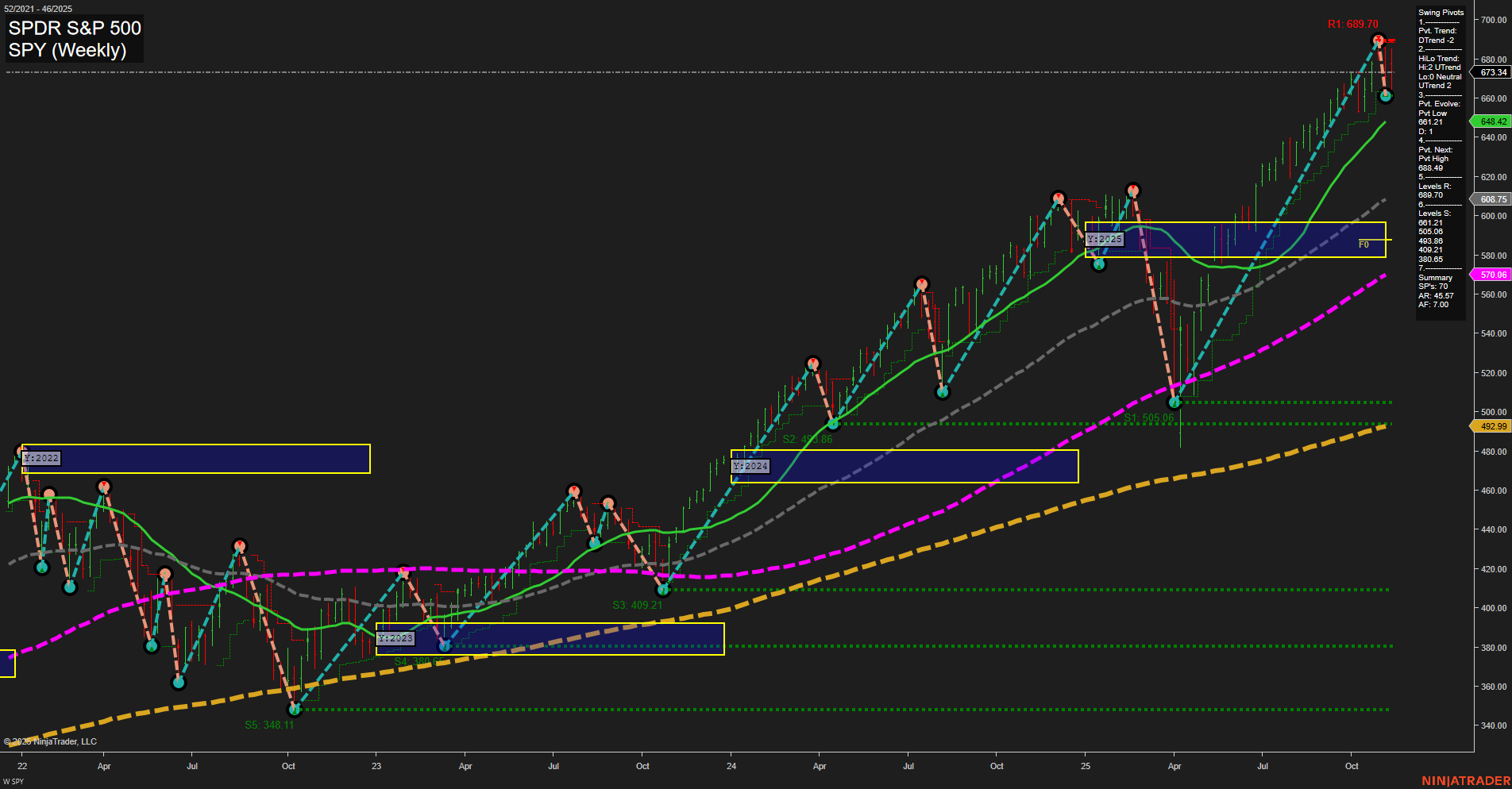

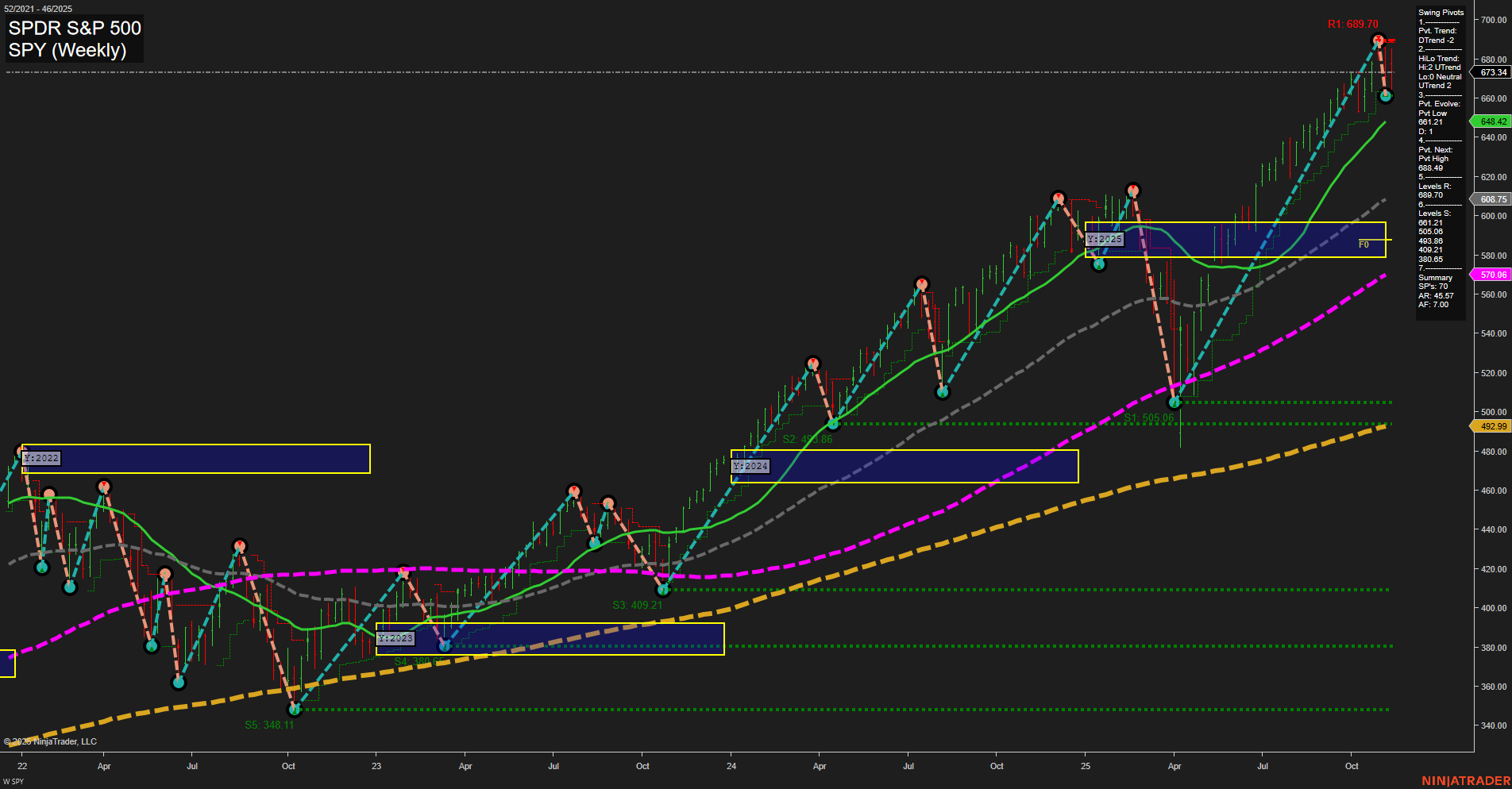

SPY SPDR S&P 500 Weekly Chart Analysis: 2025-Nov-16 18:17 CT

Price Action

- Last: 673.34,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 689.70,

- 4. Pvt. Next: Pvt low 643.42,

- 5. Levels R: 689.70,

- 6. Levels S: 643.42, 570.06, 492.86, 409.21, 348.11.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 673.34 Down Trend,

- (Intermediate-Term) 10 Week: 658.49 Down Trend,

- (Long-Term) 20 Week: 643.42 Up Trend,

- (Long-Term) 55 Week: 570.06 Up Trend,

- (Long-Term) 100 Week: 492.86 Up Trend,

- (Long-Term) 200 Week: 429.99 Up Trend.

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The SPY weekly chart shows a strong long-term uptrend, with all major long-term moving averages (20, 55, 100, 200 week) trending higher and well below current price, confirming persistent bullish momentum over the past year. However, recent price action has shifted: the last swing pivot marked a new high at 689.70, but the current short-term trend has turned down (DTrend), and both the 5- and 10-week moving averages have rolled over, indicating a short-term pullback or correction phase. The most immediate support is at 643.42, with deeper levels at 570.06 and below, while resistance is set at the recent high. The intermediate-term trend remains up, suggesting the current move may be a retracement within a broader bullish structure. The chart reflects a classic scenario where a strong rally is undergoing a corrective phase, with volatility elevated and the potential for further downside tests before any resumption of the primary uptrend. Futures swing traders will note the interplay between short-term weakness and long-term strength, with the market currently consolidating after a significant advance.

Chart Analysis ATS AI Generated: 2025-11-16 18:18 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.