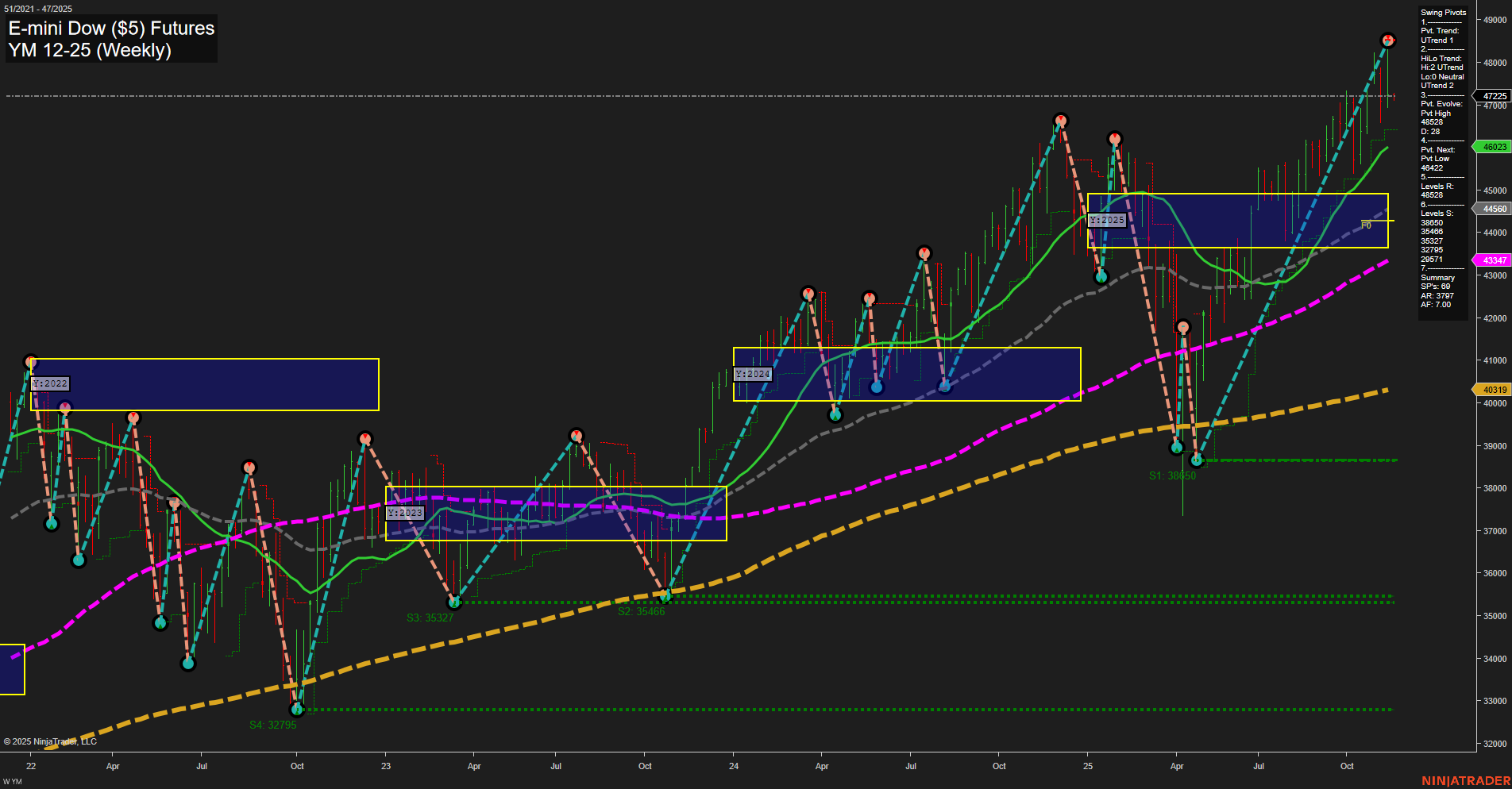

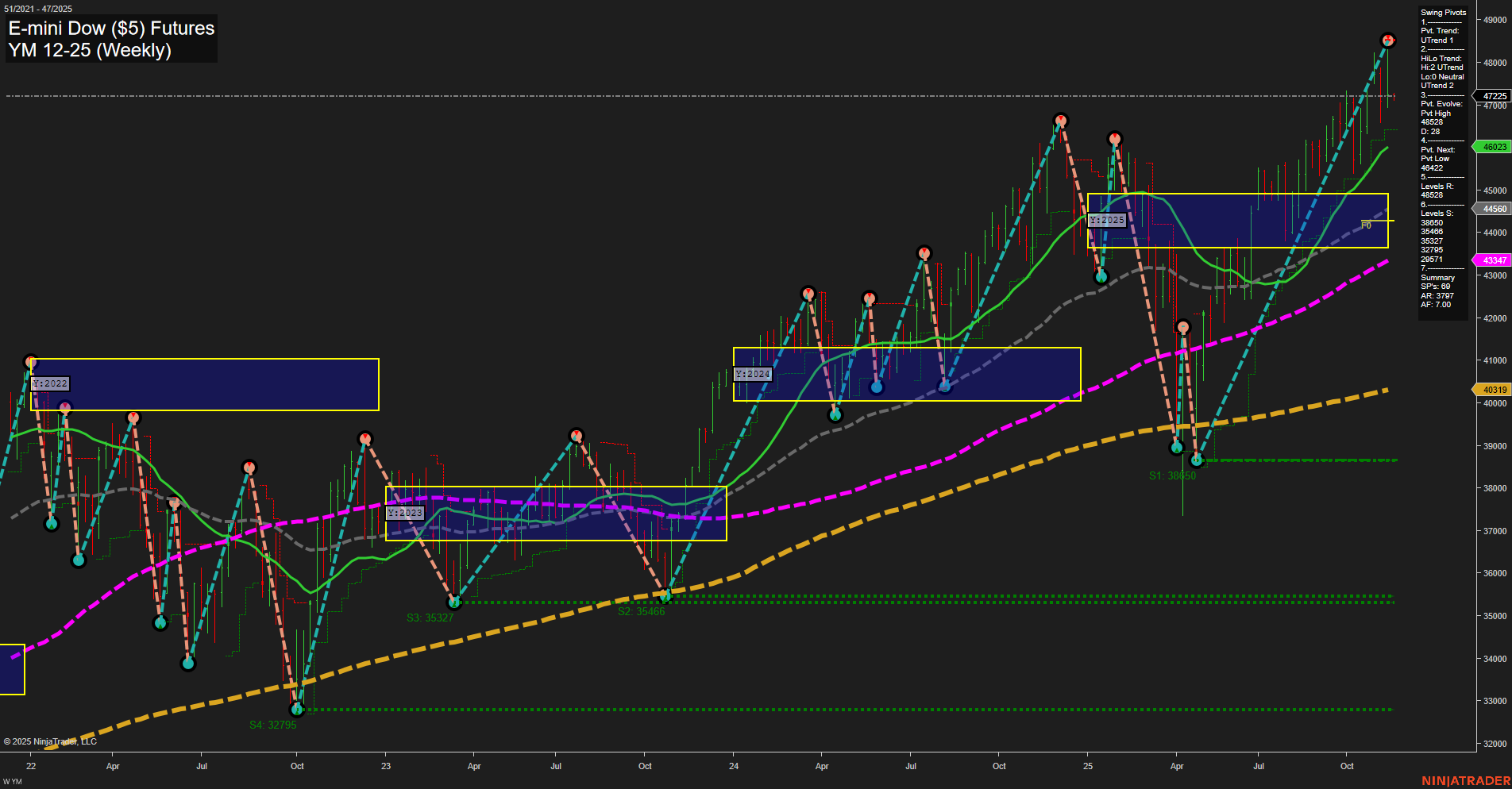

YM E-mini Dow ($5) Futures Weekly Chart Analysis: 2025-Nov-16 18:20 CT

Price Action

- Last: 47717,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -5%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 41%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 46%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 47717,

- 4. Pvt. Next: Pvt low 46422,

- 5. Levels R: 47717, 46825, 44560,

- 6. Levels S: 40319, 38450, 35327, 32795.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 46825 Up Trend,

- (Intermediate-Term) 10 Week: 46023 Up Trend,

- (Long-Term) 20 Week: 44560 Up Trend,

- (Long-Term) 55 Week: 43347 Up Trend,

- (Long-Term) 100 Week: 40319 Up Trend,

- (Long-Term) 200 Week: 38450 Up Trend.

Recent Trade Signals

- 13 Nov 2025: Short YM 12-25 @ 47717 Signals.USAR.TR120

- 10 Nov 2025: Long YM 12-25 @ 47325 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The YM E-mini Dow futures are exhibiting strong upward momentum on the weekly chart, with the most recent price action printing large bars and fast momentum, indicating heightened volatility and active participation. Despite a short-term WSFG downtrend and a recent short signal, the prevailing swing pivot and HiLo trends remain upward, supported by a series of higher highs and higher lows. Intermediate and long-term trends are firmly bullish, as confirmed by all major moving averages trending higher and price holding well above key support levels. The market has recently tested and bounced from major support zones, and is now challenging resistance at new highs. The overall structure suggests a robust uptrend with periodic pullbacks, typical of a trending market with healthy corrections. The short-term neutral rating reflects the mixed signals from the latest short entry against the broader bullish backdrop, while intermediate and long-term outlooks remain positive.

Chart Analysis ATS AI Generated: 2025-11-16 18:20 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.