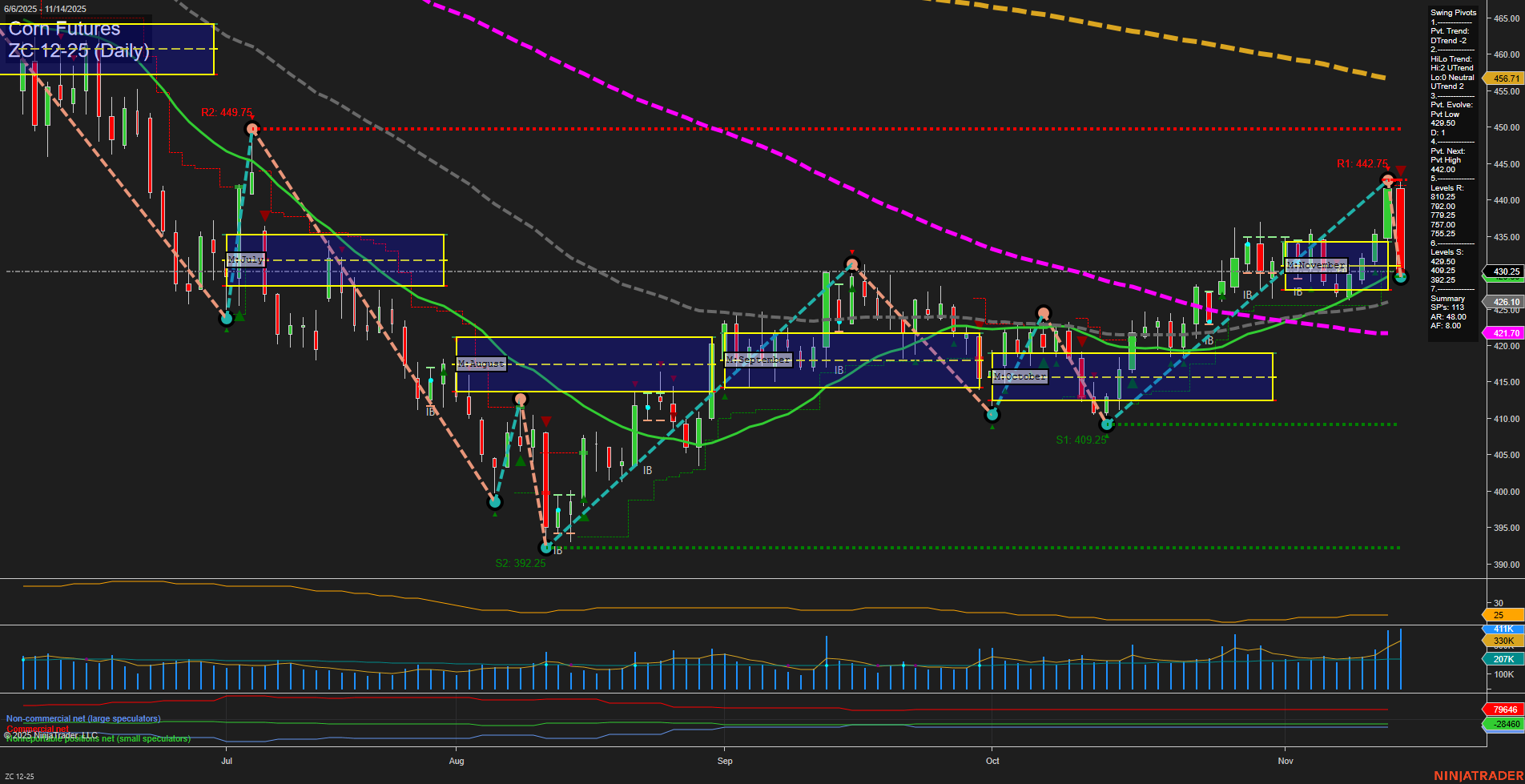

Corn futures have recently experienced a sharp move with large, fast momentum bars, indicating heightened volatility and strong participation. The short-term trend has shifted to a downtrend (DTrend) following a pivot high at 442.00, but the intermediate-term trend remains up, supported by the monthly session fib grid and higher pivot lows. Price is currently above both the weekly and monthly NTZ/F0% levels, reflecting underlying bullishness in the short and intermediate timeframes. All short and intermediate moving averages are trending up, confirming the recent rally, though the 200-day MA remains in a downtrend, highlighting persistent long-term bearishness. Key resistance is clustered between 426.75 and 442.75, while support is well below at 409.25 and 392.25, suggesting a wide trading range. The recent long signal at 431.5 aligns with the intermediate uptrend, but the short-term pullback and large ATR point to potential choppiness or a corrective phase. Overall, the market is in a transition zone: short-term neutral as it digests gains, intermediate-term bullish with higher lows, but still facing long-term headwinds. Swing traders should watch for resolution of this short-term pullback to gauge if the intermediate uptrend can extend or if a deeper retracement is underway.