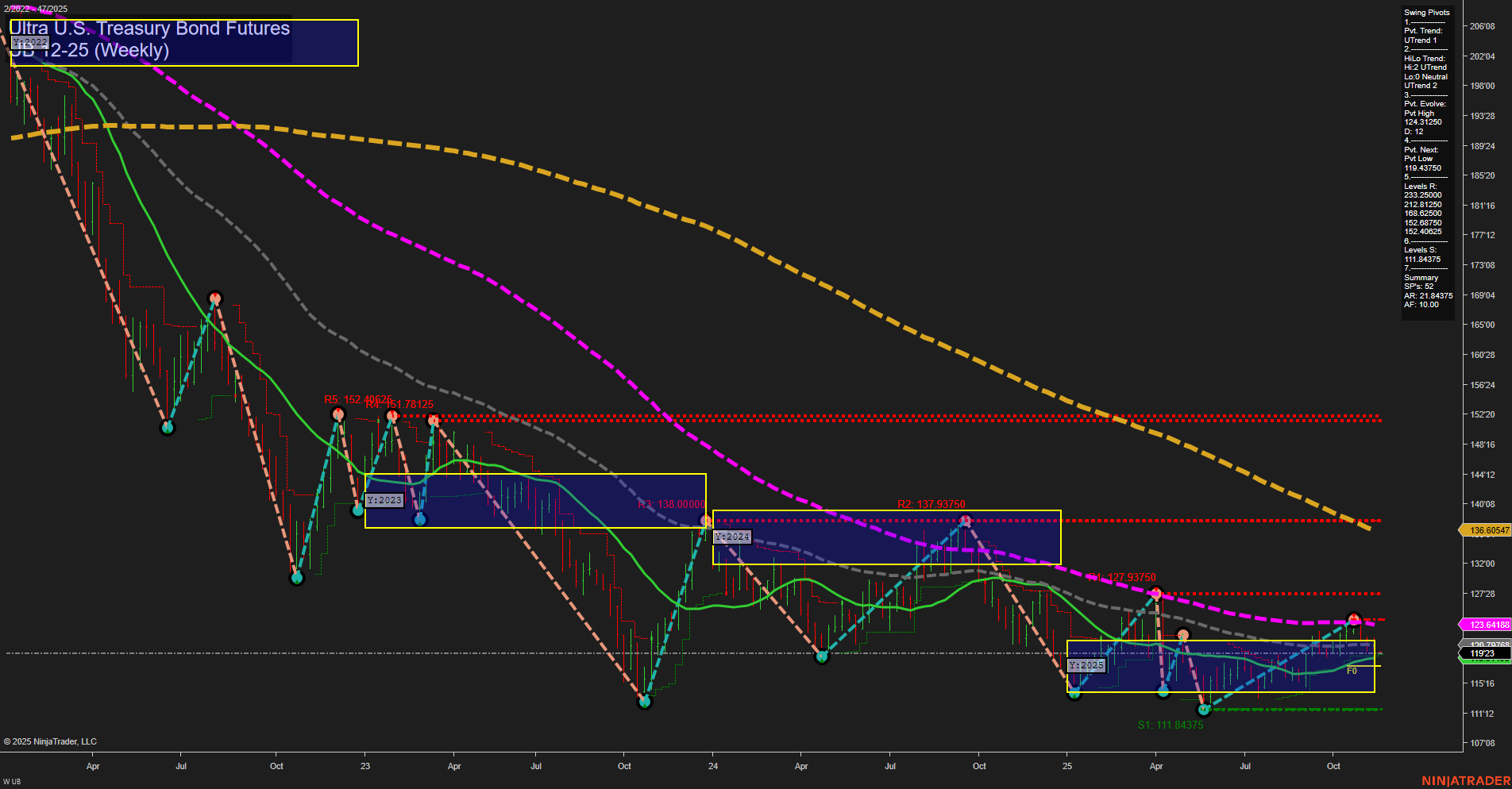

The UB Ultra U.S. Treasury Bond Futures weekly chart shows a market in transition. Price action is currently consolidating below the NTZ F0% level on both the weekly and monthly session fib grids, indicating persistent short- and intermediate-term downward pressure. The short-term swing pivot trend has shifted to an uptrend, but the intermediate-term HiLo trend remains down, reflecting a market that is attempting to recover from recent lows but is still facing significant resistance overhead. Recent trade signals highlight mixed sentiment, with both long and short entries triggered in close succession, underscoring the choppy and indecisive nature of the current environment. The 5- and 10-week moving averages are trending up, suggesting some short-term strength, but all major long-term benchmarks (20, 55, 100, and 200 week) remain in clear downtrends, reinforcing the dominant bearish structure. Key resistance levels are stacked well above current price, while support is defined by the recent swing low at 111'84375. The yearly session fib grid trend is up, hinting at potential for a longer-term base, but the prevailing technicals and swing structure suggest that rallies are likely to encounter strong selling pressure until a decisive breakout above major resistance occurs. The market is currently in a consolidation phase, with volatility and two-way trade likely to persist as it tests the boundaries of its recent range.