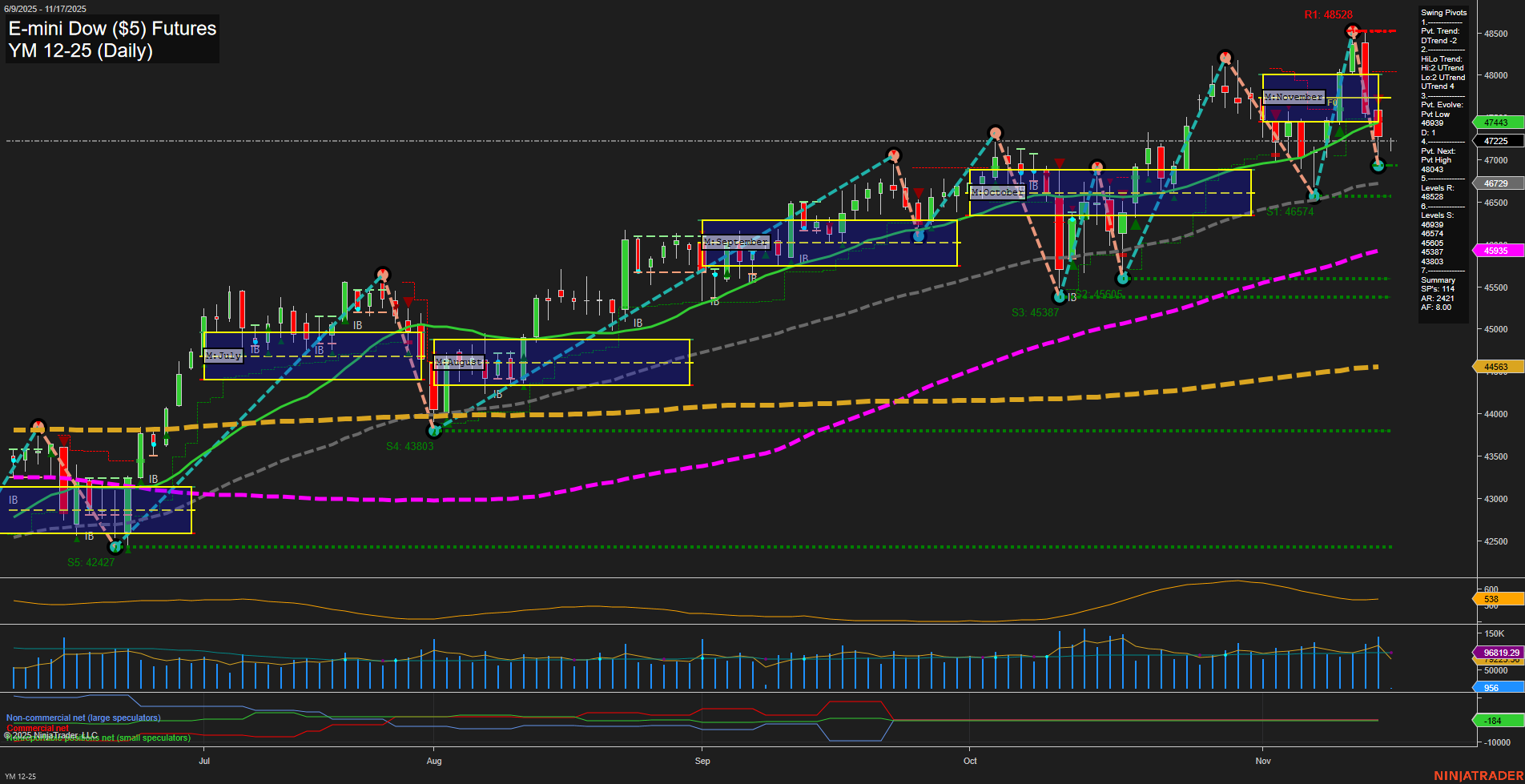

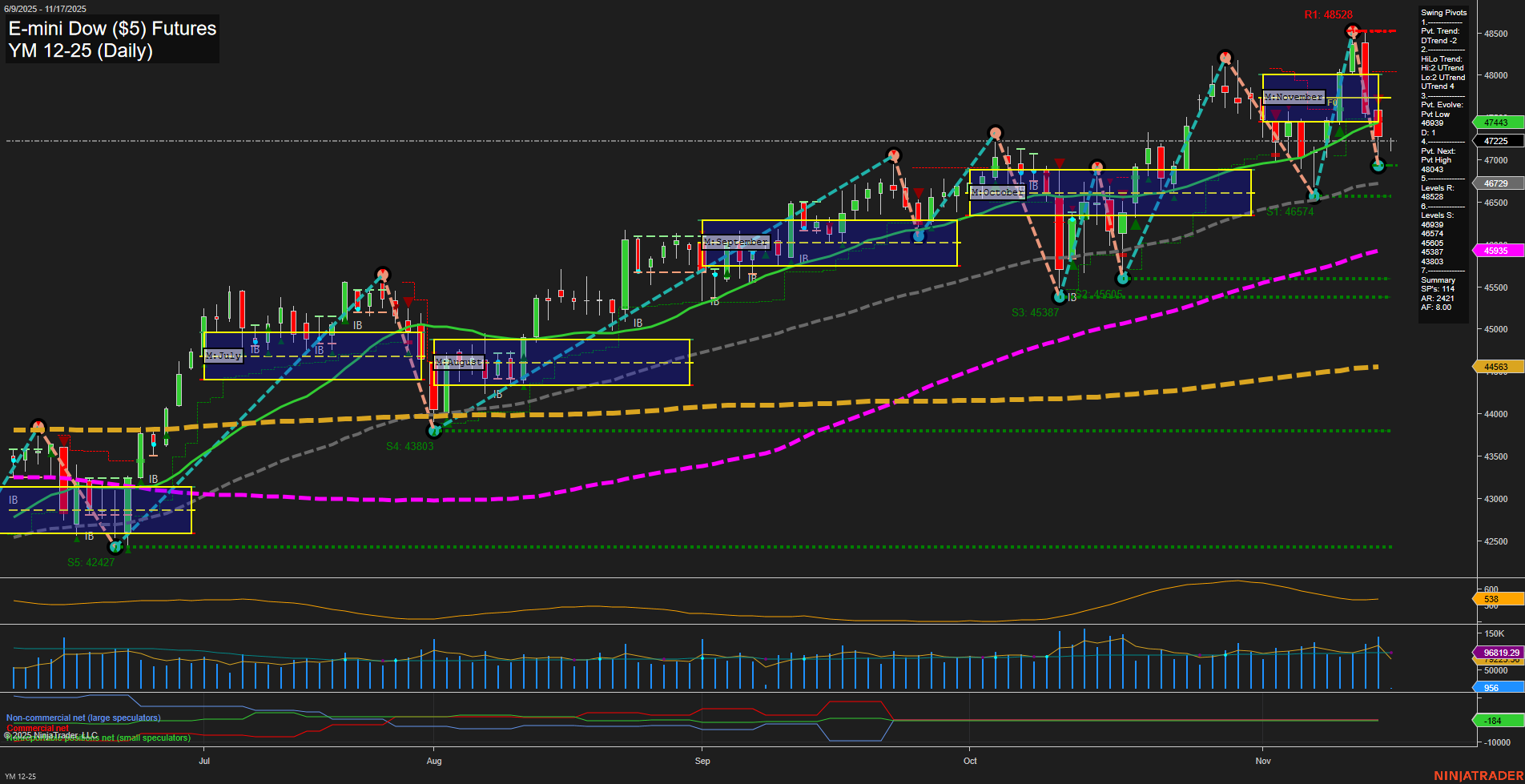

YM E-mini Dow ($5) Futures Daily Chart Analysis: 2025-Nov-16 18:19 CT

Price Action

- Last: 47,443,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -5%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 41%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 46%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 46729,

- 4. Pvt. Next: Pvt high 48043,

- 5. Levels R: 48528, 48043, 47608, 46873,

- 6. Levels S: 46729, 46574, 45387, 44563, 43803, 42427.

Daily Benchmarks

- (Short-Term) 5 Day: 47,225 Down Trend,

- (Short-Term) 10 Day: 46,799 Down Trend,

- (Intermediate-Term) 20 Day: 45,935 Up Trend,

- (Intermediate-Term) 55 Day: 44,563 Up Trend,

- (Long-Term) 100 Day: 45,963 Up Trend,

- (Long-Term) 200 Day: 44,563 Up Trend.

Additional Metrics

Recent Trade Signals

- 13 Nov 2025: Short YM 12-25 @ 47717 Signals.USAR.TR120

- 10 Nov 2025: Long YM 12-25 @ 47325 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The YM E-mini Dow is currently experiencing a short-term pullback, as indicated by the recent shift to a DTrend in the swing pivots and both the 5-day and 10-day moving averages turning down. Price has dropped below the weekly session fib grid NTZ, confirming short-term weakness, and the most recent trade signal was a short entry. However, the intermediate and long-term trends remain bullish, with price holding above the monthly and yearly fib grid NTZs and all longer-term moving averages trending up. The market has seen a fast momentum move with large bars, suggesting heightened volatility and potential for sharp reversals. Key support is clustered around 46,729 and 46,574, while resistance is overhead at 48,043 and 48,528. The current environment reflects a corrective phase within a broader uptrend, with swing traders watching for signs of stabilization or reversal at support for potential trend continuation.

Chart Analysis ATS AI Generated: 2025-11-16 18:20 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.