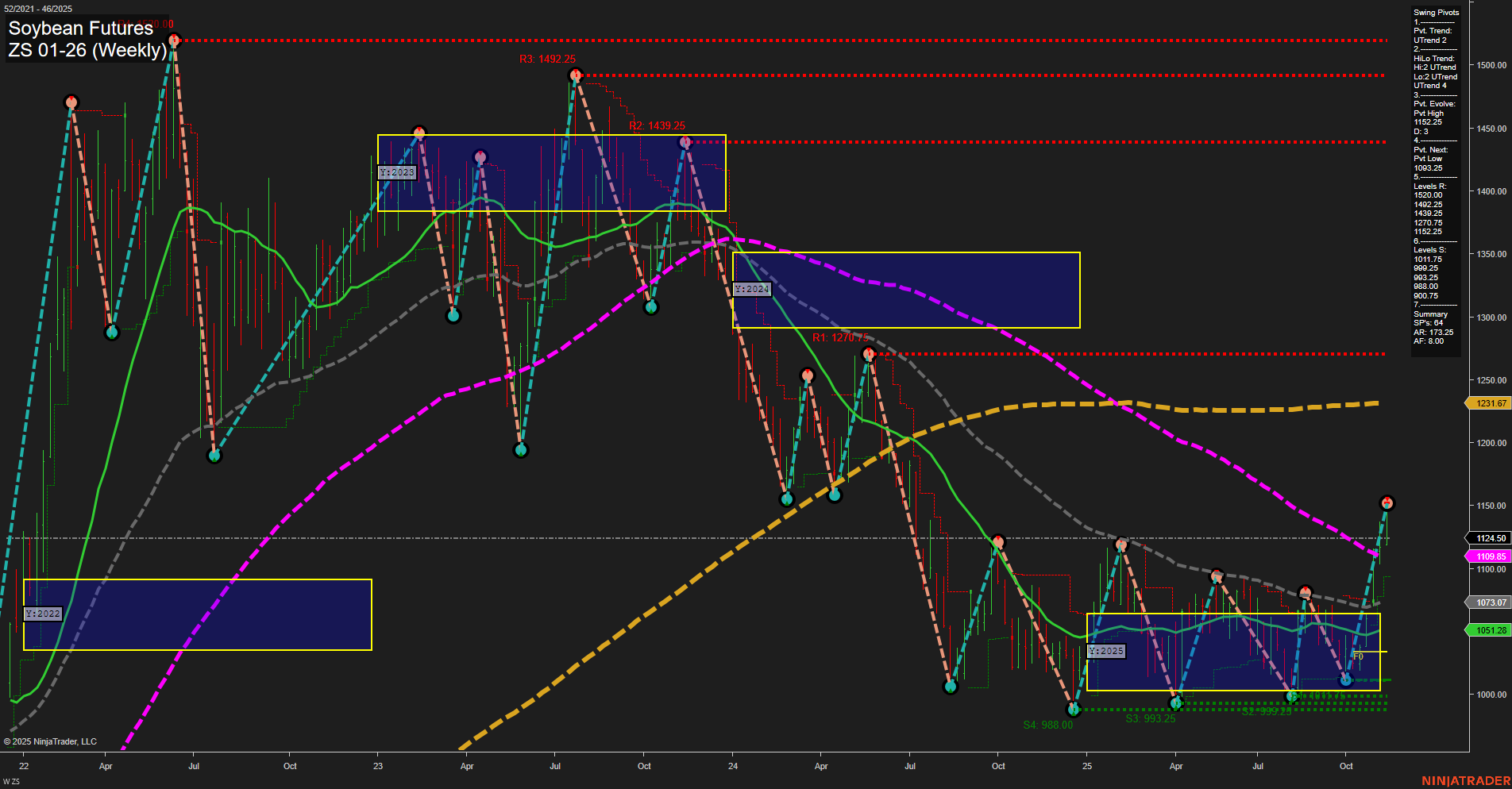

ZS Soybean Futures Weekly Chart Analysis: 2025-Nov-16 18:22 CT

Price Action

- Last: 1124.50,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 17%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 168%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 29%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 1124.50,

- 4. Pvt. Next: Pvt low 1093.25,

- 5. Levels R: 1492.25, 1439.25, 1270.75, 1178.25, 1124.50,

- 6. Levels S: 1011.75, 993.25, 988.00, 963.25, 960.00, 950.75.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1073.07 Up Trend,

- (Intermediate-Term) 10 Week: 1051.28 Up Trend,

- (Long-Term) 20 Week: 1099.85 Up Trend,

- (Long-Term) 55 Week: 1124.50 Down Trend,

- (Long-Term) 100 Week: 1231.67 Down Trend,

- (Long-Term) 200 Week: 1373.25 Down Trend.

Recent Trade Signals

- 10 Nov 2025: Long ZS 01-26 @ 1123.75 Signals.USAR-WSFG

- 10 Nov 2025: Long ZS 01-26 @ 1126.25 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

Soybean futures have staged a strong rally, with price action breaking above the NTZ F0% levels across weekly, monthly, and yearly session grids, confirming a broad-based uptrend. Momentum is fast and recent bars are large, indicating strong buying interest and a potential shift in sentiment. Both short-term and intermediate-term swing pivot trends are up, with the most recent pivot high at 1124.50 and the next key support at 1093.25. Resistance levels are stacked above, with the nearest at 1178.25 and 1270.75, while support is well-defined below 1011.75. Weekly benchmarks show all short- and intermediate-term moving averages trending up, while longer-term averages (55, 100, 200 week) remain in downtrends, suggesting the market is in the early stages of a possible longer-term reversal. Recent trade signals confirm bullish momentum in the short term. The overall structure points to a bullish environment in the short and intermediate term, with long-term sentiment neutral as the market tests key resistance and works to establish a sustained trend reversal. Volatility is elevated, and the market is emerging from a prolonged consolidation, hinting at the potential for further upside if resistance levels are overcome.

Chart Analysis ATS AI Generated: 2025-11-16 18:22 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.