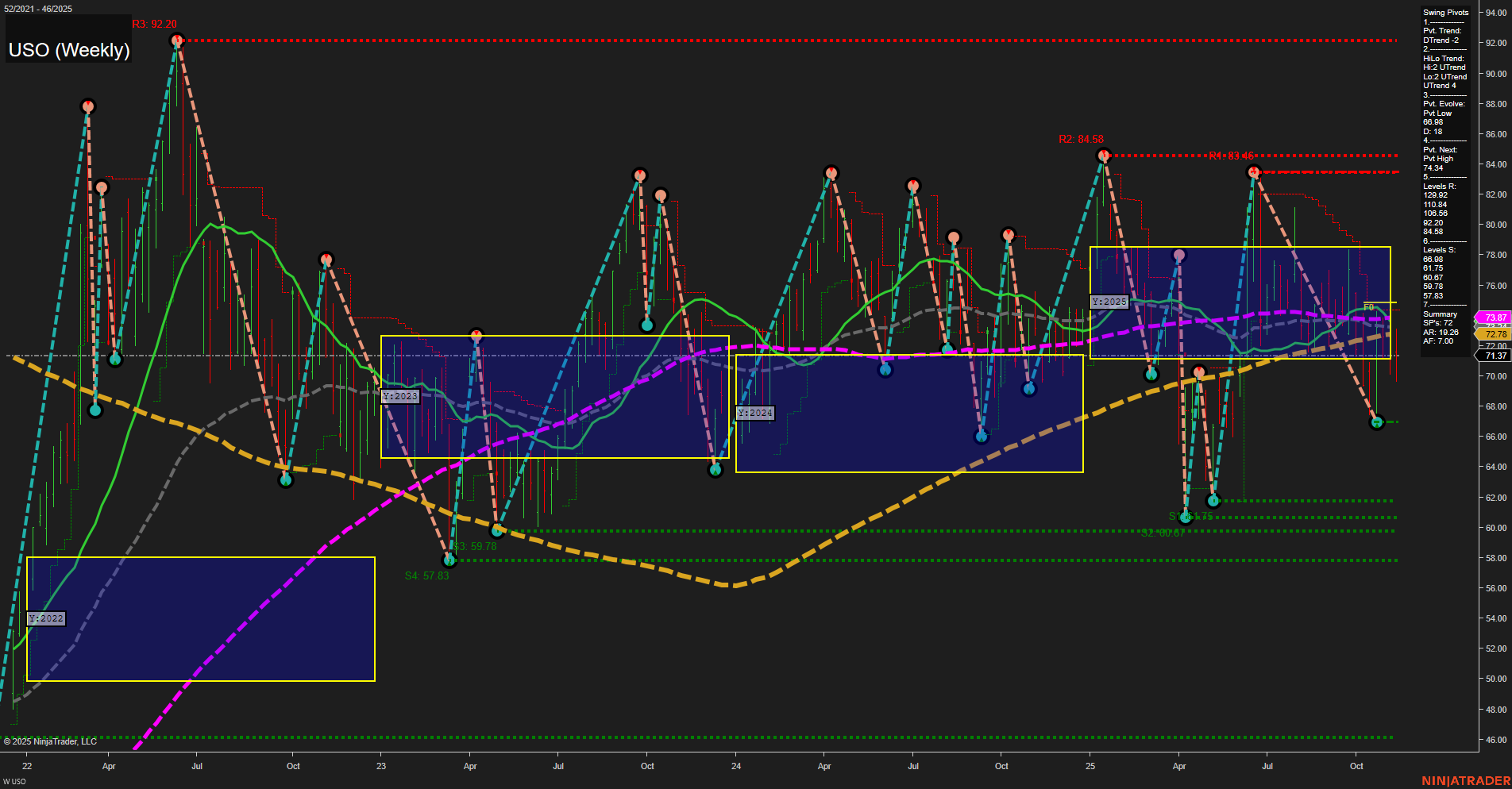

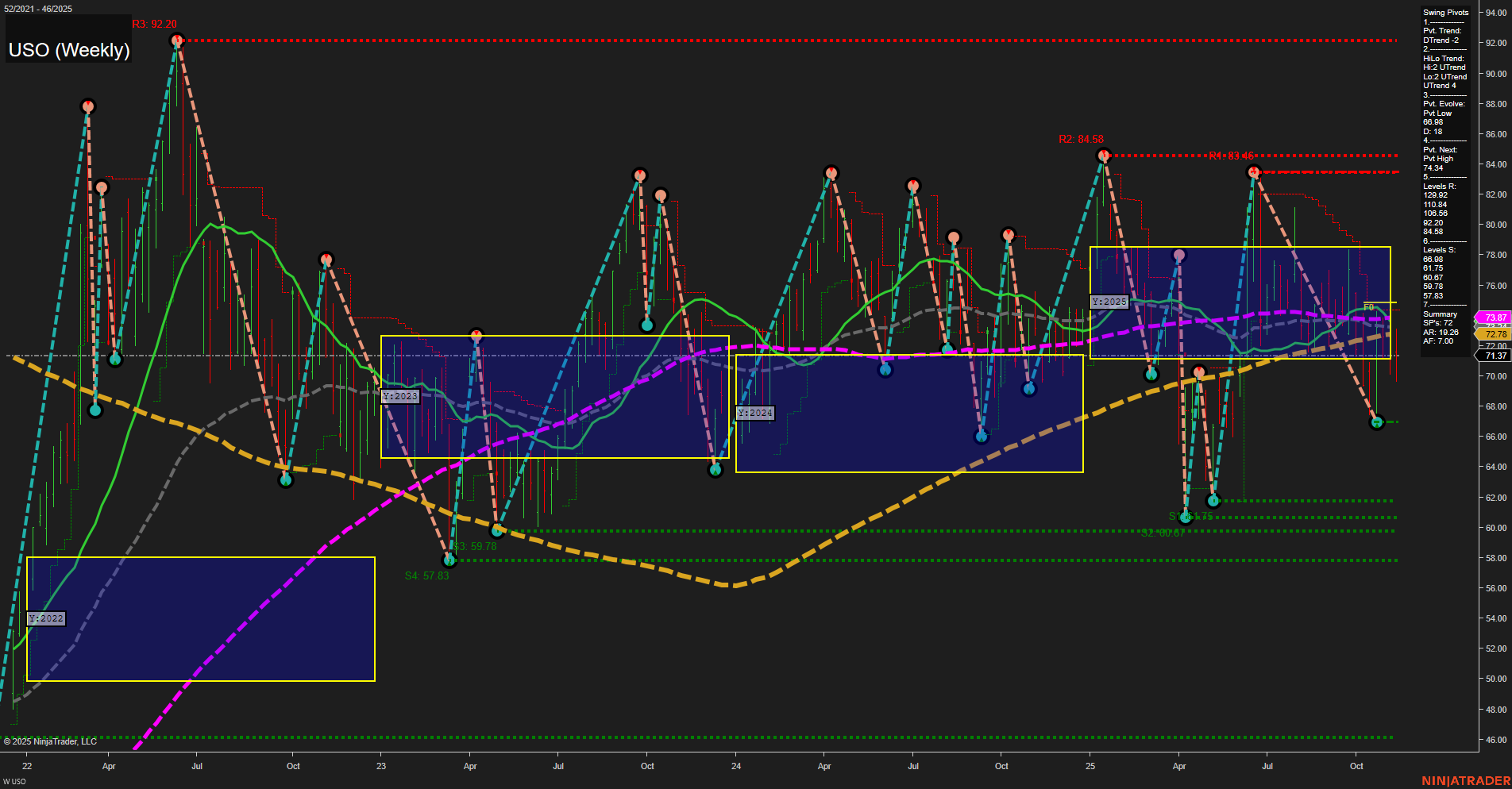

USO United States Oil Fund LP Weekly Chart Analysis: 2025-Nov-16 18:19 CT

Price Action

- Last: 73.87,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt Low 71.37,

- 4. Pvt. Next: Pvt High 73.44,

- 5. Levels R: 92.20, 84.58, 83.46, 80.84, 76.06,

- 6. Levels S: 71.37, 66.75, 60.67, 59.78, 57.83.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 72.78 Down Trend,

- (Intermediate-Term) 10 Week: 72.08 Down Trend,

- (Long-Term) 20 Week: 72.77 Down Trend,

- (Long-Term) 55 Week: 71.37 Up Trend,

- (Long-Term) 100 Week: 73.17 Down Trend,

- (Long-Term) 200 Week: 71.37 Up Trend.

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Neutral,

- Long-Term: Neutral.

Key Insights Summary

USO is currently trading in a broad consolidation range, with price action showing medium-sized bars and slow momentum, indicating a lack of strong directional conviction. The Weekly, Monthly, and Yearly Session Fib Grids all reflect a neutral bias, with price oscillating around the NTZ (neutral zone) and no clear breakout or breakdown. Swing pivot analysis shows a short-term downtrend, but the intermediate-term trend remains up, suggesting mixed signals and a choppy environment. Resistance levels are stacked well above the current price, while support levels are clustered just below, reinforcing the consolidation theme. Most benchmark moving averages are in a downtrend except for the longer-term 55 and 200-week MAs, which are slightly up, further highlighting the sideways to mildly bearish undertone. Overall, the chart suggests a market in balance, with neither bulls nor bears in control, and price action likely to remain range-bound until a decisive move occurs. This environment typically favors mean-reversion and range-based strategies over trend-following approaches.

Chart Analysis ATS AI Generated: 2025-11-16 18:19 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.