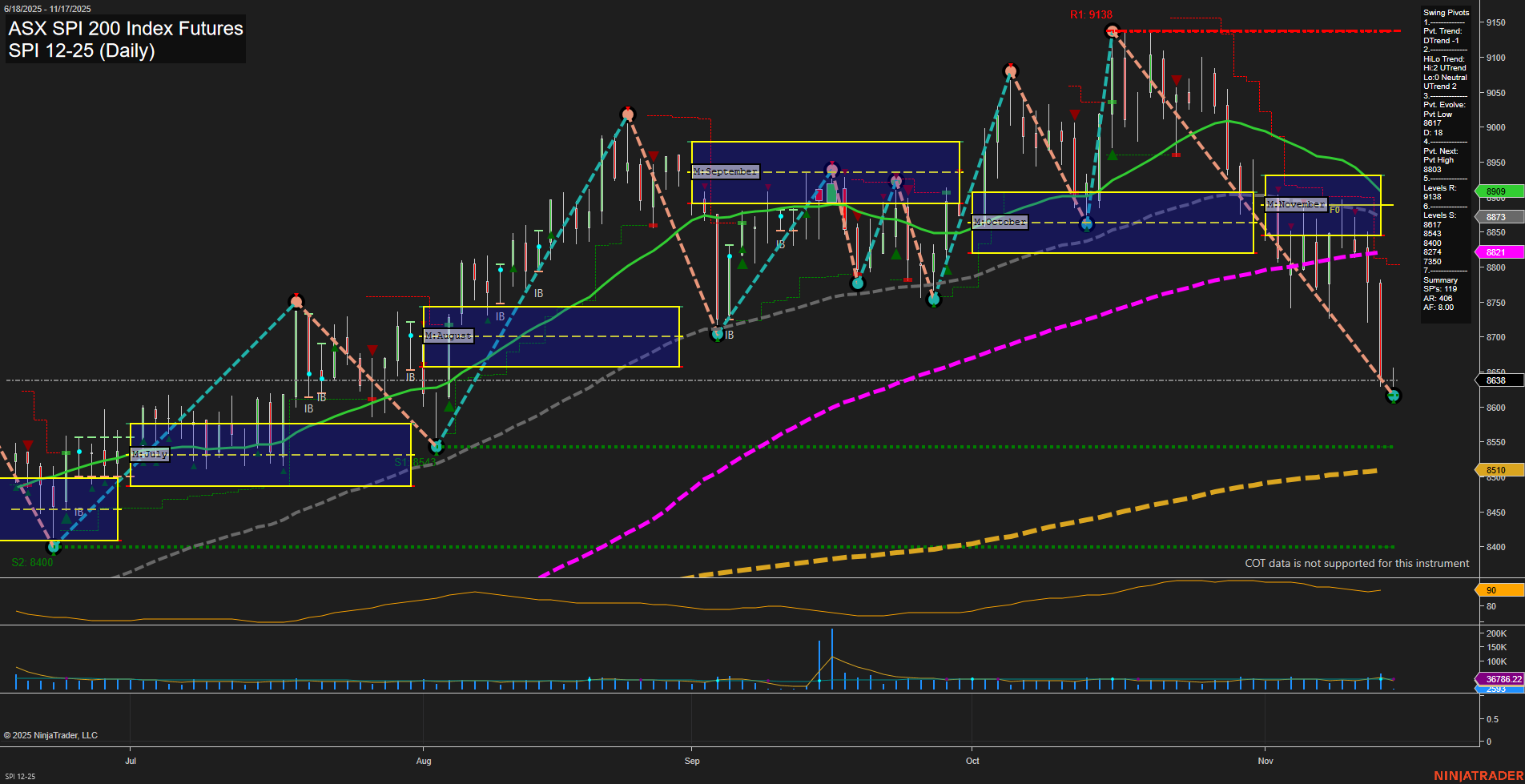

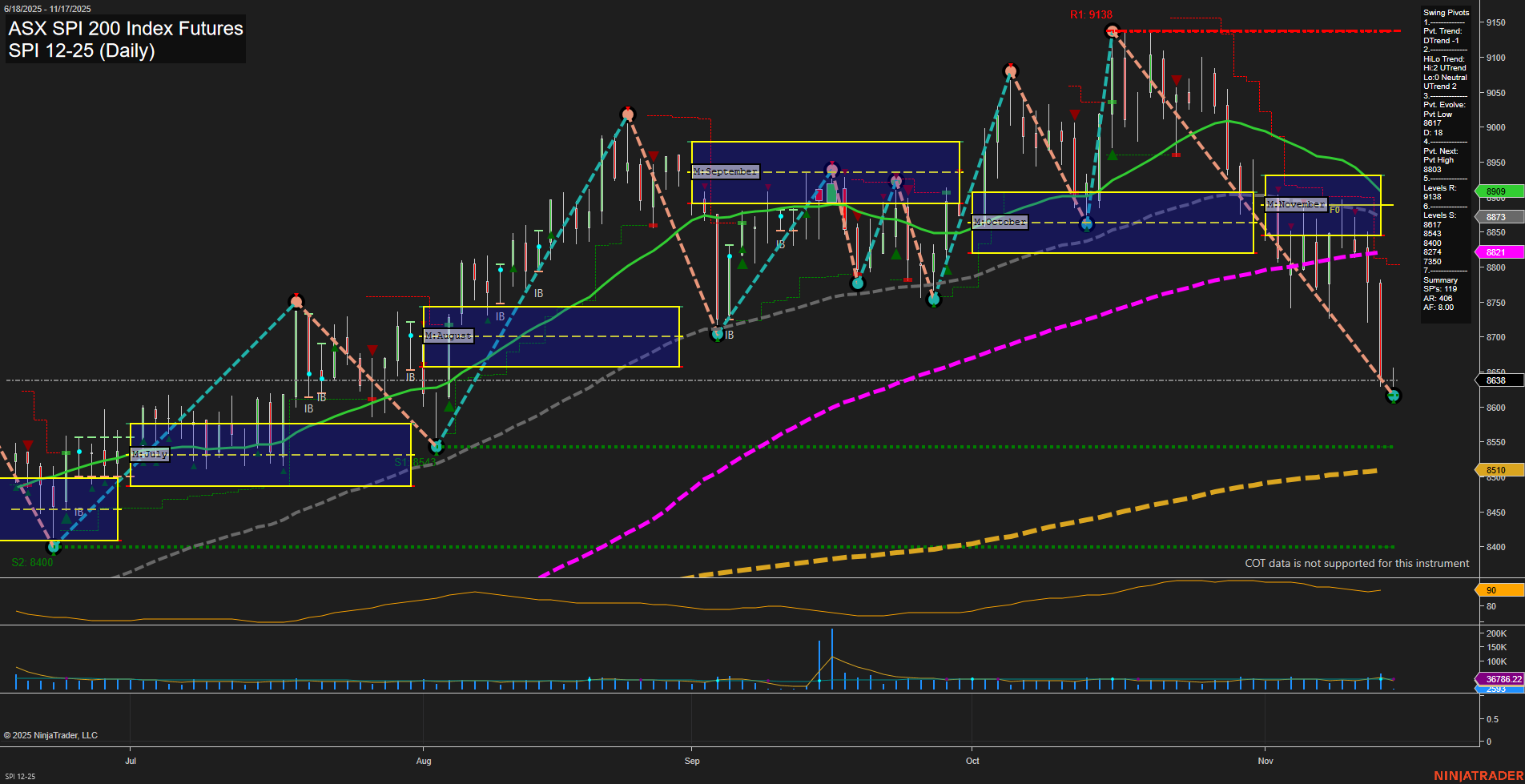

SPI ASX SPI 200 Index Futures Daily Chart Analysis: 2025-Nov-16 18:16 CT

Price Action

- Last: 8638,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 8638,

- 4. Pvt. Next: Pvt high 8803,

- 5. Levels R: 9138, 8803,

- 6. Levels S: 8510, 8400.

Daily Benchmarks

- (Short-Term) 5 Day: 8873 Down Trend,

- (Short-Term) 10 Day: 8821 Down Trend,

- (Intermediate-Term) 20 Day: 8909 Down Trend,

- (Intermediate-Term) 55 Day: 8857 Down Trend,

- (Long-Term) 100 Day: 8521 Up Trend,

- (Long-Term) 200 Day: 8510 Up Trend.

Additional Metrics

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

The SPI 200 futures are exhibiting pronounced downside momentum, with large bearish bars and fast momentum confirming a strong short-term selloff. Both the short-term and intermediate-term swing pivot trends have shifted to downtrends, with the most recent pivot low established at 8638 and the next potential reversal level at 8803. Resistance is clearly defined at 8803 and 9138, while support is seen at 8510 and 8400, suggesting the market is approaching key long-term support zones. All short- and intermediate-term moving averages are trending down, reinforcing the bearish bias, while the long-term 100 and 200 day MAs remain in uptrends, indicating the broader trend is still neutral. Volatility is elevated (ATR 96) and volume is above average (VOLMA 36762), consistent with a high-energy move. The market is in a corrective phase, with a decisive break below the monthly NTZ and a test of major support levels. The overall structure points to a market in a short- to intermediate-term downtrend, with potential for further volatility as it approaches long-term support.

Chart Analysis ATS AI Generated: 2025-11-16 18:17 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.