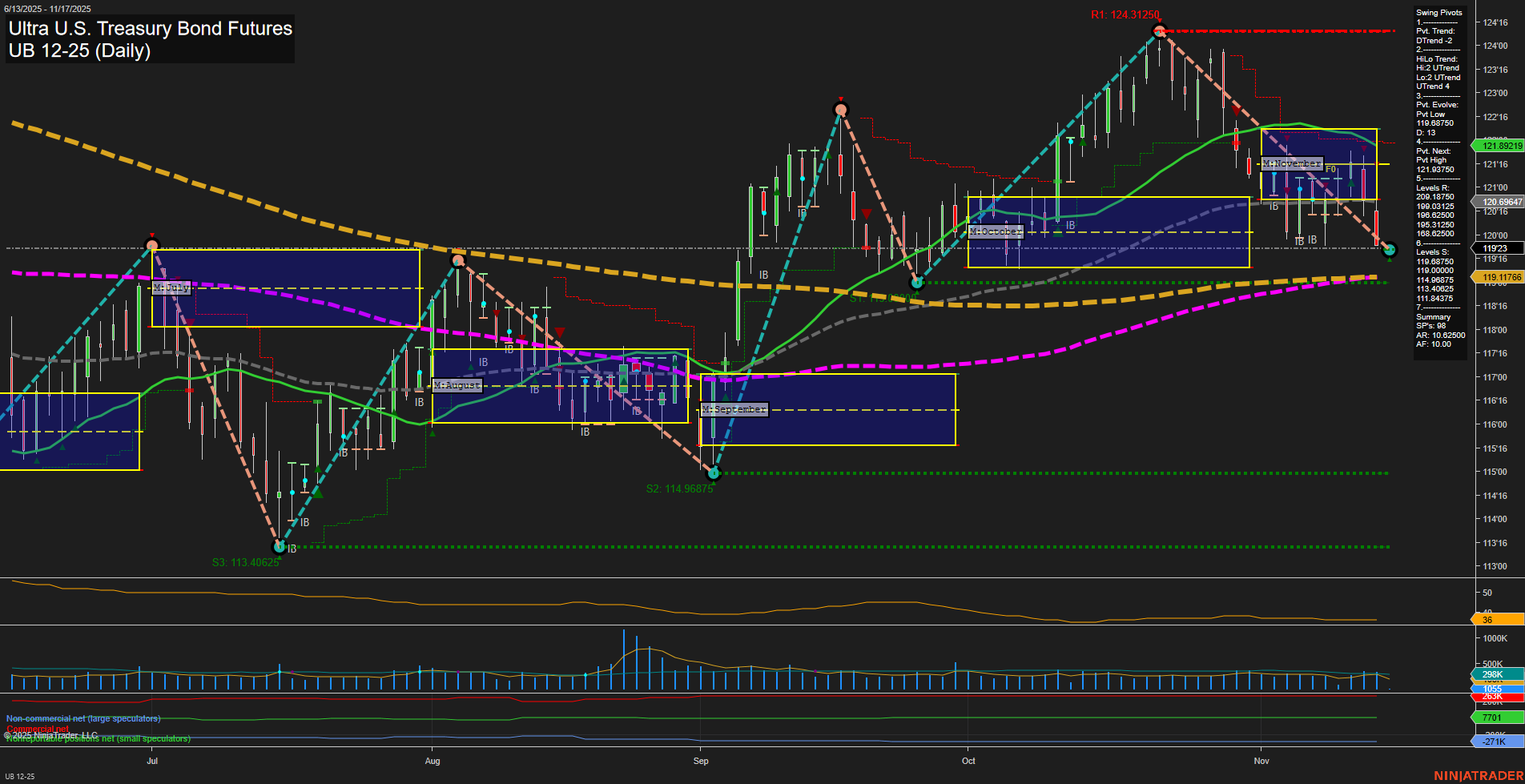

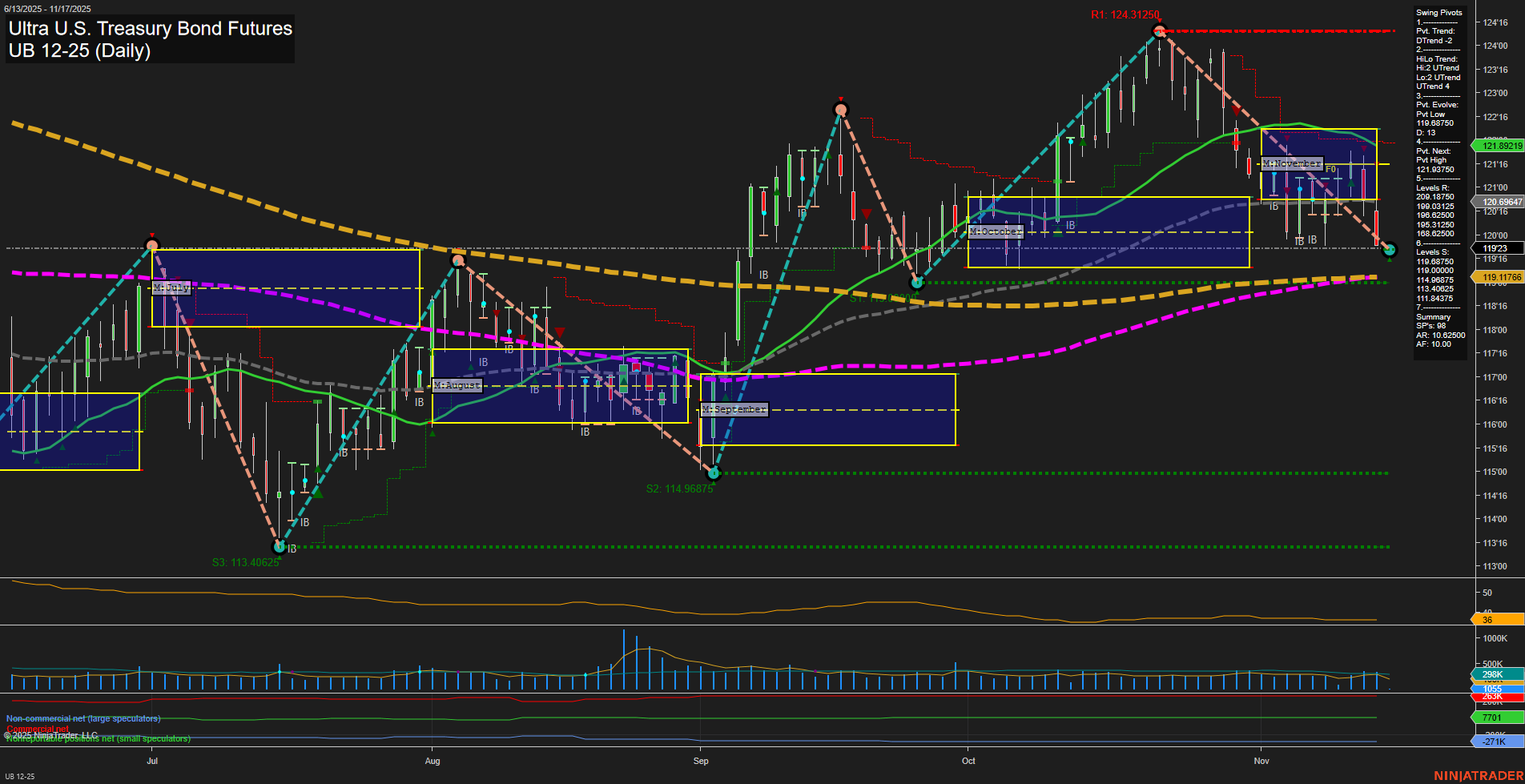

UB Ultra U.S. Treasury Bond Futures Daily Chart Analysis: 2025-Nov-16 18:18 CT

Price Action

- Last: 121.89219,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -5%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: -8%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 5%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 119.625,

- 4. Pvt. Next: Pvt high 121.875,

- 5. Levels R: 124.3125, 121.875, 121.625,

- 6. Levels S: 119.625, 119.11766, 114.96875, 113.40625.

Daily Benchmarks

- (Short-Term) 5 Day: 121.63 Down Trend,

- (Short-Term) 10 Day: 120.69 Down Trend,

- (Intermediate-Term) 20 Day: 121.89 Down Trend,

- (Intermediate-Term) 55 Day: 119.12 Up Trend,

- (Long-Term) 100 Day: 119.03 Up Trend,

- (Long-Term) 200 Day: 119.12 Down Trend.

Additional Metrics

Recent Trade Signals

- 14 Nov 2025: Long UB 12-25 @ 121.15625 Signals.USAR-WSFG

- 13 Nov 2025: Short UB 12-25 @ 120.5 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The UB Ultra U.S. Treasury Bond Futures daily chart shows a market in transition. Short-term momentum is slow and the price is trading below both the weekly and monthly session fib grid centers, indicating a bearish short-term environment. The most recent swing pivot trend is down, with resistance levels overhead and support clustered below, suggesting the market is testing lower boundaries after a recent pullback. Intermediate-term trends are mixed, with the HiLo trend still up but the monthly grid and 20-day moving average both pointing down, reflecting a choppy and potentially consolidative phase. Long-term signals remain constructive, with the yearly fib grid and 100-day moving average both trending up, hinting at underlying strength despite recent volatility. Volume and ATR are moderate, showing no extreme moves. Recent trade signals reflect this indecision, with both long and short entries triggered in the past week. Overall, the market is in a corrective phase short-term, neutral intermediate-term, but retains a bullish long-term structure, with key support and resistance levels likely to define the next directional move.

Chart Analysis ATS AI Generated: 2025-11-16 18:18 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.